- Participants of the 2023 World Economic Forum said that blockchain and distributed ledger technology have huge potential.

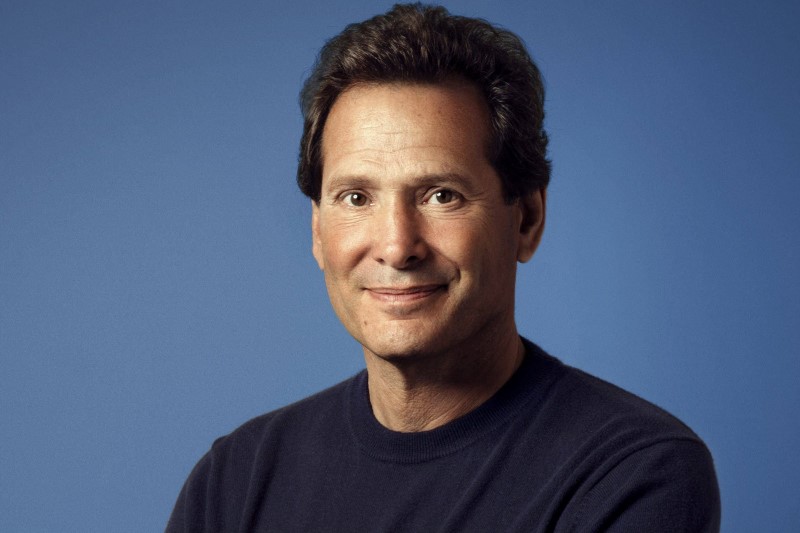

- PayPal (NASDAQ:PYPL) President and CEO Dan Schulman says that blockchain technology “performed perfectly” despite crypto crash.

- New York Stock Exchange President Lynn Martin said blockchain could make equity issuance more efficient.

- Davos saw a remarkable drop in crypto firms in attendance.

This year’s annual World Economic Forum (WEF) in Davos, Switzerland, saw a further favorable shift in attitudes toward blockchain technology. While crypto firms did not show up in as big numbers as they did in previous years, several attendees highlighted the potential of blockchain tech.

PayPal President and CEO Dan Schulman, who joined a panel discussing the FTX crash, wanted to distinguish between crypto and the underlying distributed ledger technology (DLT).

“It’s important not to conflate cryptocurrencies and CBDCs, stablecoins and DLT…. they’re very different,” Schulman said. Despite the crypto crash, “the underlying tech has performed perfectly,” Schulman added. “The promise of a distributed ledger is that it can be faster and cheaper, to settle transactions simultaneously with no middlemen. That’s an important thing.”

Lynn Martin, President of the New York Stock Exchange, echoed these statements. She believes blockchain can make issuing equity and stocks more efficient. Moreover, blockchain could allow for near-instantaneous settlement of trades.

“There is a way now that some of the technologies have been adopted and used to really make processes much more efficient,” Martin said. Panelists agreed that blockchain technology is here to stay, despite the volatility of crypto and slow mainstream adoption.

However, another upcoming tech seems to have taken some of the steam out of the excitement for blockchain. Panelists Schulman, Martin, and State Street’s Ronald O’Hanley said that the technology they were the most excited about was artificial intelligence (AI).

Fewer Crypto Firms at Davos This Year

Many firms involved with cryptocurrency were notably absent in Davos, indicating that the market crash took its toll. There were fewer crypto firms at Davos than in the past few years as the markets reeled from the FTX crash.

The crypto presence has been impossible to ignore in the past few years. Crypto companies took over stores, shops, and cafes. Their marketing was all over the small town where the World Economic Forum hosts its annual meeting. This year, the crypto presence in Davos was much more subdued.

After a $1,4 trillion loss in the crypto market crash, crypto firms seem more conservative in how they spend money.

On the Flipside

- A smaller crypto presence at Davos could indicate that the recent crash helped regulate some of the excesses in the industry. Less money spent on marketing could mean that there’s more money for developers that are actually building new technology.

Why You Should Care

Despite a lesser crypto presence at WEF2023, the attitude toward blockchain technology remains positive. This strongly indicates its long-term potential to transform technology and finance.