By Barani Krishnan

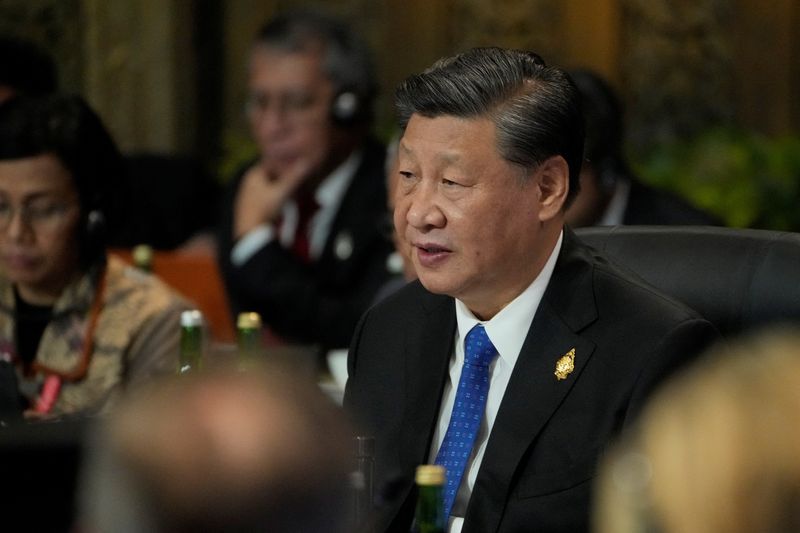

Investing.com -- Whatever update to OPEC+ production policy is announced by Saudi Energy Minister Abdulaziz bin Salman today, the year-end narrative for oil might be decided by the man whose country consumes most of the commodity: China’s Xi Jinping.

From one tightening after another of his Zero-COVID policy since October, China’s president has been forced to loosen some of the hatches to the lockdowns in major Chinese cities amid widespread and rare public protests.

The oil market’s reaction to the retreat shown by the Xi administration was swift. Crude prices soared over the past week with the same urgency with which they had plunged earlier in November as traders quickly worked out the math of mobility and energy demand returning to communities that had been suppressed for months.

Yet, the rebound proved modest and fleeting. After a four-day run-up, the market turned down, closing Friday lower. New York-traded West Texas Intermediate, or WTI, still finished with a 5% gain on the week and London’s Brent with a 2% rise. But oil bulls were disappointed as that contrasted with the 19% dive in the U.S. crude benchmark and the 16% tumble in the U.K. crude gauge over three previous weeks.

There were reasons, of course, for the dispirited performance.

Some held back support for oil on Friday to see if OPEC+ would order deeper production cuts for January. The 23-nation alliance - which represents the 13-member Saudi-led Organization of the Petroleum Exporting Countries and 10 other oil producers steered by Russia - had already announced in October a 2 million-barrels-per-day reduction that is to last through 2023. Where cuts are concerned, the more the merrier for oil bulls, and there was no certainty of that as yet on Friday.

Also weighing on sentiment was news that European Union countries had agreed to a price cap of $60 per barrel on Russian oil exports to punish Moscow over its war against Ukraine.

Crude traders had initially feared that EU countries might go for a much smaller limit of $50 a barrel or below that could sufficiently anger President Vladimir Putin and prompt him to carry out his threat of slashing Russian oil production or exports to punish Europe instead over the move. But by moving up the cap, Europe may avert any Russian retaliation - keeping Moscow’s oil supplies to the region flowing and crude prices lower.

The rebound in the dollar from 3-½ month lows was another bearish factor for oil and most other commodities priced in the currency.

The greenback rose after data showed the United States added 263,000 jobs in November - the smallest since February 2021 but still more than 30% above market forecasts. The strong jobs number could make the Federal Reserve rethink its plan to impose smaller rate hikes hereon to curb inflation when the central bank holds its monthly policy meeting on Dec. 14.

Then, there was just profit-taking by some oil traders. If the market didn’t give anything back, it could have ended the week up 10%. That’s a lot of money to leave on the table, especially when there’s no certainty of what OPEC+ would do.

But more than all these were nagging concerns about how China’s oil demand would fare if Beijing reverts to aggressive COVID action later in December and over the coming year.

“The Chinese government sold a narrative of how it successfully defeated COVID. Then, the narrative got away from it,” Jen Kirby wrote in a column that appeared in a Thursday edition of the Vox.

“That narrative has been critical for President Xi. China’s triumphalism now looks like it had serious limitations - namely that China didn’t have a real exit plan from this strict containment strategy, especially as COVID-19 evolved and, with the Omicron variants, became even more transmissible.”

The consensus among health experts and veteran China observers is that Beijing will likely loosen some of its strictest health policies and end up increasing COVID caseloads in the process. New infections from the virus hit a record high of 31,444 on Nov. 24. Some fear more dramatic spikes in a population that has a massive immunity gap for COVID compared with other nations.

And the more the COVID duress on China, the more its contagion impact on oil, say analysts who predict the country could experience a demand slide of more than 1 million barrels per day versus the norm.

“Chinese crude imports may go below 9 million barrels per day in January," Amrita Sen, director of research at Energy Aspects, said in a Nov. 29 interview with Bloomberg Television.

Chinese oil imports stood at a five-month high of 10.2 million barrels per day in October -- slightly above the pre-virus average -- after the government issued an additional fuel-export quota in an attempt to help revive the country’s economy.

“Our view remains that zero-COVID will be in place through the winter,” Sen said, adding that Energy Aspects’ base case was for a China reopening from COVID in April.

