- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

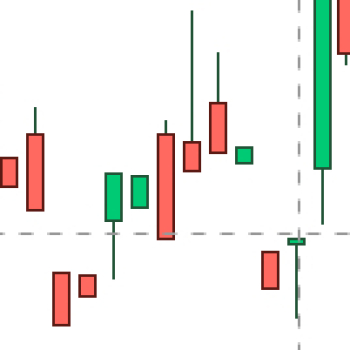

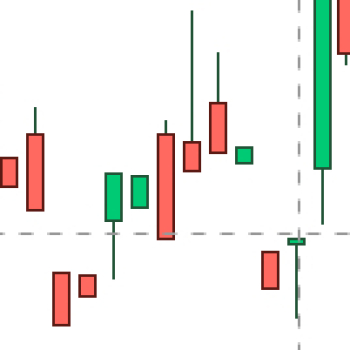

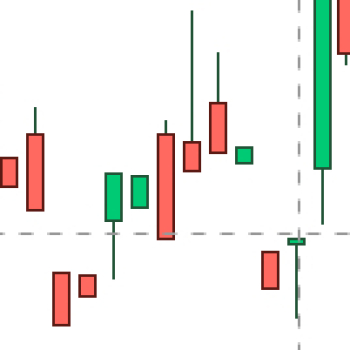

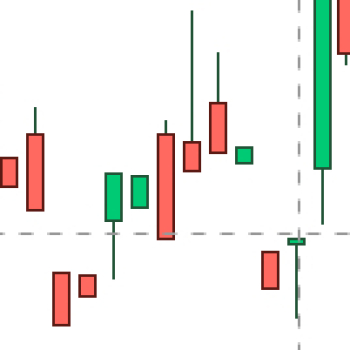

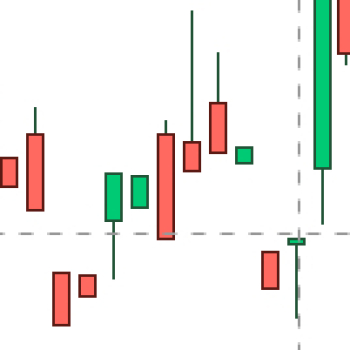

ICE US Coffee C Futures - May 25 (KCc1)

368.85

+8.45(+2.34%)

Delayed Data·

Day's Range

362.70

372.15

52 wk Range

196.60

440.85

US Coffee C Futures Discussions

Compiled here, all relevant comments and discussions regarding US Coffee C Futures. Please note that all comments included here have met Investing.com's Comment Guidelines.

The danger the futures market is ultimately playing with at this point is more uncertainty. The confidence that weather and underlying drivers will revert back to norm is evaporating.

Brazil record export last five years ! Well does smart.heads must have lab growed coffee already. Wow, brave brazilian scientists :))))

No drought and heatness anymore ? How come? Global warming ended ?

The king of nonsense, the price is only speculation? drought can affect only the 2026 crop as the lost for 2025 is already done

Bruno, just drink more:)

Reuters Safra & Mercado Arabica abt 40 million bags (+ 1,75 from previous assessment). Conillon range 25 tò 26 million bags ( + 0,9/1,9 million vs previous)

Underproduction.. and record exports, :((

It begs the question what they might drink;) anyway domestic consumtion always good to hide stocks. Pure Magic.

that neans that producers had stock, Francisquini for exemplo had 850.000 bags in stock, no more

Looks like 300 will be tested soon. Enjoy.

250

If to believe the media in relation to containers bookings :), there is one sure thing that can't be blamed for lower export: absence of available containers. Now it should be plenty... :):):)

There are gonna be very good rates :) probably :):):).

There are gonna be very good rates :) probably :):):).

Would be also good to know if Boeing corporate coffee consumption is increasing now :).

up

collecting brainless bull money atm

We've been hearing this since 250.

was bullish until Jan. now bearish.

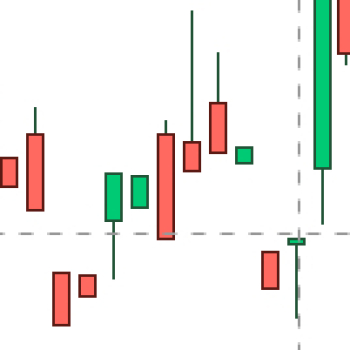

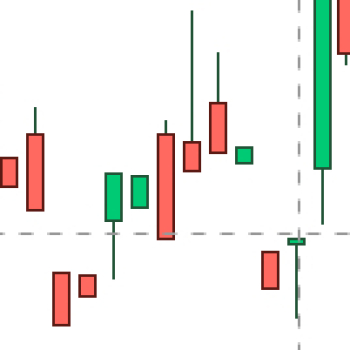

Looking at this coffee chart, bullish. Will look tomorrow morning around 8am central. Hoping to buy a dip around pit session 8am central on a day trade. If rally tomorrow morning, just buy in long on any dip

I look at the coffee chart and the bottom is in, going higher.

Gap not closed so far. It does`t matter :D Tons of them to close downside.

robusta very strong today

Does it matter?

No way Only options and arbitrage count. Anyhow COT not encuoraging the longs side

doesn't matter

Gap closed. Now chartist Happy and market could turn lower

what if will turn negative to 322!

