By Anna Irrera

NEW YORK (Reuters) - U.S.-based cryptocurrency exchange Bittrex is partnering with registered broker-dealer Rialto Trading to offer a trading venue for blockchain-based digital assets, the companies said on Thursday.

Rialto runs a U.S.-registered trading platform for fixed income products and, pending approval from regulators, will expand its operations to include virtual tokens that are registered securities, the companies said.

Both companies said they were having "detailed conversations" with regulators, but could not give any indication of when they might receive approval to launch.

The venue will be open to institutional investors, corporations, U.S.-registered broker-dealers and accredited investors - who must meet U.S. securities regulations for annual income of at least $200,000 or a net worth topping $1 million.

"We have seen interest from most of our large institutional clients that are trading our fixed income products," Rialto Trading Chief Executive Shari Noonan said in an interview.

Many cryptocurrency firms are teaming up or investing in traditional trading infrastructure to attract more business from financial institutions.

Regulators are increasing their scrutiny of the sector, noting that existing securities regulations may apply to some blockchain-based assets, more commonly referred to as cryptocurrencies.

The U.S. Securities and Exchange Commission has started clamping down on initial coin offerings, or online fundraisers where new virtual tokens are issued to contributors.

The SEC has said many of these new tokens should follow securities regulations, meaning that they would then have to be traded on registered venues such as alternative trading systems.

This has led some cryptocurrency exchanges to seek licenses or acquire companies with the regulatory authorizations.

In June, San Francisco-based Coinbase announced that it would acquire securities broker dealer Keystone Capital Corp.

The Rialto venue will enable users to trade digital assets against the dollar. Rialto also plans to provide issuance advisory and custody services.

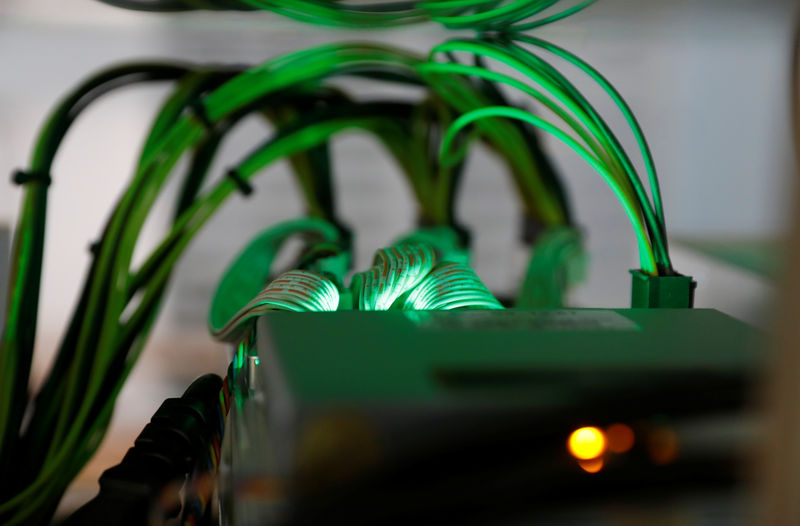

"We're merging Bittrex's technology, cybersecurity and blockchain expertise with Rialto's deep knowledge of the securities industry," Bittrex CEO Bill Shihara said in a statement.