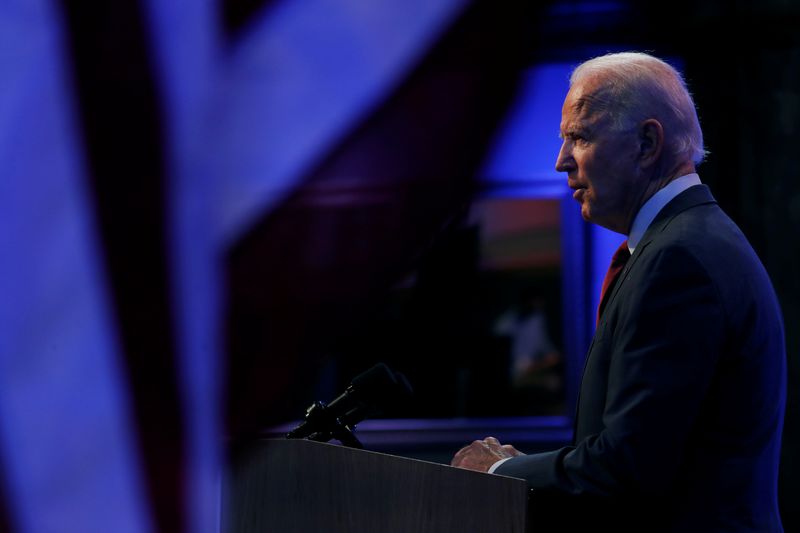

(Reuters) - Should Joe Biden win November's U.S. presidential election, there could be a number of changes in energy policy.

Here are the issues at stake:

INTERNATIONAL OIL SUPPLIES

President Donald Trump's unilateral sanctions on OPEC members Iran and Venezuela have together taken around 3 million barrels per day of crude oil off international markets, a little more than 3% of world supply. That has fit neatly into Trump's 'Energy Dominance' policy of maximizing U.S. energy production while constraining the supply of geopolitical rivals, for both economic and political advantage. With the Trump administration continuing to ramp up sanctions measures on both countries in recent weeks, there is no sign there would be a change of course if Trump is re-elected.

Biden, however, has shown an interest in multilateral diplomacy similar to previous Democratic administrations. That could mean an eventual path for Iran and Venezuela to get out from under Washington’s sanctions and start pumping again, if the right conditions are met. In Iran, that path could include a partnered approach between Washington and Europe, similar to a deal struck under Obama's administration.

In Venezuela, Biden appears likely to continue to favor sanctions to pressure the regime of President Nicolas Maduro, but could increase diplomatic efforts to end the impasse by negotiating a new election or power-sharing with the opposition. Biden's campaign has not detailed how it would approach these issues.

LINE TO OPEC

Trump has been more engaged with the Organization of the Petroleum Exporting Countries (OPEC) than most of his predecessors. He has sometimes influenced OPEC policy with his tweets and phone calls, arguing for an oil price low enough for consumers but high enough for drillers. His sanctions have weakened the influence of OPEC hawks Venezuela and Iran within the group, removing two big historical hurdles to a pro-Washington OPEC policy. That has concentrated power with leading producer Saudi Arabia, along with Russia, part of the group known as "OPEC-plus".

Biden lacks the chummy rapport that Trump has developed with OPEC kingpin Saudi Arabia’s defacto leader Crown Prince Mohammed bin Salman, meaning he may not engage as closely on the group’s production policy. He is also more likely to rely on quiet diplomatic channels for influencing the group than Trump's Twitter-centered approach.

Biden's campaign has not yet detailed how it would approach these issues, but any influence he would wield as president would likely be in service of the same goal - a moderate oil price. Any U.S. president needs affordable fuel for consumers. And for Biden, the price would need to be high enough to make clean energy alternatives to fossil fuels competitive in support of his ambitious climate plan.

A GREEN TRANSITION?

A Biden administration would look to re-enter the Paris Climate Agreement, an international pact negotiated during the Obama administration to fight global warming that Trump pulled away from saying it could hurt the U.S. economy. Biden's view is that climate change is an existential threat to the planet, and that a transition from fossil fuels can be an economic opportunity if the United States moves fast enough to become a leader in the clean energy technology.

Trump's administration has acted to weaken or eliminate emissions targets at every turn, including the U.S. Environmental Protection Agency's softening of vehicle emissions standards, and its rescinding of Obama’s Clean Power Plan requiring cuts from the electric power industry. Transport and electricity together make up around half the country’s greenhouse gas emissions.

In contrast, Biden has vowed to bring U.S. emissions down to net zero by 2050, including bringing emissions from the power industry to net zero by 2035. The U.S. utility industry has already expressed skepticism about getting to net zero in 15 years, with many companies saying they are at a loss for how to achieve their own voluntary, less ambitious goals.

While European oil and gas companies like BP (NYSE:BP) and Royal Dutch Shell (LON:RDSa) have already begun implementing strategies for a global energy transition, U.S. majors like Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) have remained focused on the traditional energy business - sheltered politically by Trump's leadership in Washington. A Biden presidency would unleash enormous pressure on U.S. majors to quickly become more green. Biden has expressed an interest in supporting climate-related lawsuits against the oil industry, and his running mate, Kamala Harris, has cited her record suing oil companies as Attorney General in California.

FEDERAL DRILLING

While Trump has sought to maximize domestic oil and gas production, Biden has promised to ban issuance of new drilling permits on federal lands and waters in order to fight global climate change.

The United States produced nearly 3 million barrels of crude oil per day from federal lands and waters in 2019, along with 13.2 billion cubic feet per day of natural gas, according to Interior Department data. That amounts to about a quarter of total domestic oil output and more than an eighth of total U.S. production of gas. A federal ban on new permits would mean those numbers trend toward zero over a matter of years.

There would also be an impact on public revenue federal oil and gas production produced about $12 billion in public revenue in 2019, divided between the U.S. Treasury, states and counties, tribes, and cleanup funds.

New Mexico, for example, received $2.4 billion in disbursements last year, much of it going to its historically underfunded education system. The state’s Democratic Governor Michelle Lujan Grisham told Reuters this spring she would seek a waiver from Biden’s government to allow continued drilling if he was elected.

Biden’s camp has been mum on whether such a waiver program would exist.