Investing.com - Copper prices bounced off the lowest level since November on Tuesday, as investors looked ahead to the start of China’s National People’s Congress annual meeting on Wednesday.

On the Comex division of the New York Mercantile Exchange, copper futures for May delivery held in a range between $3.166 a pound and $3.183 a pound.

Copper prices last traded at $3.177 a pound during European morning hours, up 0.15%.

The May copper contract tumbled to $3.156 a pound on Monday, the lowest November 21, before trimming losses to end at $3.172 a pound, down 0.49%.

Futures were likely to find support at $3.156 a pound, the low from March 3 and resistance at $3.212 a pound, the high from February 28.

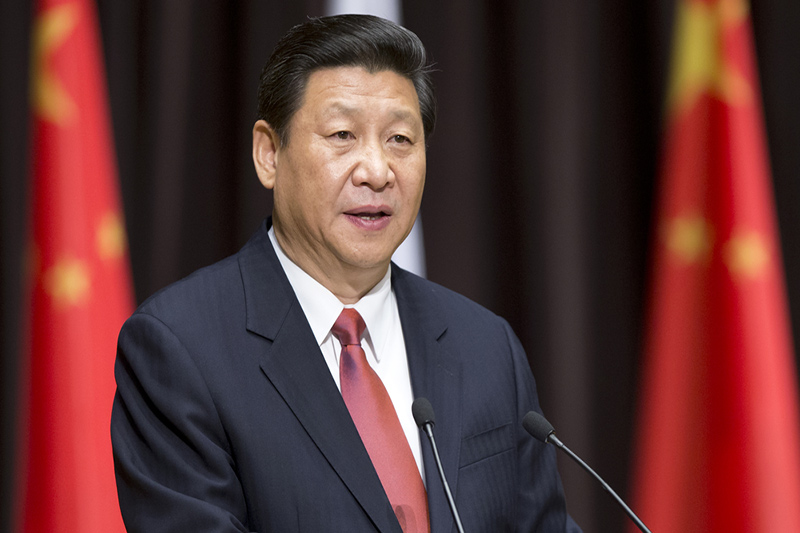

The latest meeting of the legislature, the first to be overseen by President Xi Jinping and Premier Li Keqiang, comes amid lingering concerns over the health of the country’s economy.

Investors will be looking for clues to the next steps to fix local-government finances, rein in shadow-banking risks, free up deposit rates and open up state businesses to private investment.

The Asian nation is the world’s largest copper consumer, accounting for almost 40% of world consumption last year.

Meanwhile, market sentiment recovered after Russian President Vladimir Putin ordered troops engaged in military exercises close to Ukraine’s borders back to their bases.

Copper prices fell sharply on Monday as geopolitical tensions mounted after Russia's parliament authorized President Putin to use military force in Ukraine.

Elsewhere on the Comex, gold for April delivery fell 0.8% to trade at $1,339.70 a troy ounce, while silver for May delivery dropped 0.85% to trade at $21.30 a troy ounce.