By Laura Sanicola

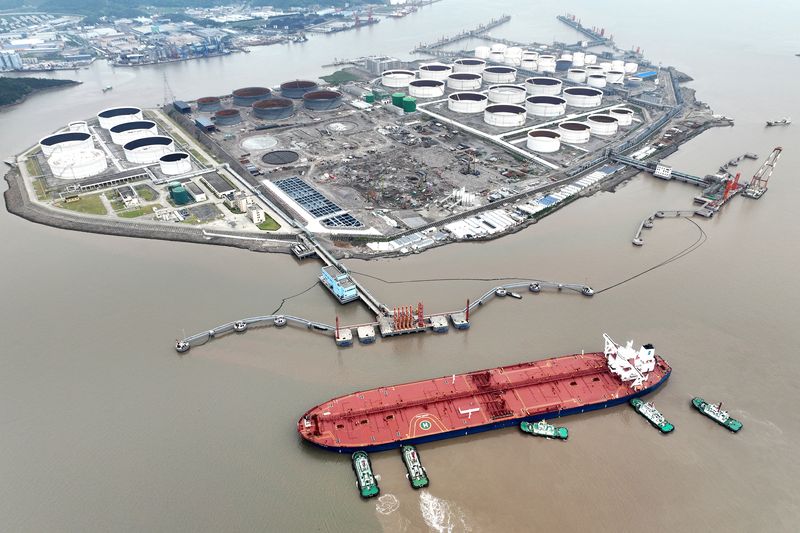

(Reuters) -The benchmark oil price settled largely unchanged on Monday, holding above the $90 a barrel reached last week for the first time in 10 months following fresh Saudi and Russian crude output cuts.

Brent crude settled down 1 cent to $90.64 a barrel while U.S. West Texas Intermediate crude settled down 22 cents to $87.29.

Saudi Arabia and Russia last week announced that they will extend voluntary supply cuts of a combined 1.3 million barrels per day (bpd) until the end of the year.

The supply cuts overshadowed continuing concern over Chinese economic activity. On Monday U.S. Deputy Treasury Secretary Wally Adeyemo said that China's economic problems were more likely to have a local impact than affect the United States.

"Much of this reduced supply has simply served to offset a major slowdown in global oil demand," said Jim Ritterbusch, president of Ritterbusch and Associates in Galena, Illinois.

U.S. crude inventories are expected to fall for the fifth week in a row by about 2 million barrels, a preliminary Reuters poll showed on Monday.

Crude supply could also see fresh disruption from powerful storms and floods in eastern Libya, in which more than 2,000 people have died and which has forced the closure of four major oil export ports since Saturday - Ras Lanuf, Zueitina, Brega and Es Sidra.

Meanwhile, Europe is expecting a light refinery maintenance season this autumn as refiners look to profit from high margins, which could support crude demand. Offline refinery capacity in Europe is pegged around 800,000 bpd according to consultancy Wood Mackenzie, down by 40% year-on-year.

A batch of macroeconomic data expected this week will inform whether central banks in Europe and the United States continue their aggressive rate hike campaigns.

U.S. August consumer price index (CPI) data is due on Wednesday and could provide a steer on whether more increases to interest rates will be on the cards.

The inflation data is likely to influence everything from stocks to foreign exchange, fixed income and commodity prices, said Naeem Aslam of Zaye Capital Markets.

The European Central Bank is also expected to announce its interest rate decision this week. On Monday, the European Commission forecast the euro zone to grow more slowly than previously expected in 2023 and 2024.

In focus too are monthly reports from the International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries (OPEC) due later this week.

The IEA last month lowered its 2024 forecast for oil demand growth to 1 million bpd, citing lacklustre macroeconomic conditions. OPEC's August report, meanwhile, kept its 2.25 million bpd demand growth forecast unchanged.