By Mark Weinraub and Karl Plume

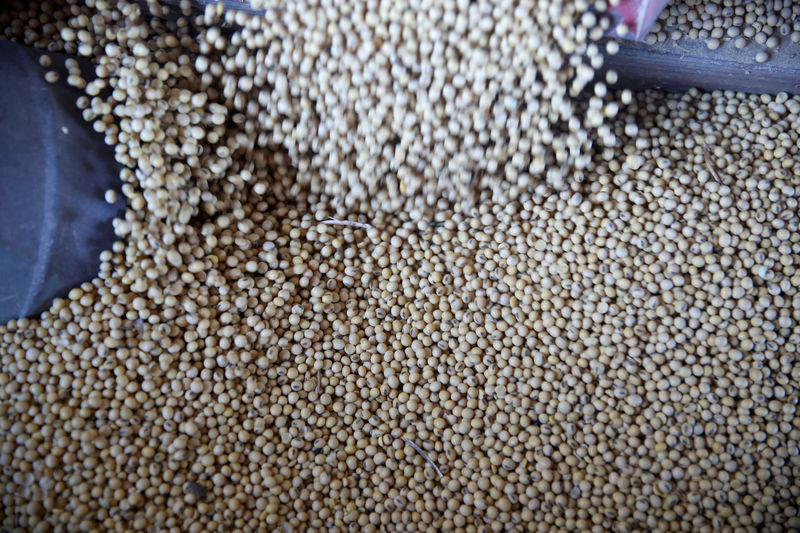

CHICAGO (Reuters) - The U.S. Department of Agriculture on Thursday confirmed a private Chinese company bought 68,000 tonnes of soybeans in the week ended July 25, the first soybean purchase since Beijing offered to exempt five crushers from import tariffs imposed more than a year ago as part of a U.S.-China trade dispute.

Soybean prices remained lower on Thursday due to the small amount, however. U.S. President Donald Trump and other top officials said Chinese President Xi Jinping promised large agricultural purchases he met Trump at the G20 summit in Japan a month ago to restart stalled trade talks.

The private purchase was also the first new soybean purchase by China since a 544,000-tonne sale to a government buyer was announced in late June.

U.S. and Chinese negotiators ended a brief round of trade talks on Wednesday with little sign of progress and agreed to meet again in September.

In its weekly export sales report, the USDA also said China bought 66,800 tonnes of soybeans for 2018/19 delivery, including 62,000 tonnes that had previously been listed as headed for unknown destinations. But China also canceled previous purchases totaling 72,900 tonnes for the current marketing year, USDA said.

China has bought about 14.3 million tonnes of U.S. soybeans in the 2018/19 season which began last September, the least in 11 years, and more than 4 million tonnes of those purchases have yet to be shipped, USDA data showed.

Chinese officials briefed private importers on July 19 on a plan to boost soybean purchases, according to three people familiar with the matter who asked not to be named.

According to one source, a group of five crushers were told by China's state planner that they could apply for exemptions from the 25% tariffs on some U.S. soybean cargoes arriving before the end of December.

The tariff made imports from rival suppliers like Brazil and Argentina far more attractive to private crushers.

But prices for soybeans shipped to Asia from the Pacific Northwest (PNW) this autumn are lower than prices for beans shipped from rival exporter Brazil if China's import tariffs are removed, U.S. export traders said.

Traders reported widespread rumors in the market last week that a large Chinese crusher purchased a small number of soybean cargoes for shipment in October from PNW terminals.

Large purchases are not expected as China’s hog herd, the largest consumer of the soybean meal produced from raw beans, has been decimated by the deadly African swine fever. Soy crushing margins are also unprofitable, limiting demand.

The purchase confirmed on Thursday was a fraction of the 87 million tonnes China, the world's top buyer, is expected to import over the 2019/20 (Sept/Aug) season.