By Ross Kerber

BOSTON (Reuters) - Top American chief executives on average made 264 times as much as their typical employee in 2019, narrower than the year before, a union report found, but the ratio is expected to rise "dramatically" due to COVID-19.

The annual report by the AFL-CIO, the largest U.S. labor federation, is frequently cited as a measure of workforce inequality.

The latest ratio was based on the $14.8 million in total compensation the average S&P 500 chief executive received in 2019, and was less than ratio of 287 to 1 that the labor group found based on corporate proxy filings made for 2018.

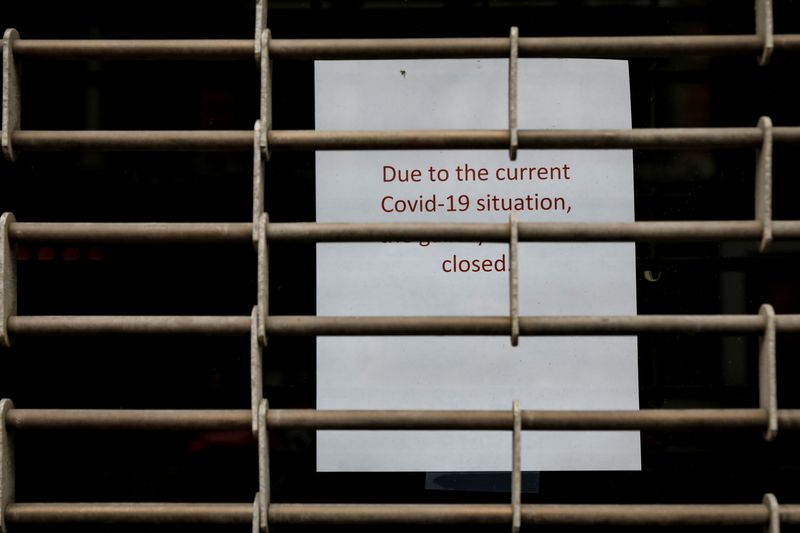

The most recent pay data was reported before the COVID-19 pandemic shut down large swaths of the American economy and led companies to lay off or otherwise stop paying millions of workers.

Those lost earnings will raise pay ratios this year, said Brandon Rees, deputy director of the AFL-CIO's office of investment.

"I would expect pay ratios to escalate dramatically for 2020, given the depths of COVID-19 related furloughs," Rees said.

The unions' report was based on the ratio that most companies report of the earnings of their CEO to the median pay of all other workers. Across all U.S. companies, production and nonsupervisory employees earned $41,442 on average in 2019, up from $39,888 in 2018, according to U.S. Labor Department figures cited by Rees.

He said another concern is that high levels of stock-based compensation mean executives are not sharing much pain when they take salary cuts as they lay off workers. [L1N2D91FP]