By Marta Nogueira, Gram Slattery and Ron Bousso

RIO DE JANEIRO/LONDON (Reuters) - As the weeks ticked down to Brazil's biggest-ever oil auction, state-run Petrobras held increasingly frantic talks to find potential partners, with the heaviest blow coming when major Exxon Mobil Corp (N:XOM) pulled out days before, according to six people familiar with the matter.

While many firms were far from ready to take on enormous signing fees and investments, Exxon came closest but ultimately failed to reach acceptable terms for the blockbuster bidding round, according to four of the sources, who requested anonymity to discuss confidential negotiations.

With that, the state firm formally known as Petroleo Brasileiro SA (SA:PETR4) was left to anchor an embarrassingly empty bidding round on Wednesday with token support from Chinese firms.

The big Brazilian round was the latest offshore auction this year to undershoot expectations, hurt by competition from shale oil and other unconventional sources as well as lower demand forecasts.

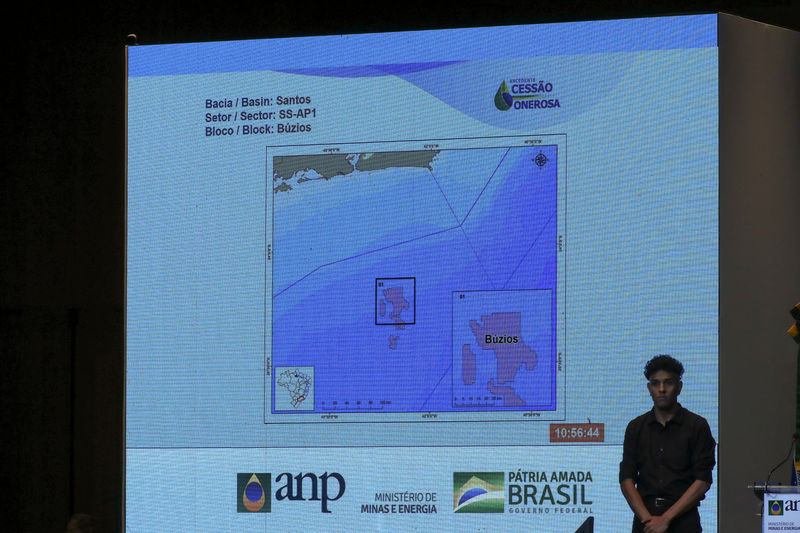

Most of the talks to form consortia between Petrobras and other oil firms were and brief and informal, according to the sources. But negotiations with Exxon were relatively advanced, offering the major a large stake in the coveted Buzios oil block until talks fell apart in the last few weeks, sources said.

The ill-fated talks show how even global firms that were seriously interested in the landmark "transfer-of-rights" (TOR) auction on Wednesday could not accept the terms of a required partnership with Petrobras – long seen as a bottleneck to the development of Brazil's most promising deepwater resources.

The proposed Exxon-Petrobras consortium, which would have included the two Chinese state firms that ultimately bought 10% of Buzios block' rights, CNODC and CNOOC (HK:0883), would have given a seal of private-sector approval to the landmark auction.

Instead the lack of major partners revealed how the powerful role of Petrobras in the so-called "pre-salt polygon," along with complicated development terms and expensive signing fees discourage interest, even among majors with large purchasing power, in one of the world's biggest proven oil reserves.

Exxon and Petrobras did not respond to requests for comment.

CNOOC and CNPC did not immediately respond to e-mails sent outside business hours.

https://graphics.reuters.com/BRAZIL-OIL/0100B2JV1WF/oil-blocks.jpg

DIFFERENCES EMERGE

Much remains unclear as to why the talks did not bear fruit.

One source said the Petrobras and Exxon disagreed over the way billions of dollars would be paid to the Brazilian firm in compensation for prior investments. Others cited differences over how much to invest in platforms to ramp up production.

Exxon was interested in taking over operations at the field, a non-starter for Petrobras, according to one of the sources.

All sources agreed that the complicated nature of the TOR auction played a major role in keeping the talks from reaching the finish line. This has been confirmed by Brazilian authorities to explain why the country failed to catch money from foreign oil companies.

"It's an awful system," Economy Minister Paulo Guedes said on Thursday. "You have to go through many layers of negotiations just to get to the oil."

Due to an agreement signed between Petrobras and the Brazilian government in 2010, the state firm already has rights to develop up to 5 billion barrels of oil in the TOR area. The Wednesday auction concerned oil in the TOR area in excess of what Petrobras had already been promised.

As a result, any winning member of a consortium would have needed to bang out a complex deal reconciling itself with the existing claims of Petrobras in the region. Brazil's government would then have needed to approve the deal.

WEAK COMPETITION

In the end, the state-run company was nearly alone in submitting minimum bids for two of the four areas in the TOR bidding round, which officials hoped would cement Brazil's ascendance as Latin America's undisputed oil powerhouse.

Petrobras won Itapu, the smallest block up for grabs, with a solo offer. Sepia and Atapu, the second and third largest blocks respectively, received no bids.

Had the government sold off all areas, it would have reaped some 106.5 billion reais ($25.8 billion) in signing bonuses. Instead Brazil got just under 70 billion reais.

The following day, Petrobras was also almost completely alone when bidding for the largest of five oil blocks offered at the country's sixth pre-salt bidding round, the Aram area. China's CNODC again accompanied the state-run company by committing to a 20% stake.

The results of both rounds were widely seen as a disappointment, as no private firms placed bids for fields that are known to hold billions of barrels of untapped crude.

Economy Minister Guedes told Reuters on Friday that the week's auctions were a "condemnation" of the production-sharing system Brazil uses in the pre-salt polygon, adding that the country needs to shift toward a concession model.

Following the results, Brazilian Mines and Energy Minister Bento Albuquerque said the government had learned a lesson, and would adjust the rules of any future auction. That could involve lowering the minimum signing bonuses required from bidders, among other parameters, he said.

"We're evaluating the whole process, and we're certain that we're going to correct it," Albuquerque told Reuters.