By Tony Munroe

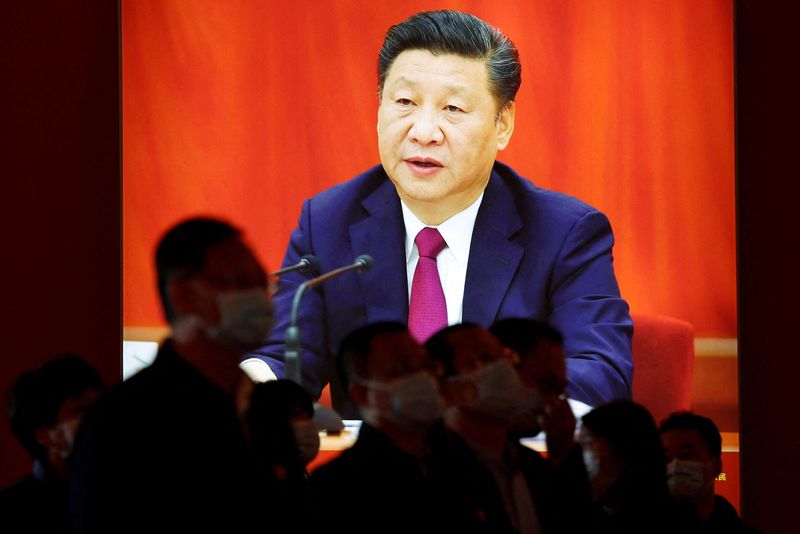

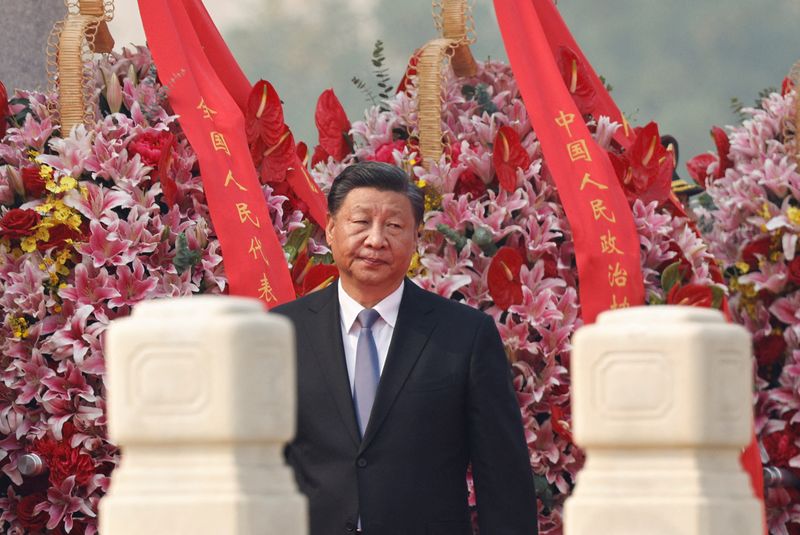

BEIJING (Reuters) - Chinese President Xi Jinping will take the stage on Sunday to kick off a historic congress of the ruling Communist Party, where he is poised to win a third term that solidifies his place as China's most powerful ruler since Mao Zedong.

The congress comes at a tumultuous time, with Xi's adherence to his zero-COVID policy battering the economy, while his support for Russia's Vladimir Putin has further alienated China from the West. Still, diplomats, economists and analysts spoken to by Reuters say Xi is set to consolidate his grip on power.

The roughly week-long congress will take place with around 2,300 delegates, mostly behind closed doors, in the vast Great Hall of the People on Tiananmen Square. The Chinese capital has ramped up security and intensified COVID screening. In nearby Hebei province, steel mills were instructed to cut back on operations to improve air quality, an industry source said.

The opacity of Chinese politics, which has been heightened since Xi assumed power a decade ago, means party watchers are left to speculate over who will be named to key posts and what those appointments mean.

Still, few expect significant deviation in direction during a third Xi term, with continued focus on policies that prioritise security and self-reliance, state control of the economy, more assertive diplomacy and a stronger military, and growing pressure to seize Taiwan.

The congress will conclude with the introduction of the next Politburo Standing Committee (PSC), the elite body that now numbers seven and that Xi has come to dominate.

"The likelihood is that the new line-up will be uncompromisingly 'Xi-ist'," said former British diplomat Charles Parton, a fellow at the London-based Council on Geostrategy.

The congress will likely begin with Xi reading a lengthy report in a televised speech that will outline broad-brush priorities for the next five years. It begins a months-long process of personnel change at the top of the party and government that will conclude in March at the annual session of parliament.

In securing a third term Xi breaks with the two-term precedent of recent decades. Also breaking with norms: no successor to Xi, 69, is expected to be identified, analysts say, which would indicate he plans to remain in power even longer.

MYSTERY MAN

China-watchers are most interested to know who among the PSC members will be tapped as the next premier - a job charged with the daunting task of managing the world's second-largest economy - when Li Keqiang steps down in March.

While several senior officials are on "usual suspects" lists, none is the obvious choice to succeed Li - an uncertainty that departs from the norm.

Still, analysts say, the views of any individual matter less nowadays as Xi has sidelined those seen as "reformers" in favour of his more state-driven and nationalistic economic policies.

"There is increasing evidence that promotion decisions over the past few years have been made less on technocratic ability, which you might expect from reformers, and more in terms of loyalty to Xi Jinping, so I think we should retire this reformers idea really," said Mark Williams, chief Asia economist at Capital Economics.

EXPECTATIONS

Xi's opening speech at the last congress, in 2017, was broadly upbeat, including ambitious plans to turn China into a leading global power by 2050. He mentioned "reforms" 70 times in a speech that lasted nearly three-and-a-half hours.

Since then, circumstances have changed dramatically: China's economy has been battered by COVID curbs, a crushing property sector crisis and blowback after Xi's clampdown on the tech sector under the banner of "common prosperity". Globally, Beijing's relations with the West have sharply deteriorated.

Investors and countless frustrated Chinese citizens hoping the congress marks a milestone after which China begins laying groundwork to dial back on zero-COVID appear increasingly likely to be disappointed as Beijing has this week repeatedly reaffirmed its commitment to the policy.

Analysts also say the congress is unlikely to trigger any immediate or dramatic changes in policy to revive an economy that is seen on track to grow about 3% this year, falling far short of the official target of around 5.5%.

"Between now and March 2023, we expect no significant policy changes, particularly to the landmark zero-COVID strategy and the unprecedented curbs on China's property sector," Nomura analysts wrote.