BEIJING (Reuters) - China faces a growing surplus of two strategic metals if Beijing restricts exports, industry players said, weighing on domestic prices even as overseas prices of the thinly traded minerals jumped this week.

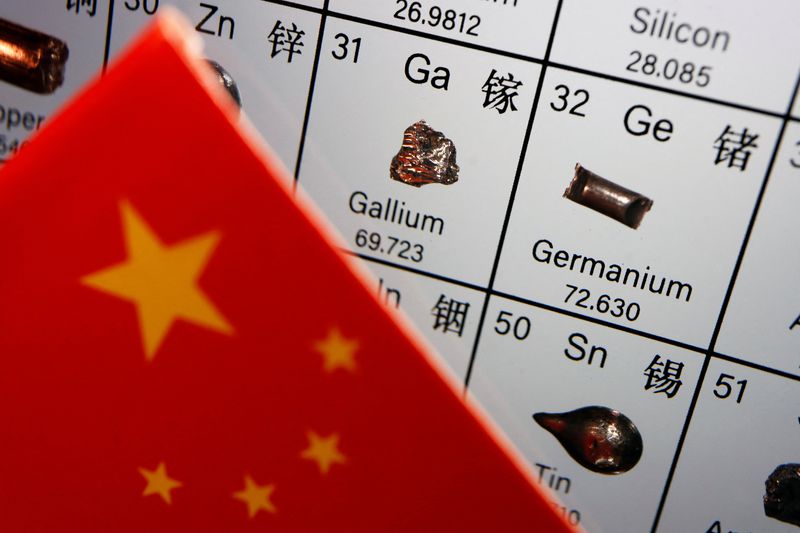

China's Ministry of Commerce said on Monday it will impose export controls on gallium and germanium from Aug. 1, used in semiconductors, satellite imagery sensors and light-emitting diodes (LED) and other applications, ramping up a tech battle with Washington.

Producers initially pushed up their offer prices for gallium by as much as 20% to 2,000 yuan ($275.93) per kilogram (kg) and 4% to 10,000 yuan per kg of germanium, according to two traders dealing in the metals and two producers.

Still, some sellers showed little interest in making any compromise on offers in anticipation of further price rises in July, said one gallium trader, while buyers have resisted attempts to increase prices.

Gallium prices in China have dropped 12% this year, pressured by its slowing economy.

China accounts for about 85% of global consumption of gallium and expanded its production capacity to nearly 1,000 metric tons last year, leaving it with a surplus of 25 metric tons that it tried to ship abroad, according to state-backed research firm Antaike.

"The market would likely have been bearish without these changes," said Theo Ruas, global sales manager at Indium Corporation, a U.S.-based refiner of raw materials for the electronics sector.

Prices of gallium with 99.99% purity in China rose 6% after Monday's news to 1,775 yuan ($244.86) per kg but has not changed since then, according to Shanghai Metal Exchange data on Refinitiv Eikon.

China's germanium ingot price has advanced only 1% to 7,250 yuan per kg since Monday.

Overseas price offers are rising much faster, amid fears that Beijing may use the permitting system to restrict shipments.

The price jump is expected to be "relatively short-lived", however, said Willis Thomas, consultant at London-based consultancy CRU.

Both metals can be produced from by-product sources, but a recovery has not yet been seen for economic reasons, he added.

For now, much depends on how hard it is to obtain a license. Other metals such as indium are also subject to the permits but face little restriction, Indium Corp's Ruas said.

LICENCE TO SHIP

Under the controls, widely seen as a retaliation for U.S. curbs on sales of key technologies to China, exporters must obtain a license to ship several forms of the metals overseas, which requires details of end-use applications.

China has given few details on how the process will work, and its commerce ministry said on Thursday that there had been no applicants so far.

The commerce ministry was due to hold a meeting with producers on Thursday, Reuters reported previously.

"Export control does not mean export prohibition, and those that comply with relevant regulations will be permitted. The Chinese government enforces export controls that do not target any particular country," spokesperson Shu Jueting told a weekly press conference.

China produces around 60% of the world's germanium, and over 90% of the world's gallium.