(Bloomberg) -- The unprecedented oil inventory glut that amassed during the coronavirus pandemic is almost gone, underpinning a price recovery that’s rescuing producers but vexing consumers.

Barely a fifth of the surplus that flooded into the storage tanks of developed economies when oil demand crashed last year remained as of February, according to the International Energy Agency. Since then, the lingering remnants have been whittled away as supplies hoarded at sea plunge and a key depot in South Africa is depleted.

The re-balancing comes as OPEC and its allies keep vast swathes of production off-line and a tentative economic recovery rekindles global fuel demand. It’s propping international crude prices near $67 a barrel, a boon for producers yet an increasing concern for motorists and governments wary of inflation.

“Commercial oil inventories across the OECD are already back down to their five-year average,” said Ed Morse, head of commodities research at Citigroup Inc (NYSE:C). “What’s left of the surplus is almost entirely concentrated in China, which has been building a permanent petroleum reserve.”

The process isn’t quite complete. A considerable overhang appears to remain off the coast of China’s Shandong province, though this may have accumulated to feed new refineries, according to consultants IHS Markit Ltd.

Working off the remainder of the global excess may take some more time, as OPEC+ is reviving some halted supplies and new virus outbreaks in India and Brazil threaten demand.

Still, the end of the glut at least appears to be in sight.

Oil inventories in developed economies stood just 57 million barrels above their 2015-2019 average as of February, down from a peak of 249 million in July, the IEA estimates.

It’s a stark turnaround from a year ago, when lockdowns crushed world fuel demand by 20% and trading giant Gunvor Group Ltd. fretted that storage space for oil would soon run out.

Stockpile Slump

In the U.S., the inventory pile-up has effectively cleared already.

Total stockpiles of crude and products subsided in late February to 1.28 billion barrels -- a level seen before coronavirus erupted -- and continue to hover there, according to the Energy Information Administration. Last week, stockpiles in the East Coast fell to their lowest in at least 30 years.

“We’re starting to see refinery runs pick up in the U.S., which will be good for potential crude stock draws,” said Mercedes McKay, a senior analyst at consultants FGE.

There have also been declines inside the nation’s Strategic Petroleum Reserve, the warren of salt caverns used to store oil for emergency use. Traders and oil companies were allowed to temporarily park oversupply there by former President Trump, and in recent months have quietly removed about 21 million barrels from the location, according to people familiar with the matter.

The oil surplus that gathered on the world’s seas is also diminishing. Ships were turned into makeshift floating depots when onshore facilities grew scarce last year, but the volumes have plunged, according to IHS Markit Ltd.

They’ve tumbled about by 27% in the past two weeks to 50.7 million barrels, the lowest in a year, IHS analysts Yen Ling Song and Fotios Katsoulas estimate.

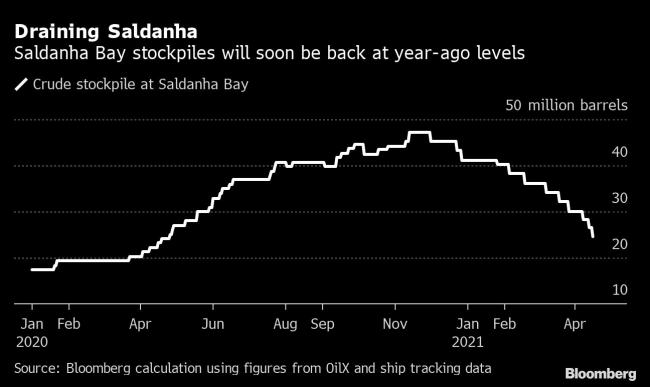

A particularly vivid symbol is the draining of crude storage tanks at the logistically-critical Saldanha Bay hub on the west coast of South Africa. It’s a popular location for traders, allowing them the flexibility to quickly send cargoes to different geographical markets.

Inventories at the terminal are set to fall to 24.5 million barrels, the lowest in a year, according to ship tracking data monitored by Bloomberg.

For the 23-nation OPEC+ coalition led by Saudi Arabia and Russia, the decline is a vindication of the bold strategy they adopted a year ago. The alliance slashed output by 10 million barrels a day last April -- roughly 10% of global supplies -- and is now in the process of carefully restoring some of the halted barrels.

The Organization of Petroleum Exporting Countries has consistently said its key objective is to normalize swollen inventories, though it’s unclear whether the cartel will open the taps once that’s achieved. In the past, the lure of high prices has prompted the group to keep production tight even after reaching its stockpile target.

Mixed Blessing

To consuming nations the great de-stocking is less of a blessing. Drivers in California are already reckoning with paying almost $4 for a gallon of gasoline, data from the AAA auto club shows. India, a major importer, has complained about the financial pain of resurgent prices.

For better or worse, the re-balancing should continue. As demand picks up further, global inventories will decline at a rate of 2.2 million barrels a day in the second half, propelling Brent crude to $74 a barrel or even higher, Citigroup predicts.

“Gasoline sales are ripping in the U.S.,” said Morse. “Demand across all products will hit record levels in the third quarter, pushed up by demand for transport fuels and petrochemical feed-stocks.”

©2021 Bloomberg L.P.