By Michael Hogan

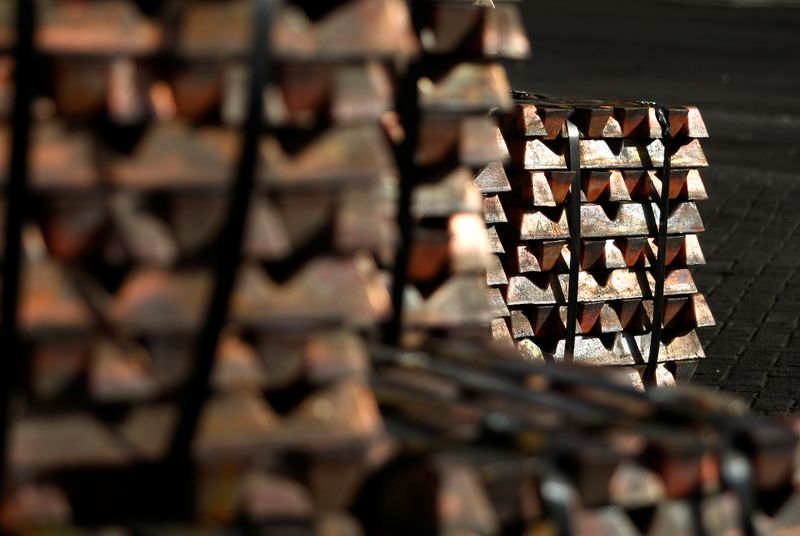

HAMBURG (Reuters) - Charges to refine copper concentrate (ore) into metal should remain stable in 2021 as the copper industry has come through the coronavirus crisis well, a senior executive at Aurubis, Europe's largest copper refiner, told Reuters on Wednesday.

“Mines are working at high capacity and ever more concentrate is coming onto the market,” said Michael Hellemann, Aurubis’ senior vice president, commercial. “I think we are facing comfortable concentrate supplies in 2021.”

Treatment and refining charges (TC/RCs), the cost of processing ore, are being discussed in the traditional year-end negotiations.

Miners pay TC/RCs to smelters to process their copper concentrate into refined metal and they are a key part of the earnings of smelters like Aurubis. Charges typically go down when concentrate supply is tight and smelters have to accept lower fees to get feedstock.

“Overall the copper industry has come through the coronavirus crisis without the disruption seen in other sectors and in 2021 I expect abundant concentrate availability,” said Hellemann.

“But there are a series of scheduled smelter maintenance shutdowns in 2021 which are expected to remove a significant amount of processing capacity from the market so mines will have to offer attractive TC/RCs to gain smelter capacity.”

TC/RCs in 2020 are $62 per tonne/6.2 cents per pound, with recent forecasts of a fall to $60 a tonne.

But fourth quarter TC/RCs in China firmed.

Premiums for copper products in 2021 are also set to be announced in coming weeks. In 2020, Aurubis gave a premium of $96 per tonne above London Metal Exchange (LME) prices.

“Considering the current copper market situation, I am cautiously optimistic we will see little change in premiums in 2021,” Hellemann said. “The copper market is looking positive with the Chinese economy recovering. Aurubis is retaining its forecast for profits in this financial year despite coronavirus.”

“There is good copper demand from the construction sector with real estate investment high, while more renewable energy projects such as wind power with a high copper content are underway. The strong trend towards electro-mobility is also helping copper demand.”

Copper scrap supplies in Europe are also currently good as Chinese buying has been reduced in recent months.