In a recent transaction, Robert Soderbery, the Executive Vice President & General Manager for Flash Business at Western Digital Corp (NASDAQ:WDC), sold 26,853 shares of the company's common stock. The sale was executed at a weighted average price of $73.4821 per share, amounting to a total value of $1,973,214.

The shares were sold in a series of transactions with prices ranging from $73.47 to $73.56, as detailed in a footnote of the filing. Following this sale, Soderbery's direct holdings in Western Digital stock stand at 144,623 shares. Additionally, the footnote disclosed that the executive's total includes 697 shares acquired under the company's Employee Stock Purchase Plan as of May 31, 2024.

Investors often monitor insider transactions as they can provide insights into an executive's perspective on the company's current valuation and future prospects. While the reasons for an insider's decision to sell can vary greatly, such transactions are required to be reported to the Securities and Exchange Commission and made public for investor scrutiny.

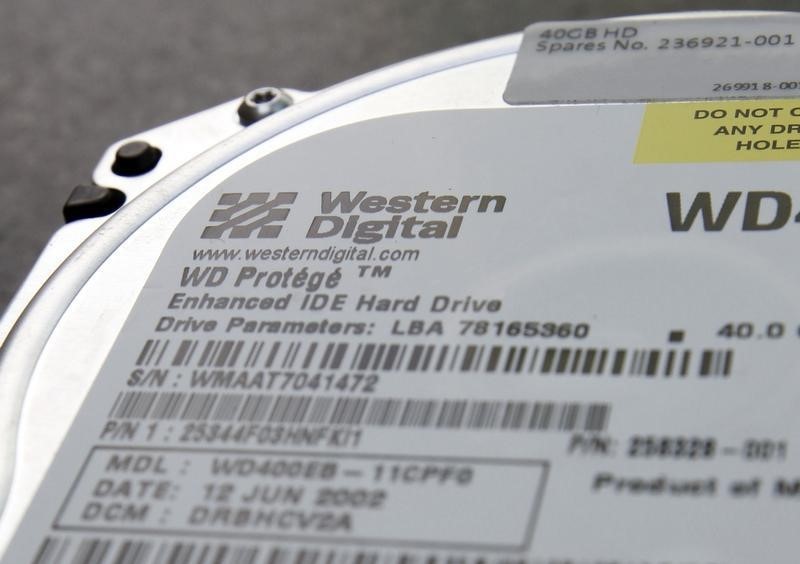

Western Digital, based in San Jose, California, is a global provider of data storage solutions and has a significant presence in the computer storage devices industry. The company's stock performance and insider transactions are closely watched by market participants, given the pivotal role of data storage in today's technology-driven economy.

The transaction was formally filed on June 6, 2024, and pertains to activities conducted on June 4, 2024. The filing was signed by Sandra Garcia, Attorney-in-Fact for Robert Soderbery.

In other recent news, Western Digital Corp has been making significant strides in the tech industry. The company has unveiled a comprehensive AI Data Cycle framework, designed to optimize storage infrastructure for AI workloads at scale. This includes the introduction of a high-performance PCIe Gen5 SSD, the Ultrastar DC SN861, and a 64TB SSD for AI data lakes, among other products.

In financial developments, Western Digital reported strong results for the third quarter of fiscal year 2024, with revenue reaching $3.5 billion and non-GAAP earnings per share of $0.63. The company anticipates Q4 revenue to be between $3.6 billion and $3.8 billion, with growth expected in both the HDD and flash segments.

Mizuho maintained a Buy rating on Western Digital, citing the potential value from the company's NAND spinoff and favorable pricing trends as key drivers. The firm's analysts expect Western Digital's revenue and earnings per share for the June quarter to remain steady at $3.70 billion and $1.05 respectively. Meanwhile, a leading financial services firm also issued a new Buy rating for Western Digital, due to expectations of a cyclical recovery in the storage industry. These are some of the recent developments for Western Digital Corp.

InvestingPro Insights

Amidst the insider trading activity at Western Digital Corp, the company's financial standing and market performance continue to be a focal point for investors. With a market capitalization of $24.6 billion, Western Digital is recognized as a significant entity in the Technology Hardware, Storage & Peripherals industry. Despite recent insider sales, the company's stock has demonstrated resilience, as reflected by a substantial 94.78% return over the past year, highlighting potential investor confidence in its long-term prospects.

An InvestingPro Tip indicates that Western Digital is a prominent player in its sector, yet analysts are skeptical about its profitability in the short term. This is underscored by a negative P/E ratio of -15.04, which suggests that the market expects the company to face challenges in generating earnings. Additionally, the company's stock price has been quite volatile, with significant movements that could attract investors looking for trading opportunities.

Furthermore, Western Digital's recent price performance has been strong, with a notable 64.25% price uptick over the last six months, placing the stock price near its 52-week high, currently at 96.9% of this threshold. This momentum is an essential consideration for investors and traders alike, as it may indicate the market's optimism about the company's direction. For those interested in a deeper analysis, InvestingPro offers additional tips on Western Digital, which can be accessed at https://www.investing.com/pro/WDC. There are currently 11 additional InvestingPro Tips available, offering comprehensive insights for a more informed investment decision. To access these tips and more, use coupon code PRONEWS24 to get an additional 10% off a yearly or biyearly Pro and Pro+ subscription.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.