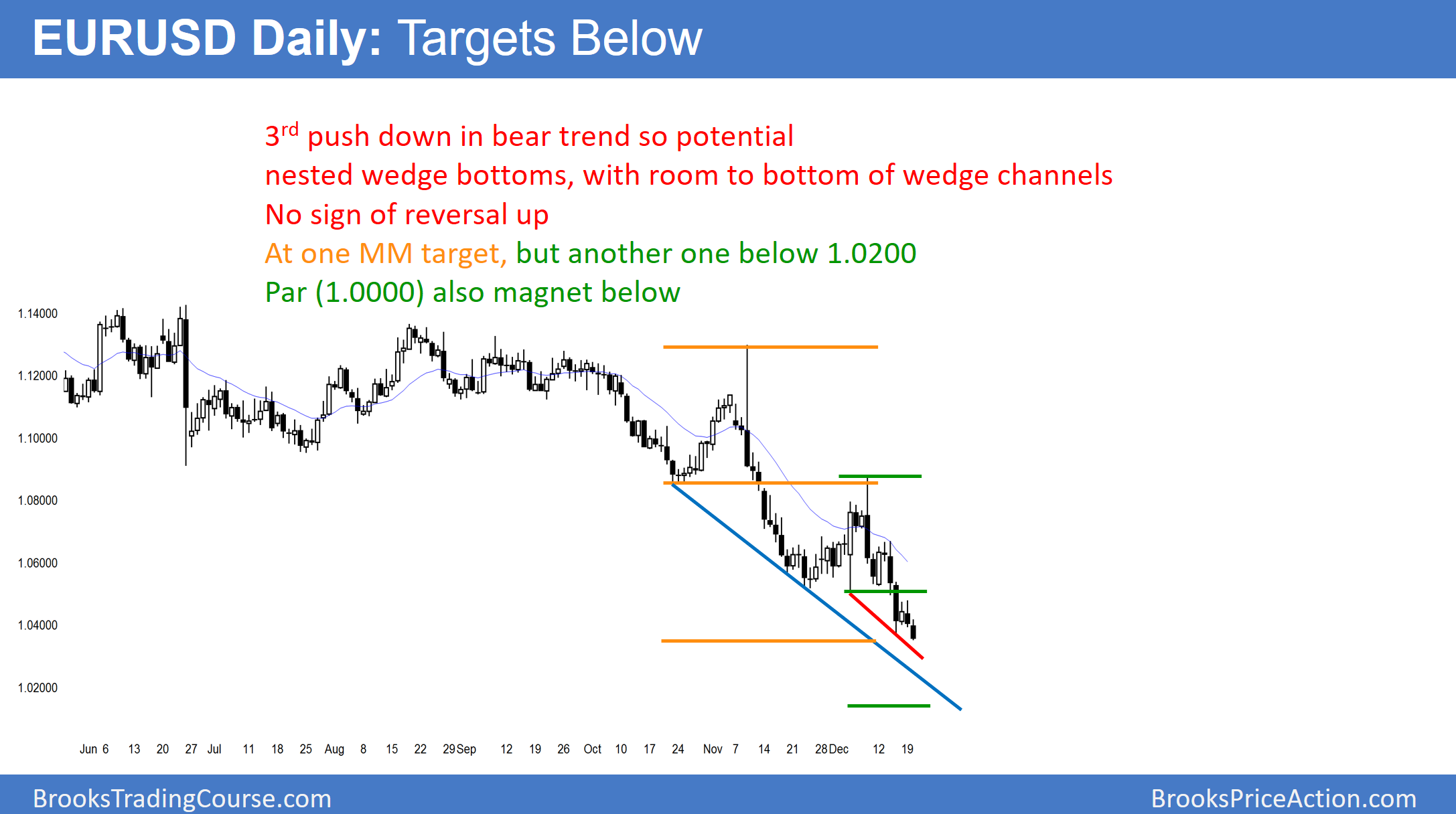

While the daily chart has nested 3rd pushes down, there is no bottom yet and there is room to the bottom of the wedge channels.

The EUR/USD bounced up from the bottom of the 3-day trading range. Yet, yesterday’s rally was weak. It was therefore more likely a bull leg in the range or the start of a small bear flag than the start of a bull trend.

Because the selloff over the past 6 week’s has been strong, the odds still favor lower prices. Yet, the bear legs on the daily chart have been big. Therefore, the stop for the bears is 200 – 400 pips above, which makes bears hesitant to sell at the low. Hence, many will wait for a bounce into a bear flag before selling.

Furthermore, the EUR/USD is at the bottom of its 2-year range and has not yet broken strongly below. In addition, the follow-through selling after big bear days has been bad. As a result of all of these mixed forces, the odds favor a trading range soon. Because there have been 2 pushes down from the December 8 lower high and the selloff was strong, the bears might get one more push down before a trading range begins.

The bulls will probably need at least 2 weeks of sideways trading before they can reverse the bear trend. Without that, the odds favor lower prices. Currency markets sometimes have big reversals at the start of the year.

Overnight EUR/USD

The EUR/USD 60-minute chart continued lower last night and fell below last week’s low. The bulls are therefore hoping for a lower low major trend reversal. Yet, on the daily chart, there is room to the bottom of the wedge channels, a measured move target, and par (1.0000). Because all support is a magnet, the odds favor lower prices.

Since the 2-day selloff had bad follow-through after every big bear bar, the 60-minute chart might enter another small trading range. In the absence of a strong reversal up, the odds are that it will create another bear flag.