By Karin Strohecker and Marc Jones

LONDON (Reuters) - Poland's tightening grip on its judiciary has prompted nationwide protests and threats of European sanctions, but its asset prices and currency have soared this year as they have in plenty of other places where democracy has been eroded.

The nationalist government in Warsaw may have angered European allies and sparked demonstrations with bills empowering it to hire and fire top judges but investors reckon the strong economy outweighs the risks.

The zloty

Returns have been strong across emerging markets this year, but the list of top performers is peppered with countries where leaders are strengthening their hold on power.

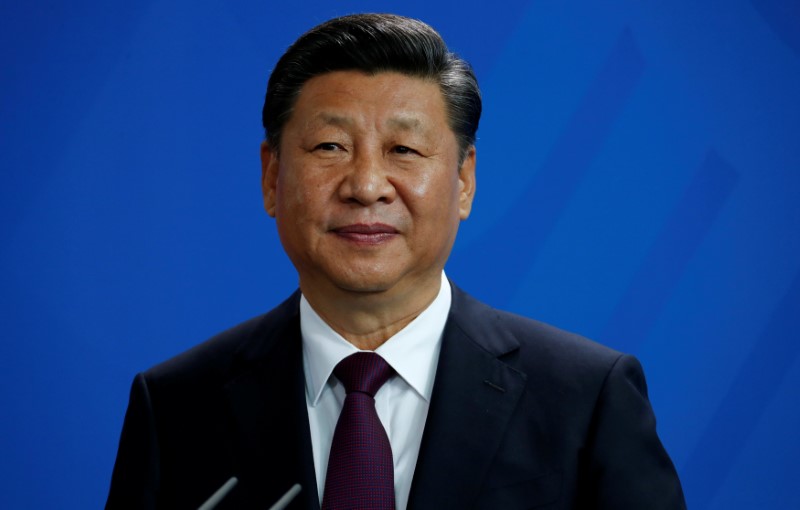

Turkish and Chinese stocks jumped more than 33 percent, while Egyptian and Turkish dollar-bonds have returned more than 10 percent, showing that markets love the economic benefits and certainty that strongman politics can deliver.

"Providing governments are responsible fiscally they can get away with a lot of undemocratic measures," said Renaissance Capital emerging market fund manager Charlie Robertson.

"They can pretty much do what they want to their own country," he added. "At least on a one-year horizon." Of course, as the likes of Zimbabwe show, authoritarian leaders do not guarantee economic success. And investment bets on undemocratic countries can turn sour - as they are now in Venezuela amid Nicolas Maduro's latest power grab and did recently in Saudi Arabia and Qatar.

Amid improving global growth and low interest rates it is not just countries where politicians are strengthening their hold that have rallied either. Chile, Brazil and South Africa have all made decent gains despite political uncertainty.

But such countries have been far outshone by the likes of Poland, Turkey, Egypt, Hungary and China, where in some cases the returns on assets have been twice as strong.

The main thing for markets is a well-managed, growing economy where the government lives within its means. Poland with robust growth, rising wages and consumer demand offers all that.

"The economy story (in Poland) has a lot going for it, enough for people to not worry too much about politics," said Kieran Curtis, investment director for emerging markets at Standard Life (LON:SL) Investments.

Turkey, one of this year's other top markets, also has a budget deficit below 3 percent of GDP - as well as dynamic growth and favourable demographics.

Its stock market fell last year after an attempted coup.

A subsequent crackdown by President Tayyip Erdogan has led to tens of thousands of arrests, but Sacha Chorley, portfolio manager at Old Mutual Global Investors said the country's strong fundamentals and profitable companies have not changed.

ORBANOMICS

Any fallout from the democratic backsliding can affect longer term investors like pension funds further down the line, since bonds' present value is linked to when they will be repaid, which is often 5-10 years away. Many are playing a much shorter-term game of a year or two though. "Are these changes going to affect fixed income investors in this period? At least in case of Poland, you can say: not that much," Standard Life's Curtis added.

Some longer term investors may also have in mind nearby Hungary.

The criticism leveled at Jaroslaw Kaczynski, who leads Poland's ruling Law and Justice (PiS) party, echoes that aimed at Hungarian Prime Minister Viktor Orban some years back and who Kaczynski is now close to. 'Orbanomics', as the policies were termed, included slapping huge taxes on banks, energy, telecoms and retailers - often foreign-owned, angering company bosses and EU regulators.

But fund managers who stuck with Hungary eventually reaped outsize returns.

Orbanomics also brought down Hungary's budget deficit, introduced a flat 15 percent income tax rate and appointed a central bank governor who launched a huge stimulus program.

As a result, growth restarted, the deficit swung into surplus. Since the end of 2012, MSCI's Hungarian shares are up 40 percent <.dMIHU00000PUS>, far outstripping broader emerging stocks (MSCIEF) which are only now back to their 2012 levels.

"Trying to trade the institutional deterioration in Hungary in recent years was one of the greatest lossmaking trades you could have made," said UBS strategist Manik Narain.

"That's certainly one thing that's encouraging people to sit back and be careful in Poland."

STRONGMAN MEDICINE

Democratic credentials have not just been pushed back across emerging markets.

The 167-nation "Democracy Index", compiled by the Economist Intelligence Unit, downgraded the United States from a "full" to a "flawed" democracy in 2016. Yet Wall Street has regularly hit record highs since then.

Hungary, Poland and Turkey have been sinking deeper into the "flawed" category since 2015. Meanwhile Russia and Egypt both share the label of "authoritarian regime".

Countries such as Singapore and China made economic development strides without adhering to Western-style democracy but a major risk is the erosion of property rights a particular problem for investors in Russia.

But there are prominent instances this year of illiberal leaders fuelling market rallies by ramming through unpopular policies.

Egyptian sovereign dollar debt has returned over 10 percent, benefiting from former military commander Abdel Fattah al-Sisi's moves to float the currency and cut subsidies.

The measures, which finally put Egypt on the road to economic recovery, were adopted despite a 20 percent inflation surge that hit the poorest the most and sparked popular anger.

"In my opinion, a democratic government would not have been able to deliver (those changes)," said Shahzad Hasan, a portfolio manager at Allianz (DE:ALVG) Global Investors. "So this was one example of where a strong man was able to deliver the painful medicine that was needed."

Another example, notes Frederic Lamotte, CIO of Indosuez Wealth Management, is India. Prime Minister Narendra Modi, criticized as authoritarian, has implemented a tax overhaul delayed for decades by political wrangling that could add 0.4 percent to the economy.

Since Modi's ascent, MSCI India has rallied 16 percent - double the gains of the broader emerging equities index. "Weak leadership will never manage any changes," Lamotte said.

EM stocks in 2017 http://tmsnrt.rs/2hn5N02

EM currencies in 2017 http://tmsnrt.rs/2hniYya

EM dollar-bond returns YTD http://reut.rs/2ePZ0j6