Jeff Currie, global head of commodities at Goldman Sachs, told CNBC recently that “demand is probably heading south again in China given what’s going on.”

Ole Hansen, Head of Commodity Strategy at Saxo Bank, also said energy traders have been mostly focused on China’s demand for oil.

“The slowdown in demand from China will be temporary but having unsuccessfully fought COVID outbreaks with lockdowns for months, the prospect for an improvement looks months away and with the added risk of an economic slowdown reducing demand elsewhere, traders have increasingly been forced to change their short-term outlook,” Hansen said on Tuesday.

Others said fears over China’s oil demand were overblown. “Oil markets may be misjudging news of China’s lockdown,” Rystad Energy said in an analysis. “The impact of the latest lockdowns as reflected in real-time traffic activity shows their likely effect on China’s short-term oil demand, particularly in transportation, is likely to be minor.”

Real-time data on mainland Chinese road activity compiled by Rystad Energy points to a small downturn in country-level road traffic, down from 97% to 95% of 2019 levels during the fourth week of November. To compare, the strict large-scale lockdown in Shanghai in April 2022 resulted in country-level road traffic numbers plunging to around 90% of pre-COVID levels.

“In essence, so far, the latest round of lockdowns appears to be mimicking previous ones, with nationwide road traffic only marginally affected while selected provinces undergoing comparatively severe lockdowns to try and suppress COVID-19 outbreaks,” Rystad Energy says, adding that the protests against the zero-COVID policy are an uncertainty going forward.

Yes, it appears that Chinese President Xi’s decisions on COVID control and public freedom will have a greater say on the oil narrative for the year-end and beyond than the tweaks on OPEC+ production and exports by Saudi energy minister Abdulaziz.

Oil: Market Settlements

WTI for January delivery did a final trade of $80.34 after officially settling Friday’s session at $79.98 per barrel, down $1.24, or 1.5%. For the week though, the U.S. crude benchmark was up 4.9%.

In the case of Brent crude, it did a final trade of $85.42 for the February delivery after officially settling at $85.57 per barrel, down $1.31, or 1.5% on the day. For the week though, the global crude benchmark was up 2.2%.

Oil Price Technical Outlook: WTI

In follow through to the previous month's potentially bearish engulfing candle, WTI rebound from $73.60 finds it challenging to clear through and close above the weekly confluence of the 5-week Exponential Moving Average (EMA) of $81.85 and the 100-week Simple Moving Average (SMA) of $81.65, technical chartist Sunil Kumar Dixit said.

“The only thing giving hope to oil bulls will be the positive close for the week, as well as bullish crossover on the weekly time frame, that makes room for a renewed advance towards the 50-month EMA of 84.58 and the monthly middle Bollinger Band of $85.33,” said Dixit, chief technical strategist at SKCharting.com.

He said strong acceptance above these resistance zones can add further momentum toward WTI’s next major supply zone of the weekly Middle Bollinger Band of $87 followed by the 50-week EMA of $89.30.

“Going into the new week, failure to clear through the $83 and $85 levels will keep the momentum subdued,” Dixit added. “Any consolidation below $81 will increase chances of a breakdown towards $77, followed by $75 and $73.”

Gold: Market Settlements and Activity

Gold retreated into familiar $1,700 territory on Friday after the release of another upbeat monthly U.S. jobs report, before futures of the yellow metal returned to their newly-established $1,800 perch ahead of the close on bets for a smaller Fed rate hike over the next two weeks.

After 15 weeks of being trapped in the claws of $1,700 pricing or lower, both COMEX and spot gold broke free to hit a 5-month high above $1,800 an ounce on Thursday as easing U.S. inflation and jobs growth pointed to the likelihood of smaller Fed rate hikes from this month.

The move was in sync with a preview issued by Investing.com before the November non-farm payrolls (NFP) report, which suggested gold’s action will be in compliance with two timelines: one reacting to Friday’s jobs data and the other more mindful of what the Fed could do the next fortnight.

“Gold has had a nice rally since early November and profit taking could settle in, but a significant pullback doesn’t seem warranted,” said Ed Moya, analyst at online trading platform OANDA. “The economy is slowing down and inflation should steadily decline here and justify a pause in Fed rate hikes after the first quarter.”

Gold futures’ benchmark February contract did a final trade of $1,811.40 an ounce after officially settling Friday at $1,809.60 on New York’s COMEX, down $5.60, or 0.3%. For the week though, the contract was up 3.1%.

The spot price of gold, which is more closely followed than futures by some traders, settled below the $1,800 mark, at $1,797.88, down $5.11 or 0.3% for Friday. For the week, it rose 2.4%.

Gold Outlook: Spot Price

The November NFP report paused spot gold's advance on Friday though bullion prices successfully tested the 100-week SMA of $1,800 in follow up with the previous month's bullish rebound, said technical chartist Dixit.

“Some signs of divergence are seen now on spot gold’s daily and 4-hour RSI (Relative Strength Index), which appears to be in disagreement with rising prices,” he said. “If this divergence shows further confirmation by a day close below $1,790, followed by $1,780, the market can start a short term correction towards $1,755 and $1,725.”

On the other hand, said Dixit, an accumulation of momentum from the $1,790-$1,770 areas can extend the rally towards $1,815, $1,825 and $1,842 in the short term.

“The December 14 Fed decision will create a wider scoreboard for both the bulls and bears,” he said, “The playground for gold longs will be $1,825-$1,845, while the range for the shorts will be $1,780-$1,750.”

Disclaimer: Barani Krishnan does not hold positions in the commodities and securities he writes about.