By Anna Driver and Lisa Baertlein

NEW YORK/LOS ANGELES (Reuters) - Union Pacific (NYSE:UNP) Corp's chief executive said another round of tariffs on Chinese goods could badly hurt his railroad and the U.S. economy, but he feels U.S. President Donald Trump is listening to his concerns.

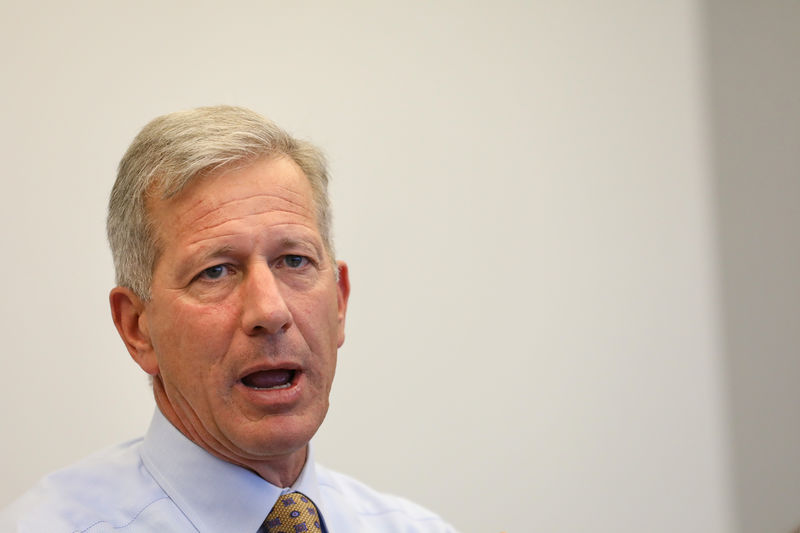

CEO Lance Fritz listed trade as one of the reasons the company has taken a more negative tone in its growth outlook. The trade wars, along with slowing industrials and devastating floods in the U.S. Midwest, have weighed on the railroad's prospects in recent months.

He said there is no doubt that the threat of 25% tariffs on an additional $300 billion in Chinese imports caused him significant concern. He met Trump on Friday.

"I was heard, understood and that's better access than we've had in a long time," Fritz said.

The Omaha, Nebraska-based company's rail network covers 32,000 route miles (51,000 km) in the Western two-thirds of the country and includes the Los Angeles/Long Beach port complex, which handles the most China ocean cargo in the United States.

"It's hard to say how quickly (the threatened tariffs) would show up in my top line, but that would be a pretty significant risk to us," Fritz said at a meeting with Reuters editors and reporters on Wednesday.

Fritz's comments underscore the risk that Trump's trade war with China poses for the U.S. economy. After talks stalled, Trump and Chinese President Xi Jinping are due to sit down at the G20 Summit in Osaka, Japan later this month.

Union Pacific expects 2019 volume growth in the low single-digit percentages. Volume fell 2% in the first quarter and 4% in the second quarter. Floods in the Midwest hampered Union Pacific's business in the first half of the year, along with concerns about the trade spat with China.

Fritz would not say how much of Union Pacific's business originates and terminates in China, but said Asia accounts for an important portion of its revenue.

U.S. exports to China tumbled 30% in the first quarter, while U.S. imports from China fell 9%, according to International Monetary Fund trade data analyzed by trade credit insurance firm Atradius.

That has hit close to home for Union Pacific, which said in April that agricultural shipments from its home state and around the Midwest tumbled since China slapped retaliatory tariffs on U.S. soybeans. The railroad's agriculture products revenue fell 3% to almost $1.1 billion in the first quarter, hurt by a 7% drop in grain carloads due to reduced exports to China.

The pressure increased on June 1, when Washington hiked tariffs on $200 billion of Chinese goods to 25% from 10% and Beijing retaliated by boosting tariffs on $60 billion in U.S. goods to 25% from 5%.

The trans-Pacific standoff comes as the railroad, one of the nation's largest, has been grappling with a softening in the truck market that makes highway shipments more competitive with rail.