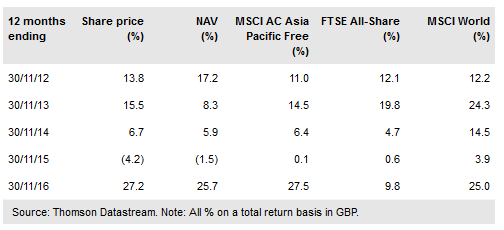

Witan Pacific Investment Trust (LON:WIPA) offers broad exposure to Asian markets including Japan and Australia, adopting a multi-manager approach which tends to smooth the performance fluctuations of individual managers. Current managers Aberdeen, Matthews and Gavekal, all invest across the region pursuing distinct, unconstrained strategies. Although weaker over six months, NAV total returns have been largely consistent with the MSCI AC Asia Pacific Free index benchmark over three years and WPC has outperformed over 10 years. Fees are competitive versus peers, with the board aiming to contain ongoing charges at 1% of net assets per annum. WPC aims to grow annual dividends above the rate of UK inflation; the current dividend yield is 1.7%.

Investment strategy: Multi-manager approach

WPC’s three external managers are Aberdeen (42% of assets), Matthews (47%) and Gavekal (11%); all of which are unconstrained by the weightings of the benchmark. Aberdeen and Matthews are bottom-up investors – Aberdeen has a long-term growth and value approach and Matthews has a specific dividend bias, with larger small and mid-cap exposure than Aberdeen. Gavekal combines a top-down and bottom-up approach to construct a portfolio of equities, bonds and cash. Since their appointments to the interim results on 31 July 2016, all three managers had outperformed the benchmark. Given WPC’s designation as a small UK AIFM, it does not employ gearing.

To read the entire report Please click on the pdf File Below