NEW YORK - Pfizer Inc. (NYSE: NYSE:PFE), a global leader in biopharmaceuticals, announced the appointment of Cyrus Taraporevala to its Board of Directors. Taraporevala, with a wealth of experience in the financial sector, steps into his new role effective immediately, also joining the Audit Committee and Compensation Committee of the board.

Taraporevala's extensive background includes his most recent position as President and CEO of State Street (NYSE:STT) Global Advisors, which he held from 2017 until his retirement in 2022. His career has spanned various leadership roles across notable financial institutions such as Fidelity, BNY Mellon (NYSE:BK), Legg Mason (NYSE:LM), and Citigroup. Additionally, Taraporevala has served as a partner at McKinsey & Company, operating out of New York and Copenhagen.

His current board memberships extend to Shell (LON:SHEL) plc and Bridgepoint Group plc, showcasing a broad engagement with corporate governance across different sectors. Taraporevala's educational credentials include a Bachelor of Commerce in Financial Accounting from Sydenham College, University of Bombay, and an MBA from Cornell University.

Albert Bourla, Chairman and CEO of Pfizer, expressed confidence in Taraporevala's appointment, citing his "vast experience in investment management, financial markets plus leadership and global operations" as valuable assets to the company. Bourla emphasized that Taraporevala's expertise would contribute to Pfizer's mission of delivering shareholder value through a balanced board with diverse competencies and perspectives.

This announcement is based on a press release statement from Pfizer Inc.

In other recent news, Pfizer is facing significant legal challenges. The U.S. Supreme Court has directed a lower court to reassess a lawsuit implicating Pfizer and other pharmaceutical companies in allegations of facilitating terrorism through illegal financial contributions.

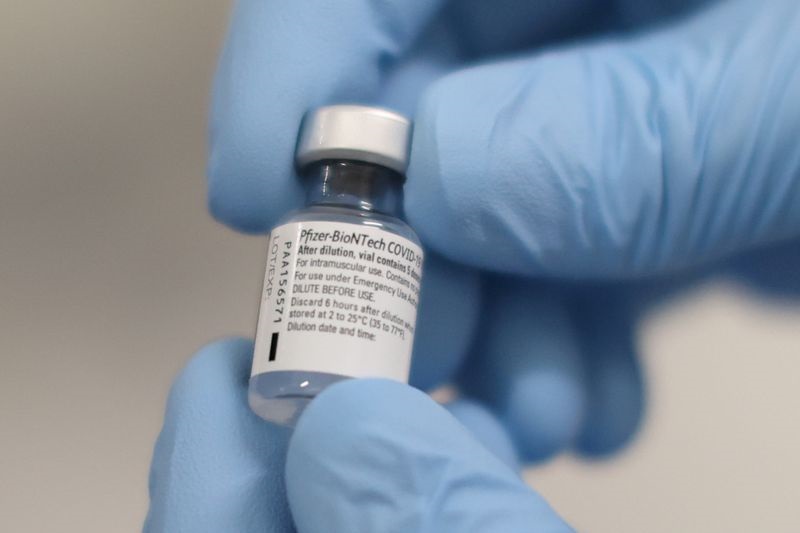

Furthermore, the state of Kansas has initiated legal action against Pfizer, alleging misleading statements about its COVID-19 vaccine. On the stock market front, Roger Williams, representative of Texas's 25th congressional district, has sold stocks from Pfizer.

Despite these developments, Jefferies, a global investment banking firm, has maintained its Buy rating for Pfizer. The firm's outlook remains positive, citing insights from a key opinion leader who suggested that Pfizer's cardiovascular drug Tafamidis is expected to maintain its position as the first-line treatment option for early-stage patients.

In the realm of vaccine development, Pfizer, along with its partners BioNTech (NASDAQ:BNTX), Moderna (NASDAQ:MRNA), and Novavax (NASDAQ:NVAX), have been involved in the development of updated COVID-19 vaccines showing promising results against newer subvariants. The U.S. Food and Drug Administration's advisory panel is set to decide whether vaccine updates should focus on the JN.1 variant for the upcoming immunization campaign.

Pfizer and BioNTech, along with Moderna, have stated their readiness to supply the updated vaccines immediately once they receive approval.

InvestingPro Insights

Pfizer Inc. (NYSE: PFE) continues to make strategic appointments to its Board of Directors, strengthening its governance and expertise in the financial sector. As of the last twelve months as of Q1 2024, the company's market capitalization stands at a robust 158.55 billion USD, reflecting its significant presence in the biopharmaceutical industry. With Cyrus Taraporevala joining the board, investors may find reassurance in the company's financial oversight and strategic planning capabilities.

InvestingPro data indicates that Pfizer's revenue has experienced a decline in the last twelve months, with a -41.08% change, signaling a challenging period for the company. Despite this, Pfizer maintains a strong gross profit margin of 59.41%, underscoring its ability to manage costs effectively and sustain profitability in its core operations. The company's dividend yield is notably high at 6.0%, which could be attractive to income-focused investors, especially considering that Pfizer has maintained dividend payments for 54 consecutive years, as highlighted by one of the InvestingPro Tips.

Investors looking for stability might also take interest in Pfizer's low price volatility, another characteristic emphasized by InvestingPro Tips. With analysts predicting profitability in the current year, and a history of raising dividends for over a decade, Pfizer presents a potentially compelling case for those seeking a blend of income and steady performance. For more detailed analysis and additional InvestingPro Tips, interested readers can explore Pfizer's profile on InvestingPro, which lists a total of 10 tips for a deeper dive into the company's financial health. Additionally, users can use the coupon code PRONEWS24 to get an extra 10% off a yearly or biyearly Pro and Pro+ subscription.

The appointment of Taraporevala is a testament to Pfizer's dynamic approach to leadership and governance. With his background in investment management and financial markets, Taraporevala is poised to contribute to Pfizer's strategic initiatives and help navigate the company through the evolving landscape of the pharmaceutical industry.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.