(Bloomberg) -- Sign up to our Next Africa newsletter and follow Bloomberg Africa on Twitter

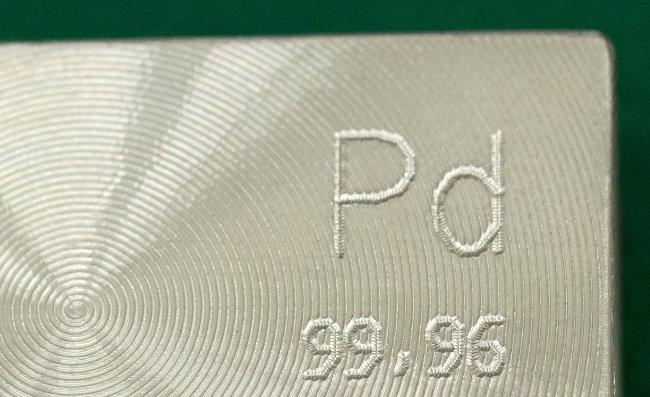

Palladium neared a record $1,900 an ounce and platinum gained after South African mining companies halted operations in response to the country’s power cuts.

South Africa, the world’s biggest producer of platinum and No. 2 palladium supplier, is facing a sixth day of rolling blackouts. State utility Eskom Holdings SOC Ltd. is struggling with breakdowns at plants and heavy rains that have soaked coal used as fuel.

“Tight supply that potentially could get even tighter due to production problems in South Africa helps provide the underlying support,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S.

Palladium may “pause at $1,900 given some technical resistance, but overall the price could go higher,” he said.

Spot platinum added 0.7% to $901.98 an ounce. Palladium rose 0.6% to $1,893.85. Prices have climbed for 13 straight days, the longest stretch since 2014.

Palladium has smashed through new record highs over the past two years because of limited supply and higher demand for the metal, which is used in autocatalysts. The auto industry has boosted purchases to meet stricter emissions rules, sending prices up 50% this year.

Carmakers are not that price sensitive given how little palladium contributes to their total costs, said Hansen.

Citigroup Inc (NYSE:C). sees palladium prices jumping to $2,500 by mid-2020 because of a persistent supply deficit. There are no signs of substitution with cheaper platinum or significant amounts of scrap metal coming to market, the bank said.

Analysts have been less bullish on the outlook for platinum, given weaker demand for the metal, mainly used in autocatalysts for diesel vehicles. Prices are up 13% this year, helped by investment buying.

Longer term, platinum may benefit from Asia’s push for fuel-cell electric vehicles, which use platinum catalysts in the electrodes, according to a report this week from precious metals refiner Heraeus Holding GmbH.