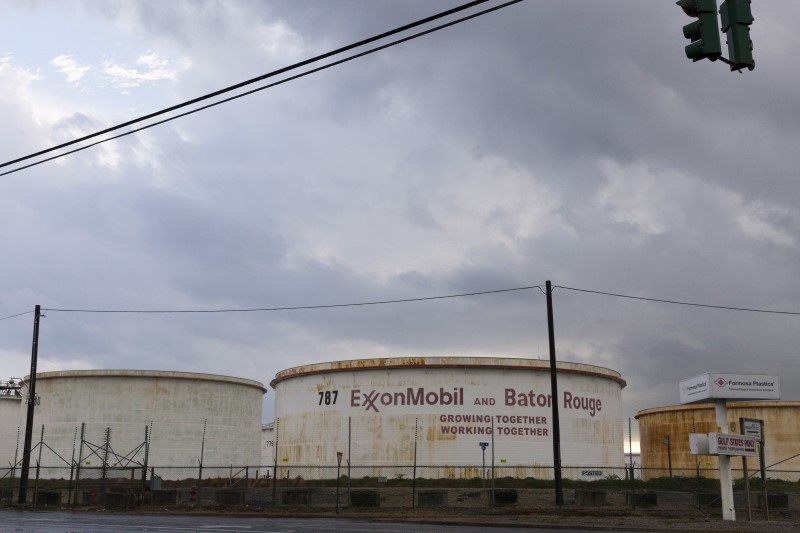

MIDLAND, Texas - ProPetro Holding Corp. (NYSE: PUMP), a Midland-based oilfield services company, announced today an agreement to provide electric hydraulic fracturing services to ExxonMobil (NYSE:XOM) for three years in the Permian Basin. The deal, which includes the deployment of two electric fracturing fleets with an option for a third, is set to commence in the first half of 2024 and may extend into early 2025.

ProPetro's CEO, Sam Sledge, emphasized the significance of this agreement with ExxonMobil, highlighting the transition towards more sustainable and industrialized operations. The services provided under the agreement will include electric hydraulic fracturing, wireline, and pump-down services, with a focus on safety, operational excellence, and environmental responsibility.

The company's FORCESM electric-powered hydraulic fracturing fleets are central to the agreement, representing ProPetro's commitment to high-quality, low-emission services. The agreement also features performance incentives, although specific financial terms were not disclosed.

ProPetro has been collaborating with ExxonMobil since 2015, and this new agreement reinforces the company's strategy to build an efficient and profitable business within the oil and gas industry.

The announcement is based on a press release statement.

InvestingPro Insights

Amidst its strategic partnership with ExxonMobil, ProPetro Holding Corp. (NYSE: PUMP) showcases promising financial metrics and analyst projections. With a market capitalization of $965.95 million, the company stands as a significant player in the oilfield services sector. Notably, ProPetro's price-to-earnings (P/E) ratio of 11.83 demonstrates investor confidence in its earnings potential, further bolstered by an adjusted P/E ratio for the last twelve months as of Q4 2023 of just 6.36, indicating a potentially undervalued stock.

InvestingPro Tips suggest that ProPetro operates with a moderate level of debt and has cash flows that can sufficiently cover interest payments, a reassuring sign for investors concerned about financial stability. Additionally, analysts predict the company will be profitable this year, which is consistent with the company's profitability over the last twelve months. It's also worth noting that ProPetro does not pay a dividend, which could be appealing to investors looking for companies that reinvest earnings back into the business for growth.

On the performance front, ProPetro has experienced a notable 27.4% revenue growth over the last twelve months as of Q4 2023, although there was a marginal quarterly revenue decline of 0.33% in Q1 2023. The company's gross profit margin stands at a healthy 30.58%, with an operating income margin of 12.66%, reflecting efficient management and a strong competitive position within its industry.

For investors seeking comprehensive analysis and additional insights, InvestingPro offers a wealth of information, including more InvestingPro Tips for ProPetro. By using the coupon code PRONEWS24, readers can get an extra 10% off a yearly or biyearly Pro and Pro+ subscription, unlocking access to a full suite of investment tools and data. Currently, there are 5 additional InvestingPro Tips available for ProPetro at https://www.investing.com/pro/PUMP, which could further guide investment decisions.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.