Though precious metal struggled yesterday to overcome important resistance levels on the price charts, overall January was a good month for gold, silver and the companies that dig these metals out of the ground. The HUI Index of leading gold and silver mining companies gained 3.6% over the course of the month – an encouraging, albeit modest, change of fortune when compared with the poor year that these stocks had over the course of 2011.

However, the share prices of gold and silver producers continue to lag behind gains in the actual metals. As ZeroHedge reports, gold and silver were clear winners over the course of January in terms of performance when compared with other assets such as stocks, bonds, industrial commodities and currencies. The silver price increased by 20% over the month, with gold gaining around 11.2%. Among the major assets surveyed, the US dollar, crude oil, and Japanese and British government bonds were the laggards.

Interestingly, as far as American stocks are concerned, performance over January is a fairly good predictor of how general equities will fair over the course of the entire year. This phenomenon is popularly referred to as the “January Barometer”. As noted by the Stock Trader’s Almanac, since 1950 the S&P 500’s performance in January has been predictive of whole-year performance 89% of the time. Thus, as the USA Today says, it’s not surprising that this index’s 4.4% gain last month – its biggest first-month gain since 1997– has fund managers salivating at the prospect of a hearty year for investors.

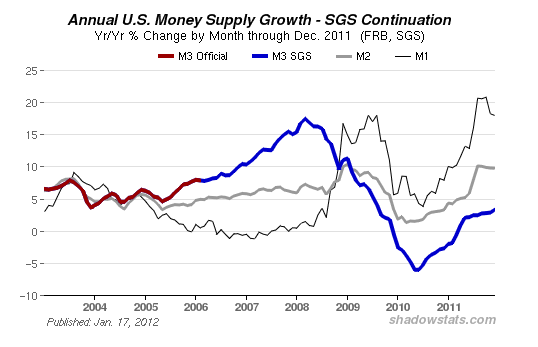

Indeed, as Bob Wenzel notes at his blog EconomicPolicyJournal, there were no down days of more than 1% on the S&P 500 during January (the last one being on December 28). As he points out, this is all an unsurprising consequence of the Federal Reserve’s money printing endeavours. As can be seen from Fed data, though year-on-year percentage growth in its broadest money supply measure (M2) has flattened in recent months, its still growing at just under 10%, while private estimates of M3 (an even broader money supply measure that the Fed stopped reporting in 2006) show growth of 3% year-to-year. As can be seen from the chart below, this growth in M3 is modest compared with the months leading up to the Bear Stearns bailout in March 2008, but it is nevertheless a good indicator that the Fed is succeeding in its efforts to fight deflation and weaken the dollar.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

‘January Barometer’ Gives Green Light to Stocks

Published 02/03/2012, 01:49 AM

‘January Barometer’ Gives Green Light to Stocks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.