Jason Geopfert of SentimenTrader.com recently explained that a three-month view of the S&P 500’s upside persistence (closing near a daily high) has reached an extreme seen in 4 other instances over the last decade. On each of those occasions, the market hammered risk assets with a significant pullback. In the last 30 years, the only time that markets did not sell off dramatically when upside persistence was this extreme occurred in 1995.

So is the market experiencing a 1995-like renaissance? Plenty of bullish prognosticators seem to think so. Of course, the recent price activity might cause the perma-bulls a bit of indigestion.

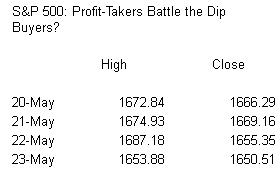

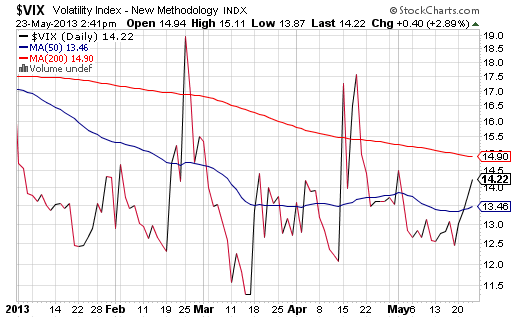

Four consecutive days of closing below the intra-day highs does not exactly constitute a pattern. Yet closing at the low end of an intra-day range and/or witnessing a pickup in CBOE S&P 500 (VIX) Volatility is rarely a positive indication. Then again, each successive VIX spike in 2013 has been weaker than its predecessor.

Will the manufacturing slowdown in China act as a precursor to a more subdued appetite for risk assets? Should a 7% single-day drubbing of Japan’s Nikkei Average be regarded with a bit more trepidation? Is the newfangled “Fed Speak” causing greater uncertainty about the future direction of monetary policy, rather than serving to provide greater clarity?

The fact that the global economy in weakening should come as no surprise to anyone. Other than a willingness by investors to acquire beaten down stocks and bonds in Europe, the region’s recession is deepening. China’s economy may be brighter than that of Europe, yet leaders are unlikely to provide stimulus with the ongoing threat of asset bubbles and inflation. Meanwhile, the one bright spot for the U.S. (real estate) is entirely dependent on the Fed’s quantitative easing program; most corporations continue to watch revenue (sales) languish.

It follows that the real Bernanke-led Federal Reserve is not going to taper or slow or exit from its dollar printing and subsequent treasury bond purchases. The conversation has, most likely, been orchestrated to cool down market exuberance. Fed officials tried to talk investors out of excessive reliance on higher-yielding assets earlier in May. Since it did not work, they increased the decibel level on the possibility of winding down “emergency” stimulus. (Printing dollars for buying bonds to depress interest rates is still emergency stimulus, isn’t it?)

Don’t get me wrong - I still believe an imminent 5% pullback is likely; I still feel that we will witness an 8%-12% corrective phase in 2013, whereby the Fed will come to the rescue at the height of fear. If adverse consequences (e.g. extreme dollar devaluation, runaway inflation, etc.) are not readily visible, why not inject the economy with more of the rate-lowering drug than $85 billion? Why not $120 billion? Maybe $150 billion smackers per month!

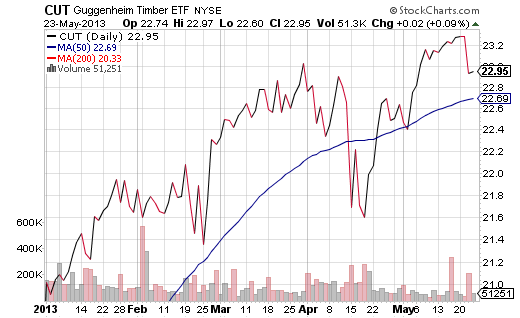

The S&P 500 is a bit more than 2% below its intra-day record. However, a number of rate-sensitive ETFs are reeling from the tapering talk, including GlobalX Super Dividend (SDIV), Cambria Shareholder Yield (SYLD) as well as Claymore Global Timber (CUT). While I still prefer to acquire any ETF at a support level like the 50-day trendline or 5% below the high, I do not believe the Fed will slow or taper its easing whatsoever. If anything, they will raise the stakes… and that favors yield producers as well as real estate-related industries.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

“Tapering Talk” Is Cheap: Buy Rate-Sensitive ETFs On Significant Dips

Published 05/24/2013, 05:48 AM

“Tapering Talk” Is Cheap: Buy Rate-Sensitive ETFs On Significant Dips

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.