By Edward Taylor

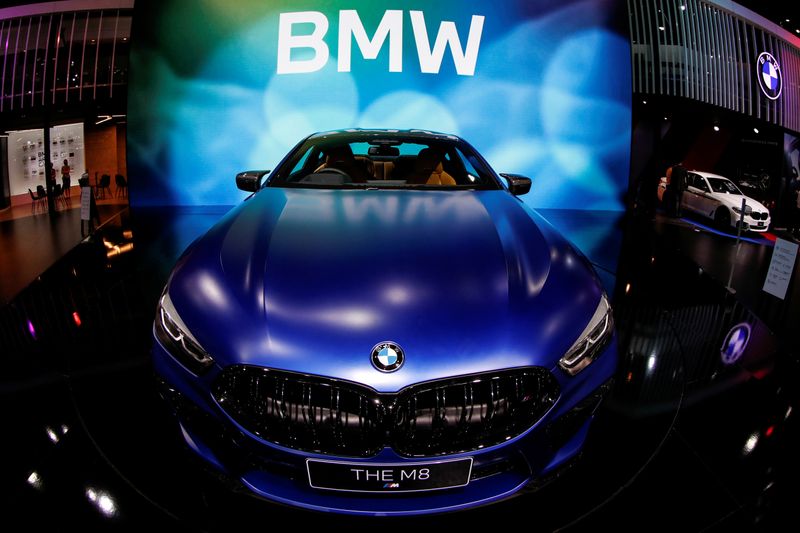

FRANKFURT (Reuters) - BMW (DE:BMWG) expects to make a profit this year if demand continues to recover, despite posting a record loss for its car division in the second quarter after sales slumped 25% because of coronavirus lockdowns, it said on Wednesday.

The German manufacturer of BMWs, Minis and Rolls-Royces said sales had started to recover during the latest three-month period, including a 17% jump in deliveries in China, but the rebound would not fully make up for sales lost to COVID-19.

As a result of the sales slide, and higher costs for developing low-emission cars, BMW posted a pretax loss of 498 million euros, its first in over 11 years, and an operating loss of 666 million euros ($790 million) for the quarter.

Shares in BMW fell 3% following the results, with some analysts saying they had not expected such a big loss in earnings before interest and taxes (EBIT).

"What matters now is how robust this upward trend is and when individual markets will follow suit," said Chief Executive Oliver Zipse, adding that its overall cars sales in July were higher than last year.

BMW said, however, that its outlook did not factor in the potential impact of a second wave of COVID-19 infections, nor the prospect of a more sustained or deeper recession than expected in its key markets.

Zipse said on a call that developments in the United States, which has the highest number of COVID-19 cases and deaths worldwide, were "extremely worrying".

Sales in the United States made up 12.6% of deliveries in the first half of 2020, down from 15.2% in 2020. Overall, BMW said it expected global demand for luxury cars to fall by a fifth this year.

'CAUTIOUS OPTIMISM'

The COVID-19 pandemic has already hit carmakers such as Fiat Chrysler (MI:FCHA), Ford (N:F) and Daimler (DE:DAIGn) particularly hard at time when the auto industry is ramping up spending to clean up their combustion engines as well as developing low-emission technologies to conform with stringent European anti-pollution rules.

BMW's EBIT margin for cars slumped to minus 10.4%, an historic low, down from 6.5% in the second quarter last year, though it maintained the forecast it made in May for a margin of 0% to 3% for the year as a whole.

By contrast, electric-only car manufacturer Tesla (O:TSLA) saw its automotive gross margin widen to 25.4% in the second quarter, up from 18.9% a year earlier, despite a 5% drop in deliveries.

Jefferies (NYSE:JEF) analyst Philippe Houchois said BMW's margin forecast for the year suggested a healthy recovery in the second half of 2020, even though the second-quarter results were below the consensus.

"We are now looking ahead to the second six-month period with cautious optimism and continue to target an EBIT margin between 0% and 3% for the automotive segment in 2020," Zipse said in a statement.

BMW reiterated that it expected to make a pretax profit in 2020, albeit well below 2019 levels and for car deliveries to customers to fall significantly this year.