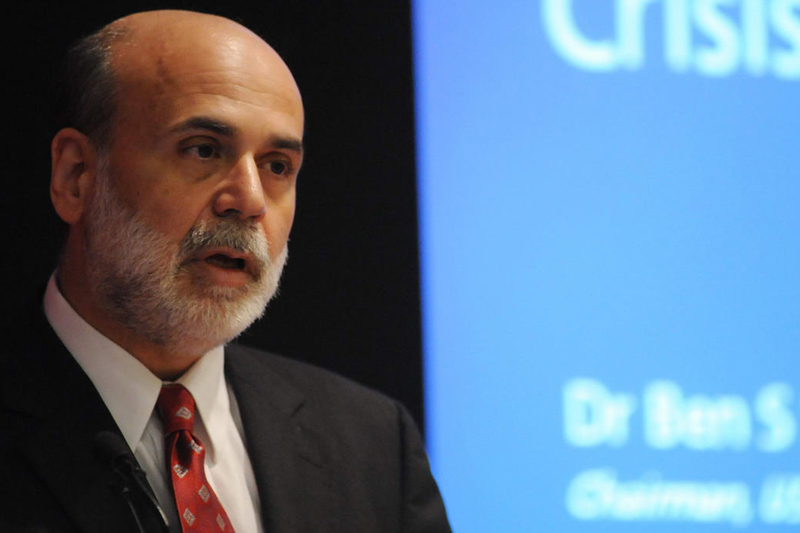

Investing.com – The U.S. dollar ended the week lower against almost all of its major counterparts on Friday, after comments by Federal Reserve Chairman Ben Bernanke spurred demand for higher yielding assets.

In a speech at the central bank’s annual retreat in Jackson Hole, Wyoming, Bernanke said the Fed remained prepared to implement fresh measures to stimulate the faltering U.S. economy, but stopped short of outlining when and if this may happen.

Bernanke said that the bank’s September policy-setting meeting would run for two days instead of one, in order to “allow a fuller discussion” of the economic outlook.

The Swiss franc weakened sharply against the greenback, after advancing ahead of the speech, amid expectations that the Fed chief would announce a third round of quantitative easing.

Separately, the Commerce Department said Friday that the U.S. economy expanded more slowly than forecast in the second quarter, as higher fuel prices, poor weather conditions and disruptions to manufacturing activity from the March earthquake in Japan weighed.

Gross domestic product rose by 1%, disappointing expectations for an expansion of 1.1%. The Commerce Department had originally estimated GDP growth of 1.3% in the second quarter.

The dollar fell steeply against the yen on Friday, coming within striking distance of the pair’s all-time low.

Earlier in the week, Japan unveiled a two-pronged approach aimed at curbing the appreciation of the yen, creating a credit line to promote foreign investment and imposing new rules on companies’ foreign exchange holdings.

Japan's Economy Minister Kaoru Yosano said Friday that the government will release a list of measures for how the next administration, which is expected to be formed next week, could respond to the appreciation of the yen.

The statement underlined the view that officials are leaning towards measures to cope with yen strength, rather than measures to counteract it through yen selling intervention.

Meanwhile, the euro remained supported despite concerns that the region’s sovereign debt crisis is deepening, as the European Central Bank continued to purchase Italian and Spanish government bonds, keeping borrowing costs at affordable levels.

Elsewhere, the pound held gains against the greenback but weakened against the euro after official data showed that U.K. GDP rose by 0.2% in the second quarter, taking annual growth to 0.7%.

The lackluster data underlined expectations that the Bank of England is likely to leave interest rates at their current record low level of 0.5% until well into 2012.

In the week ahead, investors will be focusing on Friday’s release of U.S. data on non-farm payrolls in order to gauge the strength of the U.S. recovery. Also next week, the U.S. Institute of Supply Management is to publish its index of manufacturing activity for August.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, August 29

In the euro zone, Germany is to publish preliminary data on consumer price inflation, which accounts for a majority of overall inflation. Later in the day, ECB President Jean-Claude Trichet is appearing before the European Parliament's Economic Committee in Brussels, to testify on the region’s debt crisis.

