Investing.com -- Shares in Eli Lilly and Company (N:LLY) plummeted more than 6% even as the prominent pharmaceutical company saw its quarterly earnings surge considerably last quarter, as investors voiced concerns relating to escalating drug prices in the industry.

For Eli Lilly's fourth quarter of 2015, which ended in late-December, the drug maker reported net income of $478.4 million, a 12% increase from the same period a year earlier when the Indianapolis-based company recorded earnings of $428.5 million. Eli Lilly also reported a sharp gain of 13% in per share earnings of 0.45, up from earnings per share of 0.40 over the final quarter of 2014.

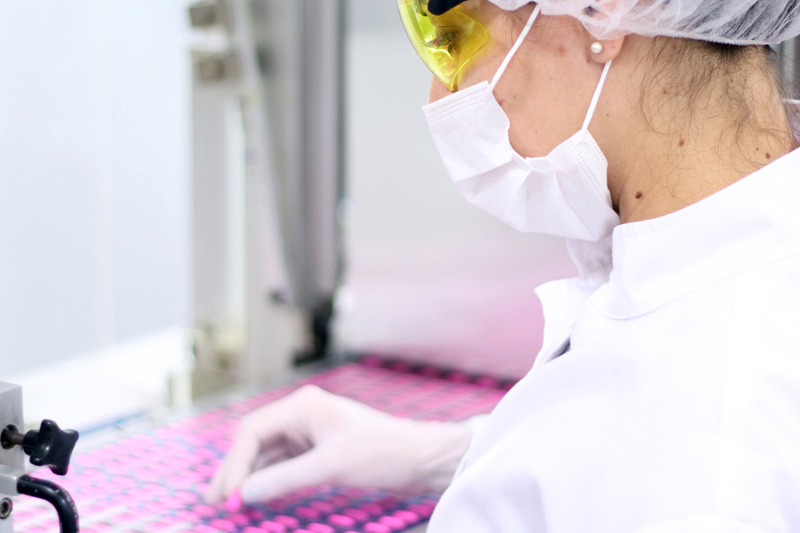

The strong earnings, however, came at a substantial cost for customers as some of the company's top-performing drugs skyrocketed over the three-month period. Sales for Humalog, the company's short-acting insulin to treat Type I and Type II Diabetes, soared approximately 10% for the quarter. The productive quarter helped drive revenues among the company's U.S. pharmaceutical division by 20%. At a maximum price of $472, Humalog is the most expensive brand of short-acting insulin on the market. Additionally, Eli Lilly hiked the prices for Strattera, its drug aimed a treating Attention Deficit Hyperactivity Disorder, Forteo, its Osteporosis drug, Effinet, a drug taken to help treat blood clots and Cialis, its drug for erectile dysfunction.

When asked on a conference call to explain the substantial increase in Humalog prices, Eli Lilly CEO John Lechleiter responded that while the treatment is costly, the disease itself is a "lot more expensive."

"Lilly's 2015 results reinforce our confidence in the future with six FDA approvals and multiple positive Phase III data readouts, as well as encouraging results from newly launched products including Cyramza, Trulicity, Jardiance and Basaglar," Lechleiter added. "In 2016, we aim to continue revenue growth, margin expansion and value creation for our shareholders, all while sustaining a flow of innovative medicines from our pipeline to improve people's lives."

Eli Lilly has been a global leader in diabetes care for more than 90 years when it introduced the world's first commercial insulin, according to the company's website. In June, the company donated 780,000 vials of insulin to the Life of a Child program, building on its annual donation of approximately 260,000 vials to the initiative. The program provides life-saving medicine to children living in impoverished communities without access to insulin. The company also helped launch the International Diabetes Federation's Bridges Program in 2006 by providing a seven-year educational grant of $10 million to the foundation.

Shares in Eli Lilly fell 4.93 or 6.03% to 76.83 in after-hours.