By Rod Nickel and Karl Plume

WINNIPEG, Manitoba/FARGO, N.D. (Reuters) - Millers and bakers are draining wheat reserves and paying more for spring wheat used in baking, as drought shrivels crops across the Canadian Prairies and northern U.S. Plains that produce more than half of the world's supply.

U.S. and Canadian farmers are bracing for a sharply smaller spring wheat harvest due to the driest conditions in decades, as severe weather damages crops across the hemisphere, from heat scorching cherries in the U.S. Pacific Northwest to frost chilling sugarcane in Brazil.

While overall global wheat stocks are large, the drought affects mainly the high-protein spring wheat crop that millers such as Archer Daniels Midland (NYSE:ADM) Co and bakers including Grupo Bimbo rely on to produce the texture and moistness in baked goods that consumers expect.

Importers from Britain to China must pay up for limited North American harvests or turn to other suppliers like Australia and Russia.

Minneapolis spring wheat futures are trading near nine-year highs, leaving Camas Country Mill in Eugene, Oregon braced to pay more, said owner Tom Hunton. He plans on passing his higher costs on to the mill's bakery customers.

Camas Country will rely on stockpiled wheat from last year to top up this year's supplies to produce flour. But Hunton worries about the drought carrying into next year.

"This isn't sustainable for anyone," he said.

In Canada, bread prices may rise as much as 6.5% by late this year, said Sylvain Charlebois, director of the Agri-Food Analytics Lab at Dalhousie University in Halifax, Nova Scotia.

U.S. prices are more difficult to forecast, since flour prices dropped earlier this year as lockdowns eased and fewer people baked at home, he said.

STEEP DROPOFF

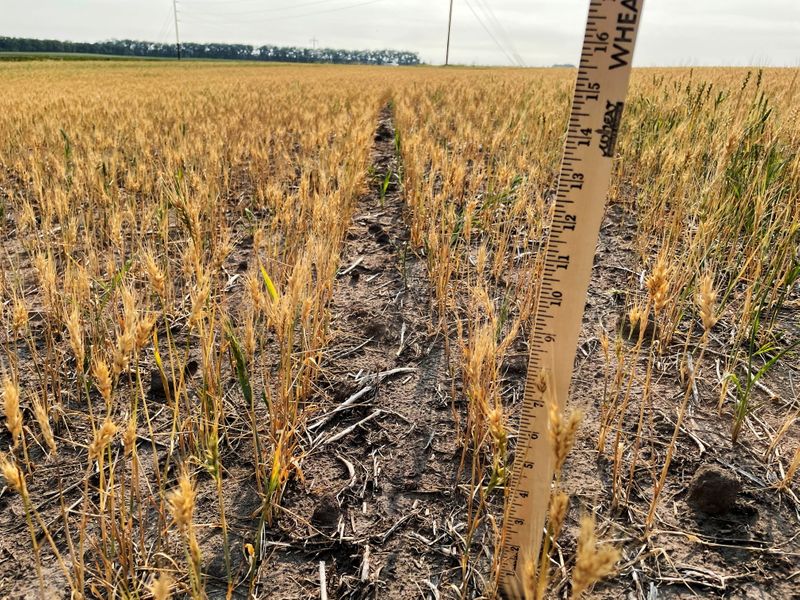

Canada's spring wheat crop is expected at between 16 and 20 million tonnes, well off last year's 25.8 million, said Bruce Burnett, director of markets and weather information at MarketsFarm. Just 16% of spring wheat in Saskatchewan and 21.6% in Alberta is in good or excellent condition, according to provincial governments.

The U.S. spring wheat harvest is expected to drop 41% from a year ago to the lowest production in 33 years, according to the U.S. Department of Agriculture (USDA).

The USDA on Monday estimated that just 10% of the country's spring wheat crop was in good or excellent condition, down from 73% a year ago and the lowest rating for this point of the season since the 1988 drought.

In Montana, where the USDA has deemed 42% of spring wheat in very poor condition and another 43% in poor shape, growers are buying out of sales contracts inked earlier in the season with elevators because they will not have wheat to deliver.

"I cancelled more contracts last week than I wrote. If they don't have a crop, they have no choice," said one commercial grain buyer who declined to be named as he is not authorized to speak to media.

IMPORTERS ADJUST

China, which normally buys modest amounts of North American spring wheat to make high-quality bread and baked goods, will likely buy more from other suppliers such as Australia, said a China-based trader with an international trading house.

Russia may make up some of North America's shortfall in the global market. Southern Russia, the country's main wheat-producing region, is producing wheat with higher protein than a year ago, Dmitry Rylko, head of the Moscow-based IKAR consultancy, said.

Spring wheat from Russia and Kazakhstan, however, does not have the same characteristics important for baking, such as gluten strength, as U.S. hard red spring wheat and Canadian Western Red Spring, said Mike Spier of U.S. Wheat Associates, a trade group that promotes U.S. wheat overseas.

The drought will force bakers to change how they work with flour, adding more water to compensate for dryness and making other adjustments to avoid producing crustier-than-usual buns, said Glenn Wilde, owner of Harvest Bakery in Winnipeg, Manitoba.

United Kingdom baker Warburtons buys half of its wheat from Canada, about 200,000 tonnes annually, grown by farmers to the company's specifications. The company will pay more this year to ensure it acquires enough Canadian spring wheat, said Adam Dyck, Warburtons' Canadian program manager, adding that many kernels may be too shrivelled to mill into flour.

Dyck said he is accustomed to seeing pockets of drought on the Prairies, but nothing this widespread.

"It's pretty unique for this generation," he said.