There are two views of the markets for the monetary metals. One, as we have discussed many times in this report, holds that gold and silver will eventually go up so high that those who own the metals will be rich. This is the Schrodinger’s dollar view. Buy gold because the dollar will soon collapse—witness China and Saudi Arabia selling dollars. And gold is going up—when it’s measured in dollars.

Believers in the surgit aurea view are always on the lookout for a new angle to support their thesis. For example, we came across this article. Apparently, silver is in such a massive shortage that a mining company, “…got approached by an electronics manufacturing company … [who] wanted to bid on our silver…”

So, a silver consumer went to a silver produce to bid (at what price?) on the silver. Therefore, silver is going to $100, and there will be “some kind of major reset."

Our view is the other view. The prices of the metals move in a dynamic process comprising producers, hedgers, consumers, warehousemen, and speculators. In short: supply and demand.

We had the good fortune this week to find another article, pure gold vs. the soggy dollars quoted above. The headline should be crystal clear to regular readers of this report. “Gold Traders Pay Most in Years to Keep Big Bullish Bet Alive.” The article states:

“The cost of rolling futures into a later-dated contract was recently the highest in about six years, said Bernard Sin, head of currency and metal trading at Geneva-based refiner MKS (Switzerland) SA. Those holding June futures would have paid an extra $3.40 an ounce on May 23 to swap that position for the most-active August contract…”

The last paragraph calls it by name: contango.

So what do you believe could drive the prices of the metals?

- Silver is going higher because consumers are talking to producers?

- Gold could go lower and the catalyst is speculators may be weary of spending $3.40 every two months ($20 per ounce per year)

This holiday-shortened week (Monday was Memorial Day in the US), the prices of the metals were sideways to down. Until Friday. And on that day, a labor report hit that motivated gold hoarders to stock up and silver consumers to go into an absolute frenzy of manufacturing thousands and thousands of tons of silver into products ranging from mobile phones to antimicrobial surfaces, to solar panels. Or is that what happened at 8:30am New York time?

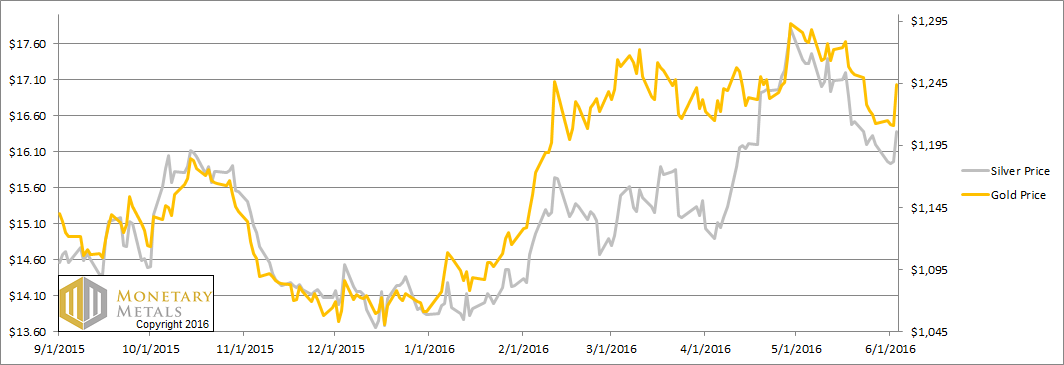

Read on for the only true picture of the supply and demand fundamentals. But first, here’s the graph of the metals’ prices.

The Prices of Gold and Silver

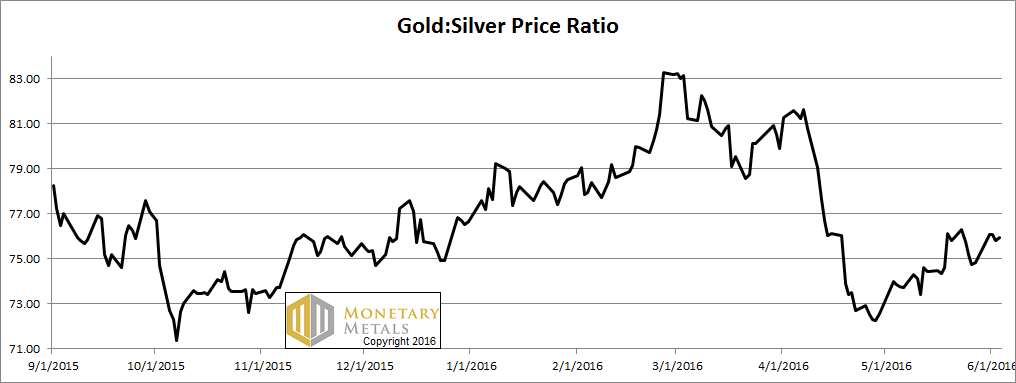

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was up over a point this week, notable when the prices of the metals were up sharply.

