eBay Inc (NASDAQ:EBAY). EBAY just released its third quarter fiscal 2016 financial results, posting earnings of 45 cents per diluted share and revenue of $2.22 billion. EBAY is a Zacks Rank #3 (Hold), and is down 6.5% to $30.40 per share in after-hours trading shortly after its earnings report was released.

Beat earnings estimates. The company posted earnings of 45 cents per diluted share, surpassing average analyst expectations of 44 cents per share.

Beat revenue estimates. The company saw revenue figures of $2.22 billion, beating our consensus estimate of $2.182 billion and gaining 5.6% year-over-year.

eBay reported gross merchandise volume of $20.1 billion, increasing 5% on a foreign exchange (FX) neutral basis and 3% on an as-reported basis.

During the quarter, the company generated $802 million of operating cash flow and $617 million of free cash flow from continuing operations while also repurchasing $500 million of its common stock.

For the upcoming holiday quarter, eBay forecast revenue of $2.36 billion to $2.41 billion and adjusted profit from continuing operations of 52 to 54 cents per share for the current quarter. Analysts on average were expecting revenue of $2.40 billion and earnings of 54 cents per share.

“In Q3 we delivered good top- and bottom-line financial results, led by consistent performance across our business," said Devin Wenig, President and CEO of eBay Inc. "We continued to transform the shopping experience on eBay, delivered more personalization capabilities and began to activate our updated brand messaging."

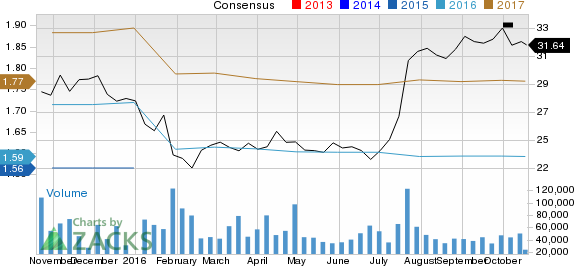

Here’s a graph that looks at eBay’s price and consensus over the past year:

eBay is one of the world's largest online trading communities. The company creates a powerful marketplace for the sale of goods and services by a passionate community of individuals and small businesses. eBay enables trade on a local, national, and international basis with local sites in numerous markets in the United States, and country-specific sites in the United Kingdom, Canada, Germany, Austria, France, Italy, Japan, Korea, and Australia.

Stocks that Aren't in the News…Yet

You are invited to download the full, up-to-the-minute list of 220 Zacks Rank #1 "Strong Buys" free of charge. Many of these companies are almost unheard of by the general public and just starting to get noticed by Wall Street. They have been pinpointed by the Zacks system that nearly tripled the market from 1988 through 2015, with a stellar average gain of +26% per year. See these high-potential stocks now >>

EBAY INC (EBAY): Free Stock Analysis Report

Original post

Zacks Investment Research