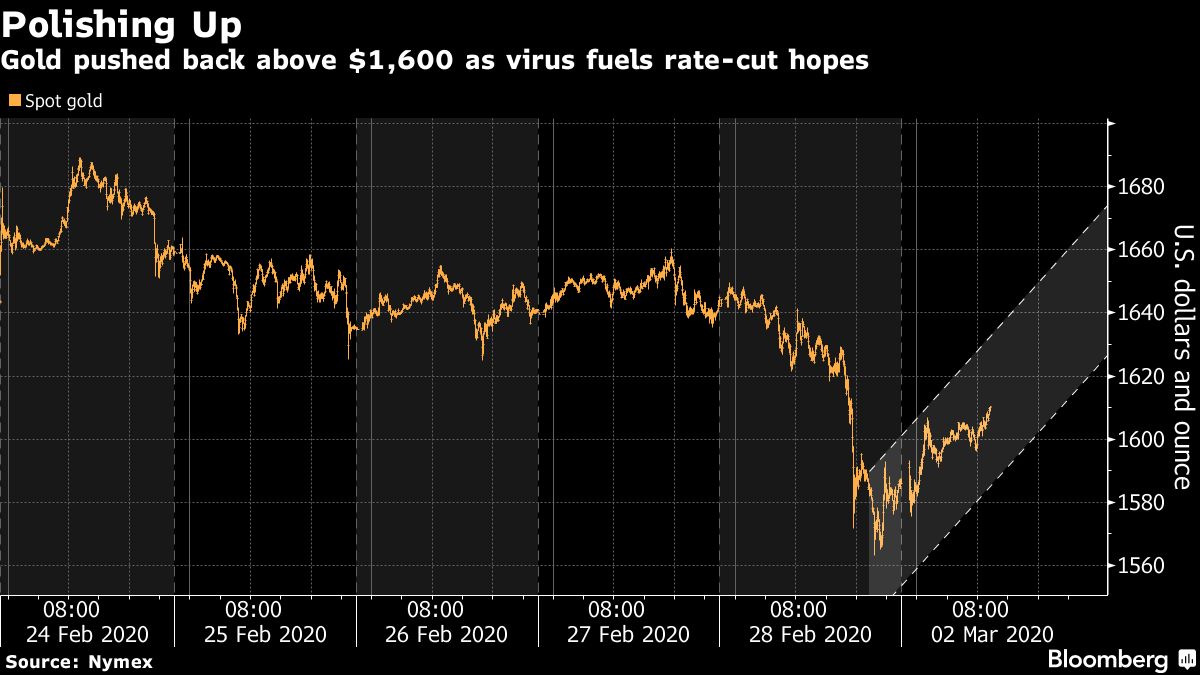

(Bloomberg) -- After getting caught up in last week’s punishing virus-driven sell-off, gold rebounded on Monday to refresh its haven credentials.

The metal advanced after a weekend of negative developments, including a surge in virus cases around the world. With rising expectations that central banks will now act, assets including copper, oil and equities also gained. Friday’s big slump in gold was put down to investors’ forced selling to cover losses elsewhere.

“Gold’s fundamentals remain overwhelmingly strong and any near-term price corrections aren’t significant in terms of the bigger picture,” said Gavin Wendt, senior resource analyst at MineLife Pty. Bullion’s retreat last week “was nowhere as bad as the 10%-plus drubbing equity markets took, so it can be argued gold has passed its safe-haven challenge,” he said.

Bullion has a long-standing reputation as a go-to asset in times of stress. That said, there’s a chance that investors sell gold during extreme turmoil, something seen late last week and, before that, for a period in the 2008 financial crisis.

Investors were “cashing out to cover losses and meet margin calls in other markets,” RBC Capital Markets said in a note, referring to Friday’s drop. “We do not view this as a loss in faith in gold’s role as a ‘perceived safe haven’ or a fundamental shift in the attitude toward gold.”

Spot gold climbed 1.5% to $1,608.91 an ounce by 11:08 a.m. in London. On Friday, prices fell as much as 5%, the biggest intraday drop since 2013. All other major precious metals also rose Monday, led by silver.

Rate-Cut Hopes

Investors are assessing gold’s outlook amid signals that the Federal Reserve will join other central banks in easing policy. Chairman Jerome Powell opened the door to a cut at the March 17-18 meeting by releasing a rare note Friday pledging to “act as appropriate” to support the economy.

The Bank of Japan issued an emergency statement as the week began, saying it will “strive to provide ample liquidity.”

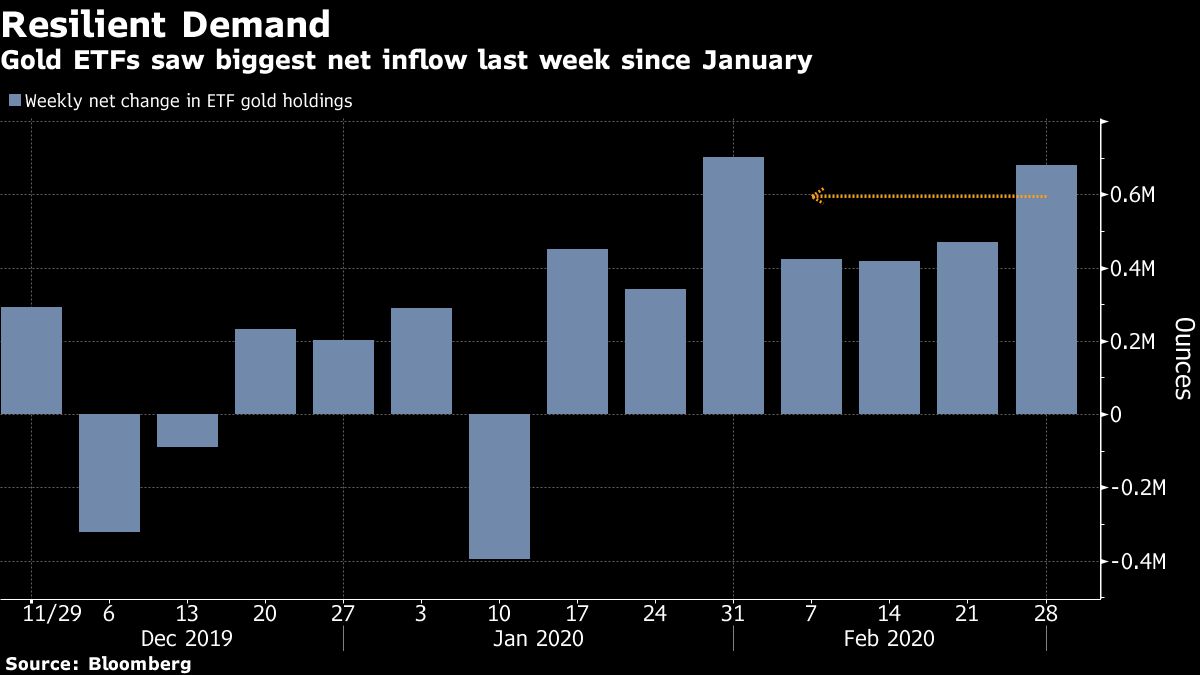

While gold prices sank on Friday, investors continued to buy into bullion-backed exchange-traded funds. The worldwide total expanded 8.6 tons to a record 2,634.4 tons, according to an initial tally compiled by Bloomberg.

“The resilience of gold ETFs is encouraging,” Joni Teves, a strategist at UBS Group AG, said in a note. “Gold looks attractive here as a hedge against the backdrop of negative rates and acute uncertainty that is likely to persist.”