Also Monday, the U.S. is to produce industry data on pending home sales, a leading indicator of health in the housing market. The nation is also to release official data on personal income and expenditure and consumer prices.

In the U.K., markets are to remain closed for a bank holiday.

Tuesday, August 30

New Zealand is to publish official data on building permits, a leading gauge of future construction activity. Elsewhere, Australia is to release government data on building approvals. Japan is to produce official data on retail sales, the foremost indicator of consumer spending, which accounts for the majority of overall economic activity, as well as data on household spending and the unemployment rate.

In Europe, Switzerland’s UBS bank is to publish its consumption index, an important indicator of consumer spending. Meanwhile, the U.K. is to produce official data on net lending to individuals, and reports on M4 money supply and mortgage approvals.

Canada is to release official data on the nation’s current account, as well as reports on raw material price inflation, an important signal of overall inflation.

The U.S. is to release data on consumer confidence, a leading indicator of consumer spending, as well as an industry report on house price inflation. In addition, the Federal Reserve’s Open Market Committee is to publish the minutes of its most recent policy setting meeting.

Wednesday, August 31

The U.K. is to release a report on consumer confidence, an important indicator of consumer spending. Japan is to publish preliminary data on industrial production, a leading indicator of economic strength, as well as data on average cash earnings and housing starts.

Elsewhere, New Zealand is to publish a report on business confidence, while Australia is to produce government data on private sector credit.

In the euro zone, Germany is to release official data on retail sales and employment change, leading indicators of economic health. The single currency bloc is to produce preliminary data on consumer price inflation and the unemployment rate.

In the U.S., payroll processing firm ADP is to release a report on non-farm payrolls, which leads government data by two days. The U.S. is also to publish data on manufacturing activity in the Chicago area, factory orders and crude oil stockpiles.

Meanwhile, Canada is to publish official data on GDP, an all-inclusive measure of economic activity and the most important indicator of economic growth.

Thursday, September 1

Australia is to publish official data on private capital expenditure, as well as government data on retail sales and commodity prices, which make up approximately half of the country’s export revenue.

The U.K. is to publish two separate industry reports on house price inflation, a leading indicator of economic health. The country is also to release data on activity in the manufacturing sector.

Switzerland is to publish official data on GDP, as well as government data on retail sales, the foremost indicator of consumer spending, which accounts for the majority of overall economic activity. The country is also to produce official data on manufacturing sector activity.

Later in the day, the U.S. is to publish its closely watched weekly report on initial jobless claims, while the ISM is to produce data on manufacturing growth.

Friday, September 2

Japan is to publish government data on capital spending, a leading indicator of economic wellbeing.

In Europe, Switzerland is to produce official data on the country’s employment level, while the U.K. is to release official data on construction sector activity.

The U.S. is to round up the week with a government report on private sector job creation, a key indicator of overall economic health. The country is also to publish official data on the unemployment rate and average hourly earnings, an important inflationary indicator.

In a speech at the central bank’s annual retreat in Jackson Hole, Wyoming, Bernanke said the Fed remained prepared to implement fresh measures to stimulate the faltering U.S. economy, but stopped short of outlining when and if this may happen.

Bernanke said that the bank’s September policy-setting meeting would run for two days instead of one, in order to “allow a fuller discussion” of the economic outlook.

The Swiss franc weakened sharply against the greenback, after advancing ahead of the speech, amid expectations that the Fed chief would announce a third round of quantitative easing.

Separately, the Commerce Department said Friday that the U.S. economy expanded more slowly than forecast in the second quarter, as higher fuel prices, poor weather conditions and disruptions to manufacturing activity from the March earthquake in Japan weighed.

Gross domestic product rose by 1%, disappointing expectations for an expansion of 1.1%. The Commerce Department had originally estimated GDP growth of 1.3% in the second quarter.

The dollar fell steeply against the yen on Friday, coming within striking distance of the pair’s all-time low.

Earlier in the week, Japan unveiled a two-pronged approach aimed at curbing the appreciation of the yen, creating a credit line to promote foreign investment and imposing new rules on companies’ foreign exchange holdings.