400 this week or next?

Hope soo 450 would be lovely

As Dude said, beatiful weekly hammer.

Wick me up.

The May contract is about to expire, much more open interest and volume is already on the July contract.

I would kindly add to it that tariffs (China) risk is in place and so the stock market drop and/or a much bigger scale event. Assuming current price and no disaster stated or expected tomorrow, recents rains, rationing, harvest around the corner, etc it would be accurate for KC after reaching intraday high yesterday to continue downside and to close Friday around 330 or lower. However this is not what has happened... Not to say that it will skyrocket on Monday, etc but to underline that general mood is not bearish still :).

Do not forget of the option expiry yesterday. Look also to COT that obviously do not include the last 3 days action buy apparently indicate specs and index not so eager of the ling side not excluded a Jump tò 366 only tò close gap

Inmet published data for March for Bello Horizonte vs 1991 - 2020 (normal :)). Precipitation in March 2025 in BH was 134.3mm, 68% of would be normal 197.5mm.

How much in March could havebeen good for coffee?

Cecafe, A, 2025: Jan - 3.299mb, Feb - 2.899mb, March - 2.813mb. Conilon: Jan - 334kb, Feb - 231kb, March - 139 kb (!) Whoever thinks what :):):), but numbers go down...

And one more thing: you refer constantly to brick and mortar vendors in relation to whole/ground coffee but I suggest you to look at online sales and their growth within 2024 and the trend. Online sellers do not have the same service expense as brick and mortar and assuming fast delivery, it does not matter for the households/companies/hotels/etc from where to order but it makes a huge difference for vendors as brick and mortar can't operate on the same profit margin as online sellers. In the restaurants the price for coffee is comparing to the prices of other beverages in the menu and sales of coffee are insignificant vs meals/alcohol, in coffee shops price of powder is within 10% of the total structure, the rise in other 90% within last few years makes rise in coffee prices not visible. :)

Lavazza in US still offers 100 pods on Amazon for $50 with the next day delivery and there are plenty of competitive offers still. You don't think they all are stupid, right ??? :):):) And this is Lavazza machines pods, NE original compatible $45 for 120 pods. Does it hurt RETAIL consumption in your view ??? :):):) (Home, offices, hotels, etc...)

Whole beans/ground $25 per 1kg, 10gm per cup - 0.25c. Does it hurt consumption ? It doesn't and especially, facing the reality if Chinese goods will be 145% duty paid :):):). Coffee will stay one rare super cheap pleasure :):):):):) indeed, talking home, office, etc...

Wow inventory grew 8k! and pending +30k!

Im totally wrong

Im totally wrong the world consumption dayle is around 488.000 bags

Brasil is the one still delivering, last 16 months including April, is about 60 million bags

Easy long add here.

Radio Maja is broadcasting again! This time Maja gives a new number for Brazil, 40-44 million bags in total! Trump isn't the only one who likes extreme numbers! ;)

The rumors from producers are that 2025 will be below 2023. If to remove extremes and to operate in USDA terms, then it would look (currently) as 40 - 42mb. Vs 2023 it would be 5 - 3mb less, average 4mb, vs it would be perfect - 7 - 5mb less, A meaning. R remains a wild card :) as some issues have been admitted but all are seeing record crop :). Last year some issues have been mentioned too :) but final figures did not confirm it. Can this year be a different one ??? :):):)

You did not understand, because it is actually difficult to comprehend. She says Brazil will harvest 40-44 million bags of Arabica and Robusta combined.

Will 450come this year?

Alpha Centauri why dear ?

Maybe, after gap close @265 it wants to see the 300;)

*365

quote myself yesterday at 2.oo pm "fundamentals still high, prices at the origins doubled in 48 hours, colombia is not offering anymore, rebound will come shortly"

It also includes May Conab and June USDA reports :). Is the ball back to the keeper ??? :):):).

Fundamental technically speaking, yes - if football is Fairplay.

It goes very technically for now :): got out of the channel, stopped, got back in, now backtesting lower border, if backtest will sustain - 365 would be :) next and it is roughly middle of the channel and then we'll see. As tariffs have been delayed (or removed :):):) ) the primary factors remain coffee fundamentals/weather and general risk, which risk is hanging on China and it is still ON and big way. Nobody knows but some solution :) may be just around the corner as it is very hard to imagine what US will be doing otherwise :). China risk factor, if not subdued/removed would force further liquidation of whatever :) , KC including, but it does not affect the price directly as the tariffs do. And tariffs are OFF practically till the moment when harvest will be known :). Thus, unless China situation will escalate quickly :), the ball is indeed back to the keeper :).

General weather situation appears good with recent rains and more in forecast in Vietnam (beside dry season:):):) It`s not Monsoon yet. Little bit demand at 3.30 but where`s the money of those micro lots of those euphoric Guate buyers?... Total Beef trap here?

Holy cow! Gold trading at 3133 now off correction low around 2980. What an opportunity it was to buy during the tariff fear selloff

Trump canceling the tariffs for 90 days came out after the coffee close at 12:30 central. Official close around 3.40 before the Trump announcement. After tariff pause, commodities rallied big but coffee was already closed. Tonight open at 2:30 am while we are sleeping will be interesting.

bond markets are damaged, problems are still in the market.

...

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.