The Ratio of the Gold Price to the Silver Price

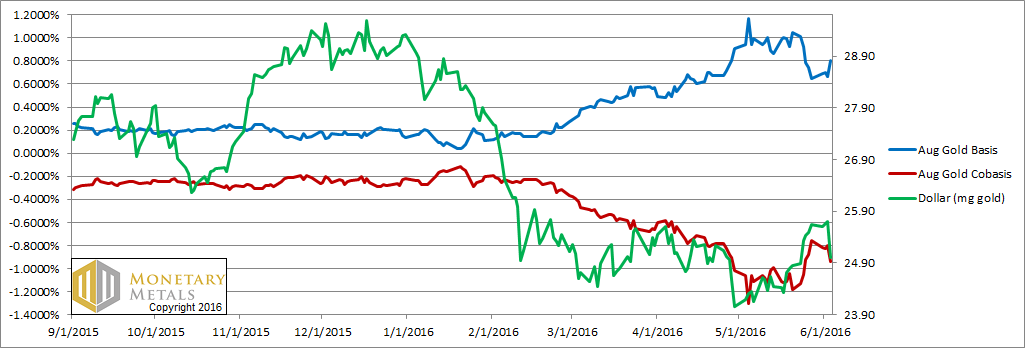

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Look at that blue line (abundance) rising, especially on Friday. Gold became even more abundant than it was last week, even when the price was not rising. And when the price spiked on Friday, there were even fewer buyers of metal and even more sellers.

For now, the speculators are making up for the lack of real demand. Perhaps because they are reading other analysts, they believe market conditions are tight and going to get tighter. Or perhaps they are still stuck on bad labor market à Fed money printing à rising quantity of dollars à rising gold price.

They are wrong.

The fundamental price of gold did rise this week. About $6, to $1175. In other words, it’s about $70 under the current market price. When the speculators realize they are wrong—or when other events force them to let go—the price could return to that level. Or if it overshoots by an equal amount to the downside, we may learn to say hello to 10 handle again.

It’s always possible that the fundamentals will get tighter from here, and an initial wrong bet may turn out to be right. However, we wouldn’t bet on it.

Now let’s turn to silver.

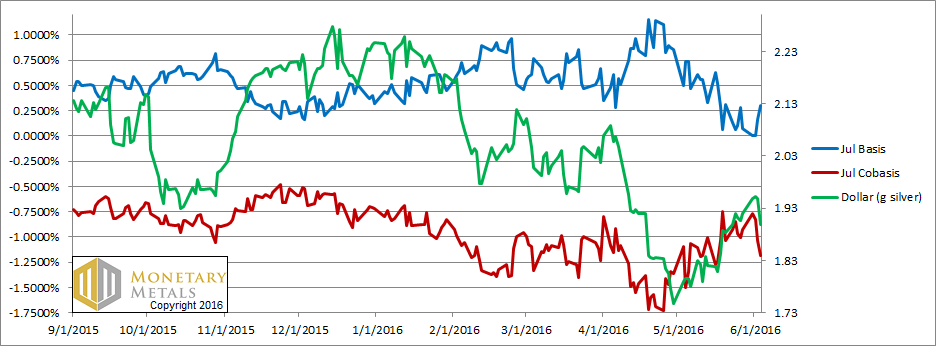

The Silver Basis and Cobasis and the Dollar Price

There was a big decrease in the scarcity of silver this week, especially Thursday when the price was going nowhere and even more so on Friday when the price spiked.

Our calculated fundamental price—the level at which supply matches demand at current market conditions—fell further to below $13.70.

To put this in perspective, if the silver speculators let go and the market price snaps to its fundamental, it will rapidly drop about $2.70. If it overshoots by the same magnitude to the downside, we may get to enjoy $11 silver. At least, it will be enjoyed by those who haven’t lost too many dollars betting on silver.

Perhaps that mobile phone manufacturer, driven by falling volumes and compressing profit margins, is pressured to approach silver mining companies (and all other suppliers) to see if they can cut their costs. Perhaps they were not bidding up scarce silver at the source, but putting in a lowball bid below market. We don’t have that information, but one thing’s for sure.

Silver demand is weak while silver supply is robust.