MELBOURNE (Reuters) -A sharp slide in nickel prices over the past year, driven by a jump in Indonesian supply, has hit Australian nickel producers, leading to mine closures, production cuts and writedowns in recent months.

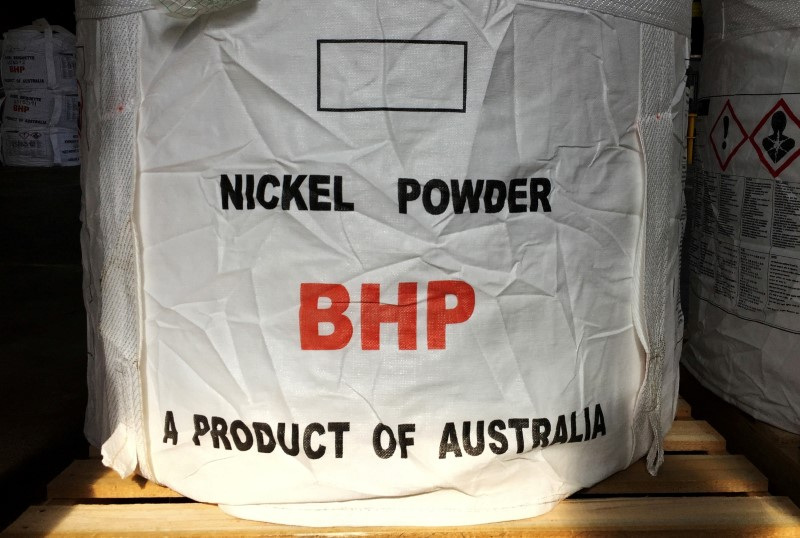

Australia is the world's fifth biggest producer of mined and refined nickel, with output led by BHP Group (NYSE:BHP).

Following are moves by nickel producers and developers to cope with the slump:

* Wyloo Metals, a private investment company owned by iron ore billionaire Andrew Forrest, said on Monday it will put its Australian Kambalda nickel operations on care and maintenance at the end of May as a result of low nickel prices.

* Diversified miner South32 (OTC:SOUHY) said on Monday it had commenced a strategic review of its nickel operation Cerro Matoso in Colombia to evaluate options to improve its competitive position amid a sharp downturn in the nickel market.

* BHP, the world's biggest listed miner, said on Jan. 18 it was reevaluating its nickel business. Analysts said it may need to write down its $1.2 billion West Musgrave project and could potentially delay it. It will provide more detail at its half year earnings on Feb 20.

BHP signed a deal to supply nickel to Tesla (NASDAQ:TSLA) in 2021.

* Canada's First Quantum Minerals (OTC:FQVLF) said on Jan. 15 it will cut jobs and production at its Ravensthorpe mine in Australia due to a "significant" downturn in prices that it expects to last three years.

* Panoramic Resources went into voluntary administration in December. On Jan. 8, its administrators said operations at its Savannah nickel project would be suspended as the "prospect of achieving a near-term turnaround of operations and finances is low". The project remains up for sale.

* Battery materials producer IGO flagged in December it expects to book a further impairment to its Cosmos nickel project when it reports on Jan. 31, adding to an almost A$1 billion writedown in the 2023 financial year.