On Tuesday, Western Digital Corp. (NASDAQ:WDC) received a new Buy rating from a leading financial services firm, accompanied by a price target set at $90.00. The endorsement comes amid expectations of a cyclical recovery in the storage industry, which is anticipated to benefit the company due to its involvement in both Hard Disk Drive (HDD) and Solid State Drive (SSD) markets.

The firm's analyst cites several factors contributing to the positive outlook for Western Digital. These include improved margins resulting from a more rational and capacity-constrained flash industry. The analysis leverages the firm's Global Memory Model to support this view. Additionally, the potential spin-off of Western Digital's flash business is seen as a value-unlocking move, based on a Sum of the Parts (SOTP) analysis.

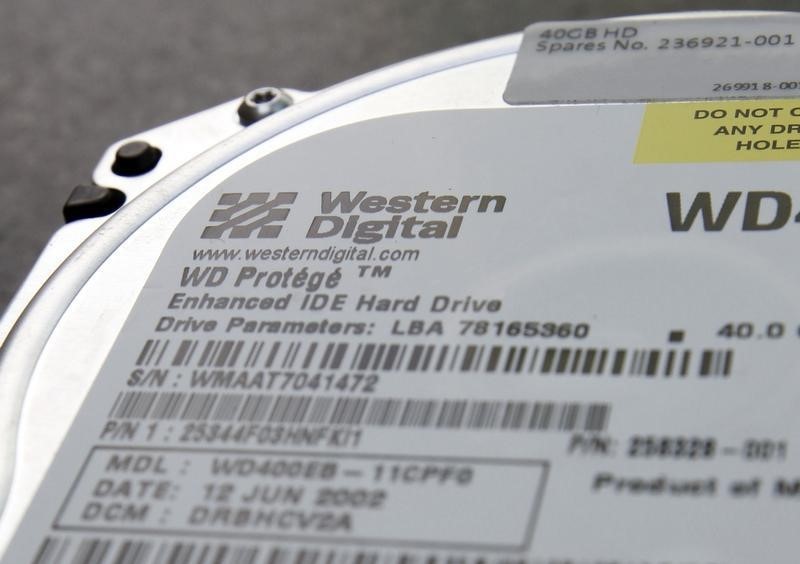

Western Digital's dual exposure to HDD and SSD is particularly noteworthy as it positions the company to capitalize on different segments within the storage market. The firm's assessment suggests that the company's diverse product line could serve as a hedge against market fluctuations and provide a stable growth trajectory.

The price target of $90.00 represents a significant potential upside of over 26% from the company's recent stock price. This target is influenced by the expected industry recovery and the company's strategic positioning.

InvestingPro Insights

Western Digital Corp. (NASDAQ:WDC) has been in the limelight following a new Buy rating with a robust price target of $90.00. In light of this, real-time data and InvestingPro Tips provide a deeper dive into the company's current financial health and market position. With a market capitalization of $23.17 billion, Western Digital shows significant industry presence. Interestingly, despite a challenging past year with a revenue decline of nearly 16%, the company's stock has experienced a strong return of over 114% year-over-year. This indicates investor confidence and a market that may be pricing in future recovery prospects.

An InvestingPro Tip highlights that 18 analysts have revised their earnings upwards for the upcoming period, suggesting that the market sentiment is improving and may align with the recent Buy rating and price target. However, it's important to note that analysts do not anticipate the company to be profitable this year, and the firm suffers from weak gross profit margins, at 13.83% over the last twelve months as of Q3 2024. On the upside, Western Digital has been identified as a prominent player in the Technology Hardware, Storage & Peripherals industry, which could be a key driver in its cyclical recovery.

For investors looking for a deeper analysis and additional insights, InvestingPro offers more tips on Western Digital, which can be accessed at https://www.investing.com/pro/WDC. Additionally, users can apply the coupon code PRONEWS24 to receive an extra 10% off a yearly or biyearly Pro and Pro+ subscription, unlocking further valuable investment information.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.