By Scott DiSavino

NEW YORK (Reuters) -Oil prices edged up about 1% on Wednesday from a five-month low in the prior session on a bigger-than-expected weekly withdrawal from U.S. crude storage and on worries about the security of Middle East oil supplies after a tanker attack in the Red Sea.

Traders also noted crude prices held gains after the U.S. Federal Reserve released a statement that it would hold interest rates steady as expected and signaled it would start lowering borrowing costs in 2024.

Lower interest rates cut consumer borrowing costs, which can boost economic growth and demand for oil.

Brent futures rose $1.02, or 1.4%, to settle at $74.26 a barrel. U.S. West Texas Intermediate (WTI) crude rose 86 cents, or 1.3%, to settle at $69.47.

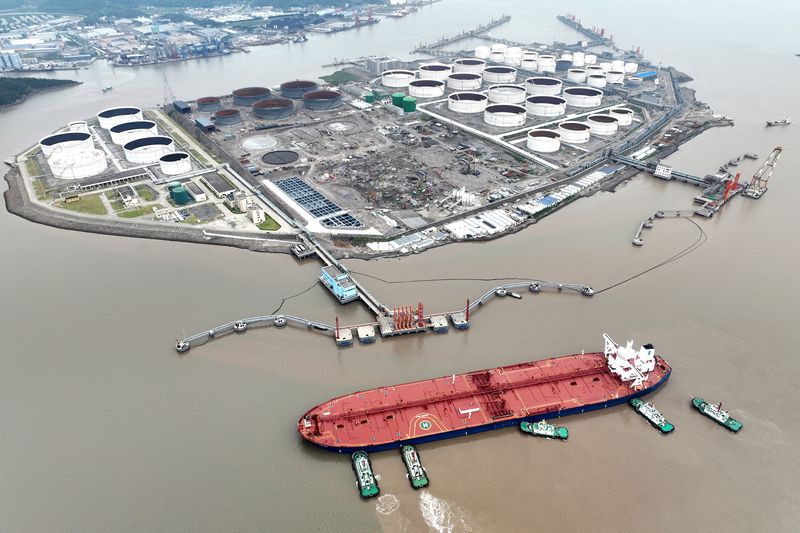

A tanker in the Red Sea off Yemen's coast was fired on by gunmen in a speedboat and targeted with missiles, the latest incident to threaten the shipping lane after Yemeni Houthi forces warned ships not to travel to Israel.

The U.S. Energy Information Administration (EIA) said energy firms pulled a bigger than expected 4.3 million barrels of crude from stockpiles during the week ended Dec. 8 as imports fell. [EIA/S] [EIA/A]

"This (EIA) report is definitely more supportive than the (API) report that we saw yesterday," said Phil Flynn, an analyst at Price Futures Group, referring to the "larger than expected drawdown in crude oil supplies" in the EIA report.

On Tuesday, both Brent and WTI futures fell to their lowest since June and were in contango, with prices in later months higher than earlier months. Traders say this is bearish because it can encourage marketers to buy oil at current prices and store it to sell later when prices are higher.

U.S. INTEREST RATES

The U.S. Fed said it held interest rates steady and signaled an end to monetary policy tightening to fight inflation and lower borrowing costs coming in 2024.

Elsewhere, nearly 200 nations reached an historic deal at the COP28 conference to begin reducing global consumption of fossil fuels.

Saudi Arabia's energy minister said he was in agreement with the COP28 presidency on the final deal, adding it would not affect the kingdom's hydrocarbon exports.

In its monthly report, the Organization of the Petroleum Exporting Countries (OPEC) blamed the latest crude price slide on "exaggerated concerns" about oil demand growth.

Brent futures have dropped about 10% since OPEC+ announced a new round of production cuts on Nov. 30. OPEC+ includes OPEC and allies like Russia.