(Bloomberg) -- Beijing has readied a plan to restrict exports of rare earths to the U.S. if needed, as both sides in the trade war dig in for a protracted dispute, according to people familiar with the matter.

The government has prepared the steps it will take to use its stranglehold on the critical minerals in a targeted way to hurt the U.S. economy, the people said. The measures would likely focus on heavy rare earths, a sub-group of the materials where the U.S. is particularly reliant on China. The plan can be implemented as soon as the government decides to go ahead, they said, without giving further details.

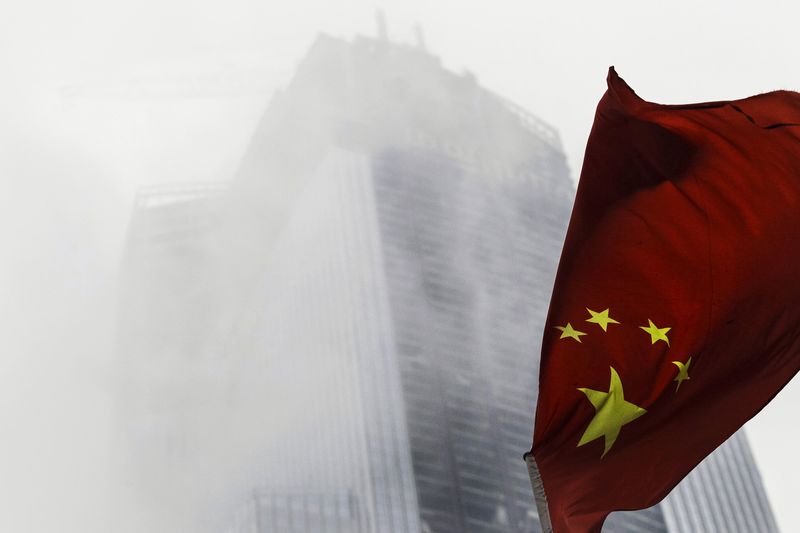

The development follows a flurry of threats this week from state media and officials, highlighting the potential use of the strategic minerals as a trade weapon. China produces about 80% of the world’s rare earths, and an even higher proportion of the elements in their processed forms.

The National Development & Reform Commission, China’s top economic planner, didn’t immediately respond to a fax seeking comment on the plan.

Heavy rare earths include dysprosium, used in magnets commonplace in almost all cars and many consumer goods. The group also has yttrium, used in lighting and flat screens, as well as ytterbium, which has applications in cancer treatments and earthquake monitoring.

Such an action would deepen a confrontation that’s roiling markets and damaging global growth. The effect of any restrictions would be significant, and clearly signal that trade tensions are escalating, according to a research note from Goldman Sachs Group Inc (NYSE:GS).

Beijing will firmly defend its national interest, and can’t accept its own rare earths supply being used “to crack down on China’s development,” commerce ministry spokesman Gao Feng said at a briefing on Thursday, adding that the nation is willing to meet “the legitimate needs” of the rest of the world.

The elements are also in weaponry, amid a host of high-tech applications crucial to U.S. supply chains. Rare earths are divided into two broad categories, heavy and light, corresponding to their atomic weight. Heavy rare earths are less common, and important for lasers, sonar and strengthening steel, among other uses.

It isn’t clear what conditions would need to be met to trigger the export restrictions, nor precisely how the curbs would be imposed, according to the people familiar with the plan. Separately, the government is taking account of how the U.S. might object to the measures at the World Trade Organization, they said.

A blockade on the supply of rare earth magnets could have a devastating impact across swathes of the U.S. economy, according to Technology Metals Research LLC. China produces 95% of the world’s output.