By Jonathan Saul and Collin Eaton (NYSE:ETN)

LONDON/HOUSTON (Reuters) - At least three tankers are on their way to Asia with U.S. oil cargoes after Washington gave temporary approval to wind down transactions with a Chinese shipping company that it sanctioned last month, according to data and shipping sources.

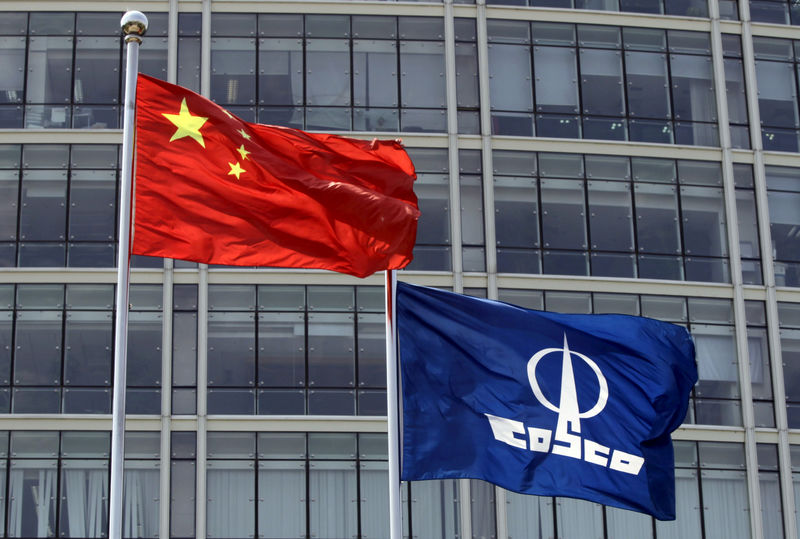

In one of the biggest sanctions actions taken by the U.S. government since its crackdown on Iranian oil exports, Washington on Sept. 25 announced sanctions on Chinese tanker companies, including COSCO Shipping Tanker (Dalian), a subsidiary of China's state-owned shipping group COSCO.

The surprise move by Washington and concern over shippers falling foul of U.S. sanctions led to oil freight costs hitting record highs around the world, adding millions of dollars in costs for every voyage.

Shipping sources said Washington had begun to grant temporary waivers for the conclusion of shipments around Oct. 15.

Refinitiv data showed three tankers - carrying millions of barrels of oil and owned by the designated COSCO subsidiary - set sail from the U.S. Gulf for destinations in Asia around that time, after waiting in the area for several weeks after sanctions were imposed.

The sources said on Friday that further COSCO tankers were preparing to sail with cargoes on board that had been held up.

This followed a notice from the U.S. Treasury on Thursday which allowed for the "maintenance or wind down of transactions" including offloading non-Iranian crude oil involving the COSCO subsidiary until Dec. 20.

One shipping source said ships with cargoes on board were more comfortable to discharge their cargoes, adding Thursday's notice by the Treasury maybe formalizes what was already known.

"These sanctions by the Trump administration were worded in a way that you can never feel completely secure. I think that’s deliberate," the source said.

Earlier this month, a source said a separate tanker owned by the affected COSCO subsidiary had received a temporary waiver from U.S. sanctions that allowed it to discharge its cargo.

Jonathan Chappell, an analyst with advisory firm Evercore ISI, said the Treasury notice was "fraught with legalese and therefore difficult to fully comprehend, opening the content up to possible misinterpretation.

"It appears that the intent of the update is to enable voyages/transactions that are already under way to be completed by Dec. 20 ... and it does not end or place a waiver on the current sanctions," Chappell said in a note on Thursday.

CNOOC, China's largest offshore oil and gas producer, said this week it would be affected by U.S. sanctions on COSCO's subsidiary but there would be no impact on its oil and gas production.