(Bloomberg) -- Iran said it will veto any OPEC decision that harms the Islamic Republic and warned that some oil producers are trying to create an alternative suppliers’ forum that supports U.S. policies hostile to the government in Tehran.

Oil Minister Bijan Namdar Zanganeh said the agreement that the Organization of Petroleum Exporting Countries and allied producers reached in 2016 to cut output is in tatters, and an OPEC committee set to meet this weekend in Algiers has no authority to impose a new supply arrangement.

“I will block any OPEC decision that poses the slightest threat to Iran,” Zanganeh said, without specifying possible actions he might take. Any decision on a new production agreement by OPEC’s Joint Ministerial Monitoring Committee that meets on Sunday would be “void” and “invalid,” he said. “Decisions can only be made at OPEC meetings in the presence of all OPEC members and by consensus of members.”

Growing Isolation

Zanganeh’s comments reflect Iran’s concern at its growing isolation within OPEC and the U.S.-led campaign to throttle its oil exports with sanctions. A flourishing partnership between its arch-rival Saudi Arabia and Russia shows signs of eclipsing OPEC’s preeminence as a global source of crude. Tehran sees Saudi Arabia, the group’s largest member, as conspiring with other producers to steal its market share. At the same time, Iran’s traditional ally within OPEC -- Venezuela -- is struggling to stave off economic collapse.

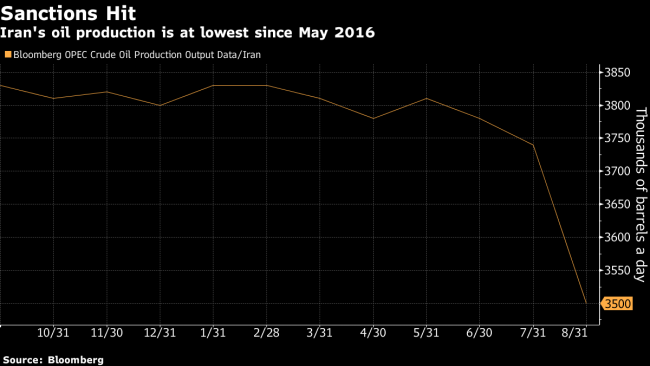

Pressure on Iran has intensified since U.S. President Donald Trump pulled out of the diplomatic accord that Barack Obama negotiated to curtail Tehran’s nuclear program. U.S. sanctions on Iran’s oil sales take effect on Nov. 4, and Trump has vowed to curb exports from OPEC’s third-biggest producer to zero. Iranian crude shipments have already plunged about 35 percent since April, according to Bloomberg tanker tracking data.

“Any country that says it can make up for the shortfall in the market is siding with the U.S.,” Zanganeh told reporters in Tehran. He said he has written letters to some OPEC and non-OPEC oil ministers expressing his concerns and has complained to the group’s secretary-general about “violations” to the original output-cuts agreement, though he wouldn’t elaborate.

“I think Mr. Trump made this decision to bring Iran’s exports to zero without any consultation with any experts, not even in his own government,” he said. “He’s realized lately that this is not doable. So, they are looking for a symbolic export of zero, if they can, even for just one month.”

Zanganeh said he won’t be attending the Algerian JMMC meeting, which is to occur just days before the two-year anniversary of OPEC’s decision to pare production and curb a glut. Russia and other suppliers agreed in December 2016 to join OPEC in trimming output. The cuts had their intended effect, and in June of this year Saudi Arabia and Russia decided to change course and boost supply to stem a price rally.

No Deal

“The agreement doesn’t really exist anymore. It’s finished,” Zanganeh said. Russia initially cut 300,000 barrels a day of production but then added it all back, he said. “There’s no agreement left, really.”

The current supply-cuts deal expires automatically at the end of this year, unless producers replace it with a new one. When OPEC and its allies agreed in June to boost output, they didn’t specify country quotas. Saudi Arabia and Russia said the increase would be about 1 million barrels a day.

Two OPEC members are seeking to damage the group and carry out “anti-Iranian policies” at the behest of the U.S., Zanganeh said. He didn’t identify the countries. Saudi Arabia and the United Arab Emirates are the staunchest backers of the U.S. within OPEC and are aligned politically against Iran in the Middle East.

The U.S. and some other OPEC members will probably increase crude supplies from their inventories to keep a lid on prices ahead of the American mid-term Congressional elections in November, he said.

Oil prices are trading near their highest in two months in London, at almost $80 a barrel, as demand concerns arising from U.S.-China trade tensions are countered by supply losses from Iran to Venezuela. Oil at $80 a barrel is a “suitable” price, Zanganeh said. Although Sunday’s gathering in Algiers is a committee review, rather than a full-scale official OPEC meeting, most major producers will attend.

Iran’s crude production dropped by 150,000 barrels a day to 3.58 million a day in August, OPEC’s research department said earlier this month in a report. Saudi Arabia bolstered supplies again to 10.4 million a day, according to the report.