A look at the day ahead in markets from Sujata Rao

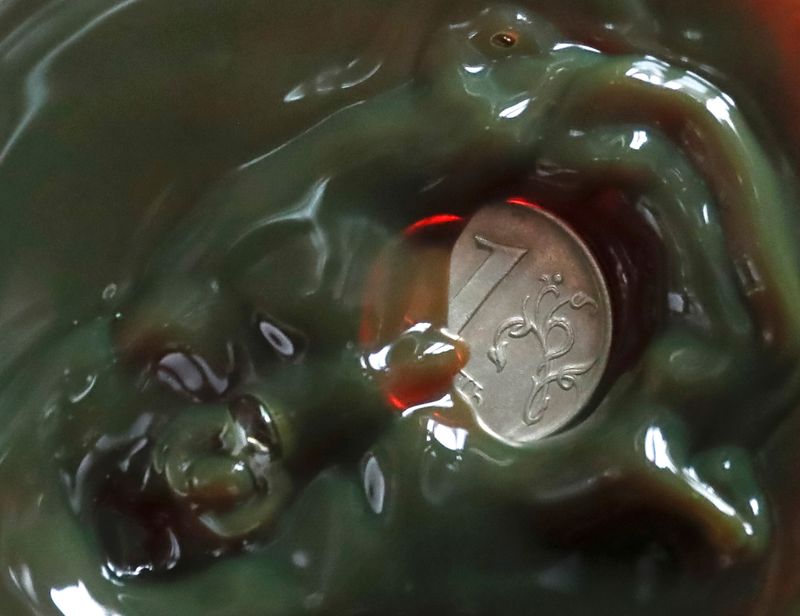

It's a month since Russian troops stormed into Ukraine, goading the West into an unexpectedly severe sanctions response. Now, a new twist -- President Vladimir Putin wants "unfriendly" nations to pay for energy imports in roubles, not euros or dollars.

And contracts must be switched in a week, Putin has demanded.

The demand carries all kinds of ramifications and it's unclear if Western firms, wary of trading Russian assets, will agree. But the announcement promptly sent European gas prices higher. And meanwhile, a Kazakh oil pipeline outage has lifted Brent crude back above $120 a barrel.

It all heaps on the price pressures -- JPMorgan (NYSE:JPM)'s latest estimate is for global inflation to hit 6.3% this quarter, the fastest increase in a quarter of a century. And more aggressive central banks -- even habitually dovish U.S. policymakers now seem willing to endorse bigger interest rate rises in May.

And of course recession fears are on the rise, as U.S. bond yield curves are signalling.

Graphic: U.S. bond yield curve: https://fingfx.thomsonreuters.com/gfx/mkt/gdpzyjykjvw/US2203.PNG

We will get an idea of the kind of hit to business activity and sentiment are taking from the war as advance readings of March Purchasing Managers Indexes (PMIs) trickle out.

Japanese PMIs show business optimism has notably softened but Europe may fare worse; Wednesday data showed consumer confidence plunging in March to May 2020 lows.

All that and more will be debated at a summit of NATO and European leaders in Brussels, which U.S. President Joe Biden will join. Expect more sanctions against Russia.

Finally, equity trading has resumed in Moscow after a 3-1/2-week shutdown, albeit on a limited basis. And currency traders are awaiting clarity of whether European buyers can swing rouble payments for gas -- that possibility lifted the Russian currency 8% on Wednesday.

Graphic: Who buys Russia's oil and gas? Who buys Russia's oil and gas?: https://graphics.reuters.com/GLOBAL-OIL/RUSSIA/myvmnxxolpr/chart.png

Key developments that should provide more direction to markets on Thursday:

-ECB board member Frank Elderson speaks

-Fed speakers: Chicago President Charles Evans, Minneapolis Fed's Neel Kashkari, Governor Christopher Waller, Atlanta Fed's Rafael Bostic

-Switzerland to resist global rate-hike trend

-Norway to raise rates by 25 bps

-U.S. weekly jobless claims/final core PCE/durable goods

-U.S. 10-year TIPS auction

- Mexico to raise rates by 50 bps, South Africa to deliver 25 bps rise