Investing.com –Last week saw the U.S. dollar close lower against all of its major rivals after senior Federal Reserve officials indicated that the bank would almost certainly have to provide fresh stimulus to the faltering U.S. economy.

The dollar fell to a 6-month low against the euro by close of trade on Friday. Against the yen, the dollar closed just above its lowest level since Japan's September 15 intervention in the currency market. Meanwhile, the dollar closed at a 30-month low against the Swiss franc and a 26-month low against the Australian dollar.

On Friday, Federal Reserve Bank of New York President William Dudley, speaking in relation to the U.S. economy said that "The current situation is wholly unsatisfactory".

Meanwhile, Chicago Fed President Charles Evans said that further steps to stimulate the U.S. economy may be "desirable". However both officials stopped short of specifically endorsing a second round of quantitative easing.

The Fed's dovish comments overshadowed Friday's better-than-expected data on U.S. consumer sentiment and spending.

Next week, the U.S. is due to release the closely watched ADP report on non-farm employment change ahead of Friday's government data on non-farm payrolls. In addition, the country is to release official data on initial jobless claims, manufacturing activity and pending home sales.

Elsewhere in the world, the week ahead will be dominated by rate statements. In the euro zone, the European Central Bank is to announce its minimum bid rate, while in the U.K. the Bank of England is also to announce its benchmark interest rate. In addition Britain is to release official data on inflation, manufacturing and service sector growth and house prices.

The Bank of Japan and the Reserve Bank of Australia are both to announce their benchmark interest rates, while Australia will also release key data on unemployment, retail sales and trade balance.

Also next week, Canada is to release official data on manufacturing, housing, unemployment and business outlook, while New Zealand is to release key data on business confidence.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, October 4

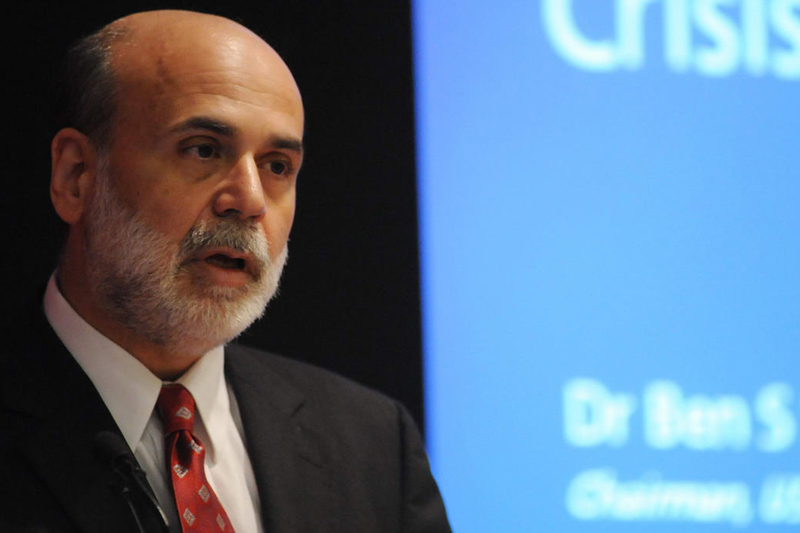

The U.S. is to start the week by releasing official data on pending home sales and factory orders, while Federal Reserve Chairman Ben Bernanke is due to deliver a speech at a public engagement. His comments will be closely scrutinized for any clues to the future direction of monetary policy.

Elsewhere, the euro zone is to produce data on investor confidence and producer price inflation, while the U.K. is due to publish a report on activity in its construction sector. Later in the day, Bank of England monetary policy Committee Member Paul Tucker is due to speak on the country’s economy.

Also Monday, Japan is to release data on average cash earnings; New Zealand is to produce a report on business confidence while Australia is due to publish industry data on its services sector.

Tuesday, October 5

Both the U.S. and the U.K. are due to release official data on services sector growth, a leading indicator of economic health.

Meanwhile, the euro zone is to publish official data on retail sales, a leading indicator of consumer spending while Switzerland is to produce official data on consumer price inflation.

Elsewhere, the Bank of Japan will announce its benchmark interest rate. The announcement will be followed by a closely watched press conference, which will be scrutinized for any clues to the future direction of monetary policy.

Also Tuesday, the Reserve Bank of Australia will announce its benchmark interest rate. The country will also produce official data on its trade balance, as well as a report on retail sales and business confidence.

Wednesday, October 6

The U.S. is to release a report on ADP non-farm employment change. This data is viewed as an accurate prediction of the governments report on non-farm payrolls released two days later. Also Wednesday, the U.S. is to publish data on crude oil inventories.

Elsewhere, the euro zone is to release final data on its GDP, the leading indicator of economic growth, while Germany is to publish data on factory orders.

Meanwhile, Canada is due to publish its Ivey PMI, a leading indicator of economic health, while Australia is to publish a report on activity in its construction sector.

Also Wednesday, the Bank of Japan is to publish its monthly report, which is a summary of the data the bank examined before setting the benchmark interest rate.

Thursday, October 7

The U.S. is to release key weekly data on initial jobless claims as well as official data on consumer credit and natural gas inventories.

In Europe, the European Central Bank is due to announce its benchmark interest rate, followed by a closely watched press conference. Also Thursday, Germany is to release key data on industrial production, while France is due to produce official data on its trade balance.

In the U.K, the Bank of England is also to announce its benchmark interest rate. The country is also due to release official data on manufacturing and industrial production, both leading indicators of economic health.

