Moderna , Inc. (NASDAQ:MRNA) director Noubar Afeyan has recently sold a significant portion of his holdings in the company. On April 24, 2024, Afeyan parted with a total of 15,000 shares of Moderna stock, garnering over $1.6 million from the sale. The transactions occurred at varying prices, ranging from $107.16 to $109.91 per share.

The sales were conducted under a pre-arranged trading plan, known as a Rule 10b5-1 plan, which Afeyan had adopted well in advance of the transactions. Such plans allow company insiders to sell a predetermined number of shares at a predetermined time, providing a defense against potential accusations of trading on non-public, material information.

Following these transactions, Afeyan still retains a substantial stake in the biotechnology firm, directly owning over 2 million shares. Additionally, through his connections with Flagship Pioneering, indirect holdings amount to nearly 9.7 million shares, reflecting his ongoing investment in the company's future.

Investors often scrutinize insider sales for hints about executives' confidence in their companies. However, it's worth noting that insiders may sell shares for various reasons that do not necessarily signal a lack of faith in the firm's prospects, such as diversifying their investment portfolio or meeting personal financial objectives.

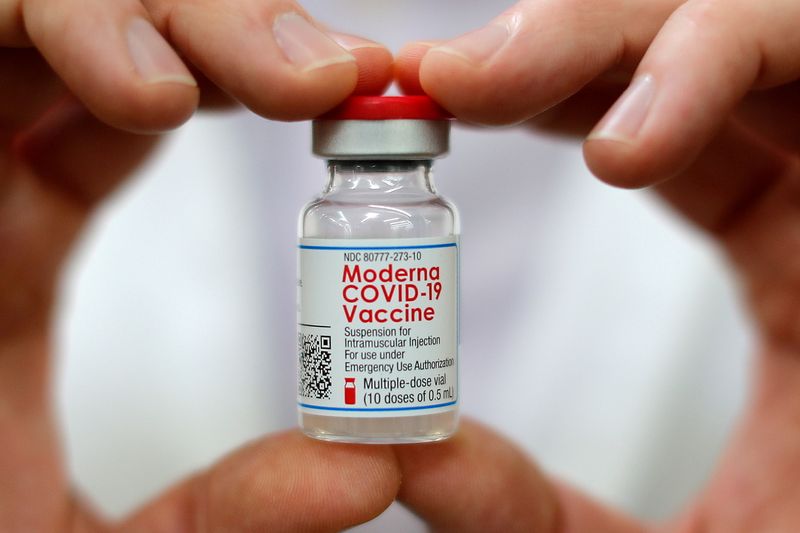

Moderna, headquartered in Cambridge, Massachusetts, continues to be at the forefront of developing messenger RNA (mRNA) therapies and vaccines, including its widely recognized COVID-19 vaccine. The company's stock performance and insider transactions remain of keen interest to investors tracking the biotech sector.

InvestingPro Insights

As Moderna, Inc. (NASDAQ:MRNA) navigates the post-pandemic market, its financial health and stock performance are under close watch by investors. According to InvestingPro data, Moderna's market capitalization stands at a robust $41.34 billion. However, the company's P/E ratio is currently negative at -8.73, reflecting challenges in maintaining profitability over the last twelve months as of Q4 2023. The company's gross profit margin also shows signs of strain, with a -39.28% reported in the same period, indicating costs have surpassed revenues.

Despite the volatility, there has been a notable price uptick with a 42.1% total return over the last six months. This could be an indicator of recovering investor confidence or a response to specific market conditions. In terms of financial stability, an InvestingPro Tip highlights that Moderna holds more cash than debt on its balance sheet, which is a positive sign for potential investors considering the company's ability to manage its financial obligations.

Another InvestingPro Tip points out that management has been actively buying back shares, which can be seen as a move to consolidate value for shareholders. This, coupled with the fact that Moderna does not pay a dividend, indicates that the company is focusing on reinvesting in its growth and research capabilities.

For those seeking more insights, there are additional InvestingPro Tips available, including analysis on sales projections and profitability forecasts. To access these valuable insights, visit https://www.investing.com/pro/MRNA and consider using the coupon code PRONEWS24 to get an additional 10% off a yearly or biyearly Pro and Pro+ subscription.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.