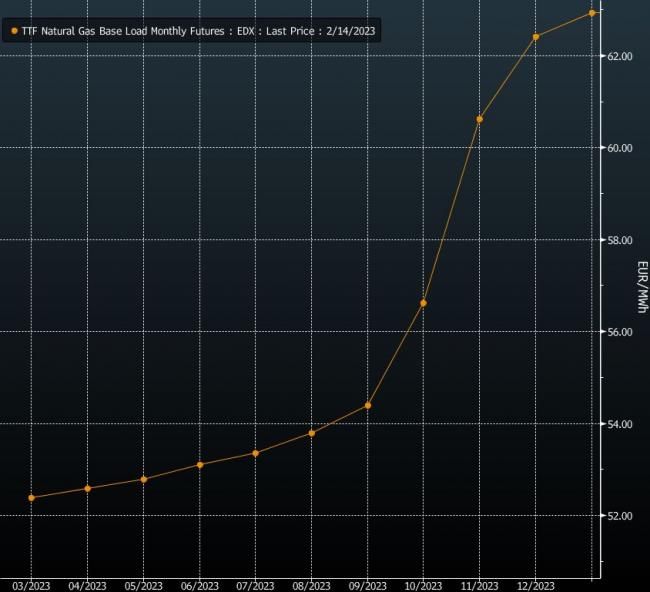

(Bloomberg) -- European natural gas prices are set to move higher through the rest of the year, futures contracts show, a sign that the energy crunch isn’t over yet.

Benchmark Dutch futures for December are currently priced above €60 per megawatt-hour, compared with about €54 for March. Both are elevated for their respective times of year, though far below the record-setting levels seen last August.

As the past year has shown, prices can change quickly along with the supply situation. Mild weather and steady imports of liquefied natural gas have so far helped to prevent energy rationing and blackouts in Europe. But attention is now turning to refilling stockpiles, this time without Russia as the primary supplier, due to the fallout over its invasion of Ukraine.

In the coming weeks, the European Commission plans to consult with member states over whether to prolong emergency steps to reduce gas demand. Those measures, put in place at the height of the crisis, are set to expire at the end of March.

Read More: European Gas Winter Respite Masks 2023 Supply Headwind

Traders are focusing on the market for LNG to replace lost supplies form Russia. With few long-term contracts to deliver the super-chilled fuel to Europe and limited supply, competition is high with Asia.

“Prices seem likely to remain structurally higher than they were before the Russian invasion,” Henning Gloystein, director for energy, climate and resources at Eurasia Group, said in a note.

“New regasification capacity in Europe — especially in the big industrial gas hubs of Germany, Italy, and the Netherlands — will help avoid serious supply shortages, though steeper LNG costs and risks of sudden price spikes could cause energy shortages,” he added.

Most of the recent LNG deals are for deliveries from new plants starting from the middle of the decade. That makes the next two winters challenging as Europe needs to tap spot markets for the fuel.

Spot LNG prices are at about $16-$17 per million British thermal units, while long-term contract prices are much lower, according to Inspired Energy.

Dutch front-month gas, Europe’s benchmark, rose for a second session, trading 3.1% higher at €54 per megawatt-hour by 11:57 a.m. in Amsterdam.