Elsewhere, Australia is to release official government data on employment change, as well as the country's unemployment rate, while the Reserve Bank of Australia is due to publish its annual report, which provides a summary of the prior year's operations.

Meanwhile, Canada is due to release official data on building permits, a leading indicator of health in the housing sector.

Also Thursday, the Bank of Japan is to publish the minutes of its monetary policy committee meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates. The country is also due to publish an index of leading economic indicators, designed to predict the future direction of the economy as well as official data on its current account.

Friday, October 8

The U.S. is to round up the week with data on non-farm employment change and a report on the country's unemployment rate. Elsewhere, Canada is also set to release key data on employment change and the country's unemployment rate, as well as data on business outlook and housing starts.

Also Friday, the U.K. is to release official data on producer price inflation, a leading indicator of economic growth.

The dollar fell to a 6-month low against the euro by close of trade on Friday. Against the yen, the dollar closed just above its lowest level since Japan's September 15 intervention in the currency market. Meanwhile, the dollar closed at a 30-month low against the Swiss franc and a 26-month low against the Australian dollar.

On Friday, Federal Reserve Bank of New York President William Dudley, speaking in relation to the U.S. economy said that "The current situation is wholly unsatisfactory".

Meanwhile, Chicago Fed President Charles Evans said that further steps to stimulate the U.S. economy may be "desirable". However both officials stopped short of specifically endorsing a second round of quantitative easing.

The Fed's dovish comments overshadowed Friday's better-than-expected data on U.S. consumer sentiment and spending.

Next week, the U.S. is due to release the closely watched ADP report on non-farm employment change ahead of Friday's government data on non-farm payrolls. In addition, the country is to release official data on initial jobless claims, manufacturing activity and pending home sales.

Elsewhere in the world, the week ahead will be dominated by rate statements. In the euro zone, the European Central Bank is to announce its minimum bid rate, while in the U.K. the Bank of England is also to announce its benchmark interest rate. In addition Britain is to release official data on inflation, manufacturing and service sector growth and house prices.

The Bank of Japan and the Reserve Bank of Australia are both to announce their benchmark interest rates, while Australia will also release key data on unemployment, retail sales and trade balance.

Also next week, Canada is to release official data on manufacturing, housing, unemployment and business outlook, while New Zealand is to release key data on business confidence.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, October 4

The U.S. is to start the week by releasing official data on pending home sales and factory orders, while Federal Reserve Chairman Ben Bernanke is due to deliver a speech at a public engagement. His comments will be closely scrutinized for any clues to the future direction of monetary policy.

Elsewhere, the euro zone is to produce data on investor confidence and producer price inflation, while the U.K. is due to publish a report on activity in its construction sector. Later in the day, Bank of England monetary policy Committee Member Paul Tucker is due to speak on the country’s economy.

Also Monday, Japan is to release data on average cash earnings; New Zealand is to produce a report on business confidence while Australia is due to publish industry data on its services sector.

Tuesday, October 5

Both the U.S. and the U.K. are due to release official data on services sector growth, a leading indicator of economic health.

Meanwhile, the euro zone is to publish official data on retail sales, a leading indicator of consumer spending while Switzerland is to produce official data on consumer price inflation.

Elsewhere, the Bank of Japan will announce its benchmark interest rate. The announcement will be followed by a closely watched press conference, which will be scrutinized for any clues to the future direction of monetary policy.

Also Tuesday, the Reserve Bank of Australia will announce its benchmark interest rate. The country will also produce official data on its trade balance, as well as a report on retail sales and business confidence.

Wednesday, October 6

The U.S. is to release a report on ADP non-farm employment change. This data is viewed as an accurate prediction of the governments report on non-farm payrolls released two days later. Also Wednesday, the U.S. is to publish data on crude oil inventories.

Elsewhere, the euro zone is to release final data on its GDP, the leading indicator of economic growth, while Germany is to publish data on factory orders.

Meanwhile, Canada is due to publish its Ivey PMI, a leading indicator of economic health, while Australia is to publish a report on activity in its construction sector.

Also Wednesday, the Bank of Japan is to publish its monthly report, which is a summary of the data the bank examined before setting the benchmark interest rate.

Thursday, October 7

The U.S. is to release key weekly data on initial jobless claims as well as official data on consumer credit and natural gas inventories.

In Europe, the European Central Bank is due to announce its benchmark interest rate, followed by a closely watched press conference. Also Thursday, Germany is to release key data on industrial production, while France is due to produce official data on its trade balance.

In the U.K, the Bank of England is also to announce its benchmark interest rate. The country is also due to release official data on manufacturing and industrial production, both leading indicators of economic health.

Elsewhere, Australia is to release official government data on employment change, as well as the country's unemployment rate, while the Reserve Bank of Australia is due to publish its annual report, which provides a summary of the prior year's operations.

Meanwhile, Canada is due to release official data on building permits, a leading indicator of health in the housing sector.

Also Thursday, the Bank of Japan is to publish the minutes of its monetary policy committee meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates. The country is also due to publish an index of leading economic indicators, designed to predict the future direction of the economy as well as official data on its current account.

Friday, October 8

The U.S. is to round up the week with data on non-farm employment change and a report on the country's unemployment rate. Elsewhere, Canada is also set to release key data on employment change and the country's unemployment rate, as well as data on business outlook and housing starts.

Also Friday, the U.K. is to release official data on producer price inflation, a leading indicator of economic growth.