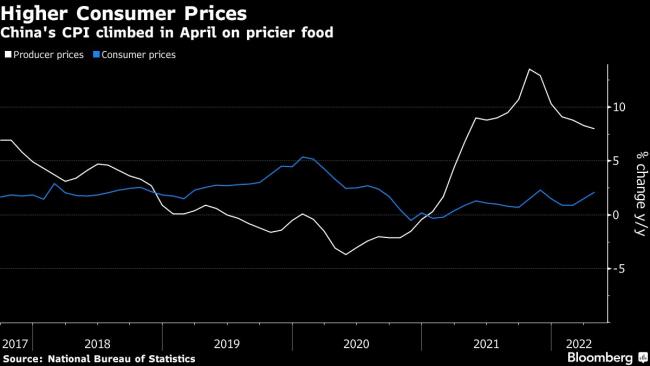

(Bloomberg) -- China’s factory gate prices rose faster than expected in April, while consumer prices climbed again as Covid outbreaks and lockdowns last month drove food and fuel costs higher.

The producer price index rose 8% from a year earlier compared to 8.3% in March, official data showed Wednesday, above the median estimate of a 7.8% increase in a Bloomberg survey of economists. Consumer-price growth accelerated to 2.1% from 1.5% in the previous month, faster than a projected 1.8% gain.

While commodity prices are inching down from the very high levels spurred by the war in Ukraine, costs remain elevated and have squeezed manufacturers’ profits. Covid outbreaks in China and restrictions intended to contain them have indirectly added to operating costs, making it tougher for factories to maintain production, obtain raw materials and ship out finished goods.

The uptick in consumer inflation was attributable to virus outbreaks and higher global commodity prices, Dong Lijuan, senior statistician at the National Bureau of Statistics, said in a statement accompanying the data.

“Panic buying and stocking among consumers likely also pushed up demand,” said Zhang Zhiwei, president and chief economist at Pinpoint Asset Management. “As supply chain disruption is gradually resolved, inflationary pressure may fade away.”

Food became pricer in April as several areas locked down to contain the spread of Covid. Fresh vegetable costs jumped 24% from a year ago, compared to an increase of 17.2% in March, NBS data showed. Pork prices continued to fall, plunging 33.3%.

A 28% jump in fuel costs also contributed to higher consumer prices. Prices of vehicle fuel rose the fastest of any metric within the CPI basket, according to a breakdown provided by the NBS.

Core CPI, which excludes volatile food and energy prices, rose 0.9%, compared to March’s 1.1% increase.

The lockdown in Shanghai threatens to exacerbate global supply chain pressures and inflation concerns, according to economists at Fitch Ratings. The economists cited a plunge in Shanghai freight traffic volume in April and early May resulting in backlogs at the port of Shanghai as contributors to those issues, according to a research note published Tuesday before China’s inflation data was released.

“With Shanghai handling around a fifth of China’s port volume and China accounting for 15% of world merchandise exports, shortages of manufactured goods could intensify, adding to existing global inflationary pressures,” the Fitch economists wrote. “This channel is likely to outweigh the effect of slower growth in China on global inflation through a weakening of commodity demand and prices.”

The decision to stand by a strategy built on strict Covid curbs has led several economists to cut growth forecasts for the year to well below the government’s target of about 5.5%, as an unswerving commitment to Covid Zero means more cities will lock down or mass test their citizens for as long as the virus is spreading. The capital city Beijing, e-commerce hub Hangzhou and Yiwu, a city known for wholesaling Christmas decorations, have all rolled out restrictions to contain the virus.

(Updates from paragraph 4 with additional context and analyst commentary.)

©2022 Bloomberg L.P.