Japan's Economy Minister Kaoru Yosano said Friday that the government will release a list of measures for how the next administration, which is expected to be formed next week, could respond to the appreciation of the yen.

The statement underlined the view that officials are leaning towards measures to cope with yen strength, rather than measures to counteract it through yen selling intervention.

Meanwhile, the euro remained supported despite concerns that the region’s sovereign debt crisis is deepening, as the European Central Bank continued to purchase Italian and Spanish government bonds, keeping borrowing costs at affordable levels.

Elsewhere, the pound held gains against the greenback but weakened against the euro after official data showed that U.K. GDP rose by 0.2% in the second quarter, taking annual growth to 0.7%.

The lackluster data underlined expectations that the Bank of England is likely to leave interest rates at their current record low level of 0.5% until well into 2012.

In the week ahead, investors will be focusing on Friday’s release of U.S. data on non-farm payrolls in order to gauge the strength of the U.S. recovery. Also next week, the U.S. Institute of Supply Management is to publish its index of manufacturing activity for August.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, August 29

In the euro zone, Germany is to publish preliminary data on consumer price inflation, which accounts for a majority of overall inflation. Later in the day, ECB President Jean-Claude Trichet is appearing before the European Parliament's Economic Committee in Brussels, to testify on the region’s debt crisis.

Also Monday, the U.S. is to produce industry data on pending home sales, a leading indicator of health in the housing market. The nation is also to release official data on personal income and expenditure and consumer prices.

In the U.K., markets are to remain closed for a bank holiday.

Tuesday, August 30

New Zealand is to publish official data on building permits, a leading gauge of future construction activity. Elsewhere, Australia is to release government data on building approvals. Japan is to produce official data on retail sales, the foremost indicator of consumer spending, which accounts for the majority of overall economic activity, as well as data on household spending and the unemployment rate.

In Europe, Switzerland’s UBS bank is to publish its consumption index, an important indicator of consumer spending. Meanwhile, the U.K. is to produce official data on net lending to individuals, and reports on M4 money supply and mortgage approvals.

Canada is to release official data on the nation’s current account, as well as reports on raw material price inflation, an important signal of overall inflation.

The U.S. is to release data on consumer confidence, a leading indicator of consumer spending, as well as an industry report on house price inflation. In addition, the Federal Reserve’s Open Market Committee is to publish the minutes of its most recent policy setting meeting.

Wednesday, August 31

The U.K. is to release a report on consumer confidence, an important indicator of consumer spending. Japan is to publish preliminary data on industrial production, a leading indicator of economic strength, as well as data on average cash earnings and housing starts.

Elsewhere, New Zealand is to publish a report on business confidence, while Australia is to produce government data on private sector credit.

In the euro zone, Germany is to release official data on retail sales and employment change, leading indicators of economic health. The single currency bloc is to produce preliminary data on consumer price inflation and the unemployment rate.

In the U.S., payroll processing firm ADP is to release a report on non-farm payrolls, which leads government data by two days. The U.S. is also to publish data on manufacturing activity in the Chicago area, factory orders and crude oil stockpiles.

Meanwhile, Canada is to publish official data on GDP, an all-inclusive measure of economic activity and the most important indicator of economic growth.

Thursday, September 1

Australia is to publish official data on private capital expenditure, as well as government data on retail sales and commodity prices, which make up approximately half of the country’s export revenue.

The U.K. is to publish two separate industry reports on house price inflation, a leading indicator of economic health. The country is also to release data on activity in the manufacturing sector.

Switzerland is to publish official data on GDP, as well as government data on retail sales, the foremost indicator of consumer spending, which accounts for the majority of overall economic activity. The country is also to produce official data on manufacturing sector activity.

Later in the day, the U.S. is to publish its closely watched weekly report on initial jobless claims, while the ISM is to produce data on manufacturing growth.

Friday, September 2

Japan is to publish government data on capital spending, a leading indicator of economic wellbeing.

In Europe, Switzerland is to produce official data on the country’s employment level, while the U.K. is to release official data on construction sector activity.

The U.S. is to round up the week with a government report on private sector job creation, a key indicator of overall economic health. The country is also to publish official data on the unemployment rate and average hourly earnings, an important inflationary indicator.