FRANKFURT (Reuters) - The Bank of Japan needs to wait a few more months to see the impact of its stimulus measures on the economy, its governor said in an interview published on Wednesday, adding that the bank could ease policy further if needed.

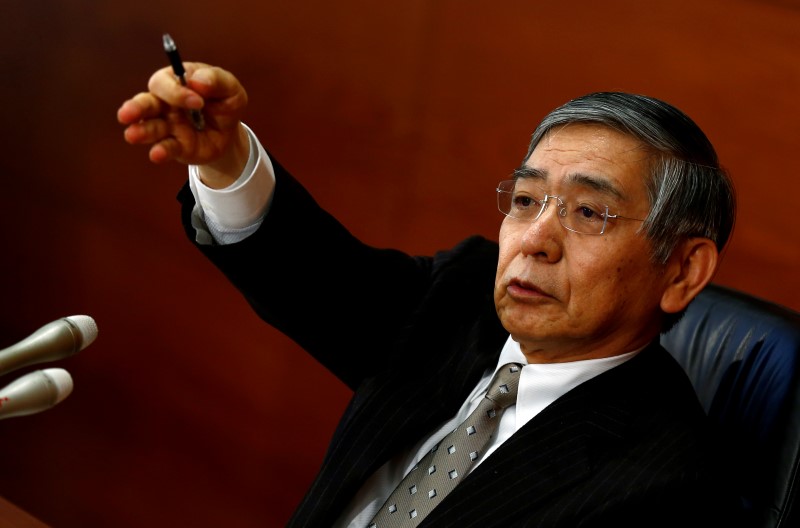

Haruhiko Kuroda's comments may signal that no more policy easing is likely soon by the Bank of Japan, which has tried to revive the world's third-largest economy with increasingly aggressive measures for three straight years.

"We have to wait a few months to see the effects in the real economy," Kuroda told German daily Boersen Zeitung.

"We have to have a little patience. We will monitor everything closely. But again, the positive inflation trend is absolutely intact."

The BOJ held off from expanding monetary stimulus last month, defying market expectations for action even as soft global demand, an unwelcome rise in the yen and weak consumption threatened to derail a fragile economic recovery.

Sources familiar with BOJ thinking told Reuters this month that the decision was partly motivated by concerns that fresh stimulus would be wasted on households and businesses, who have so far been unconvinced by the bank's foray into negative rates and huge money printing.

But the decision to hold fire, and the market reaction that drove the yen to an 18-month high, has strengthened the voices of sceptics who argue the BOJ's experiment has run its course.

Kuroda dismissed this notion, saying there was plenty more the BOJ could do if necessary.

"The quantitative easing, the qualitative easing, the negative interest rate – these are the three dimensions where we can act," Kuroda said. "We can still ease our monetary policy substantially if we consider it necessary," he said.