FORECAST

STOCKS: As 2012 begins, very little has changed from the end of 2011: the European debt contagion remains in place and is growing, China remains on a growth deceleration curve — while the US is showing stable growth, with an increasing probability of a recession. What is clear to us, is that at this point — the US is better positioned than the rest of the world, which simply means that it shall outperform yet again this year.

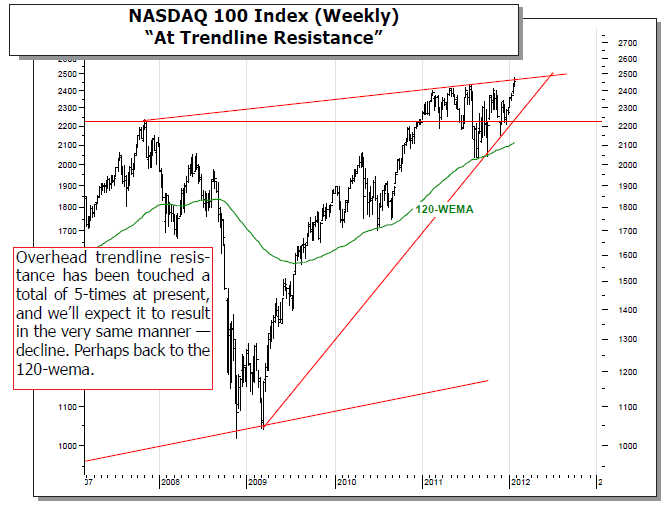

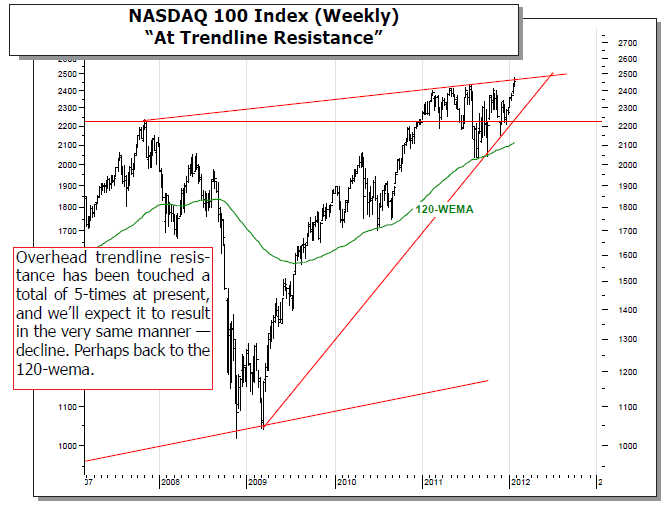

STRATEGY: Technically speaking, the S&P 500 remains above longterm support at the 45-mema at 1190; which is critical given it delineates bull & bear markets. But thus far, the 2012 rally is technically weak, and therefore suspect. Rallies are to be sold; and we’ve done so. We look to add to our short positions as the S&P 500 breaksdown below the 1265 level...still far below the current 1326.

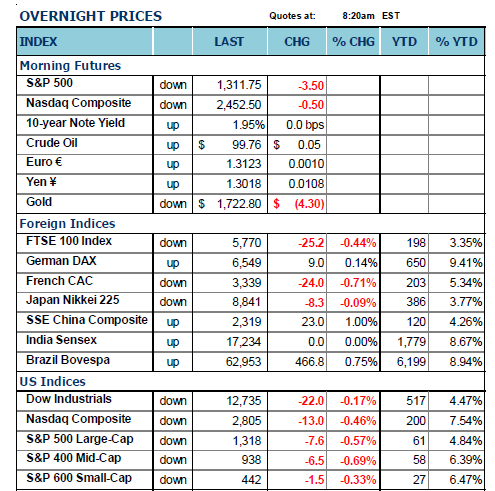

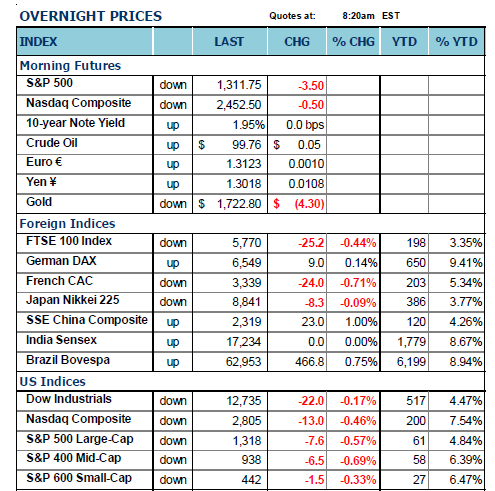

ALL WORLD MARKETS ARE TRADING LOWER as market participants appear to be using the FOMC post meeting communiqué to “sell the news” as it were, and we see European bourses lower as well as the S&P futures lower by -6 points at the time we are finishing up. Too, we find all the commodity markets lower, with the USD modestly

lower. In a word, volatility reigns supreme, and one gets the sense it shall become more so in the weeks ahead.

TRADING STRATEGY: As for the trading portfolio, yesterday we added a long position in Arch Coal (ACI) today; we’ll look to exit Chesapeake Energy (CHK) – even though we put it on the day prior. The reason is very simple: JPMorgan issued a rather damning report on the company, with a cash flow shortfall that is greater than the market anticipated. Yesterday’s losses were greater than the market, just as the prior day’s gains were less than the market. This isn’t the type of price action we like, and we simply want to exit – understanding quick, small losses are better than larger ones.

Also, we remain interested in adding gold shares, with both Eldorado Gold (EGO) and Pan American Silver (PAAS) on our radar screen. However, we want to see how they trade given the current market downdraft, which if the S&P breaks 1304 an closes below it – would signal a larger decline is underway. Moreover, this would turn our 40-day models lower as the 14-day models are now declining. Hence, there is “risk” in the markets; and we want to see how our current long positions and any potential long positions perform. If they

to listen care- fully to what RBS says as we believe their analysis has merit.

RBC’s head of US rates strategy Michael Cloherty and its Chief US economist Tom Porcelli explain it as follows:

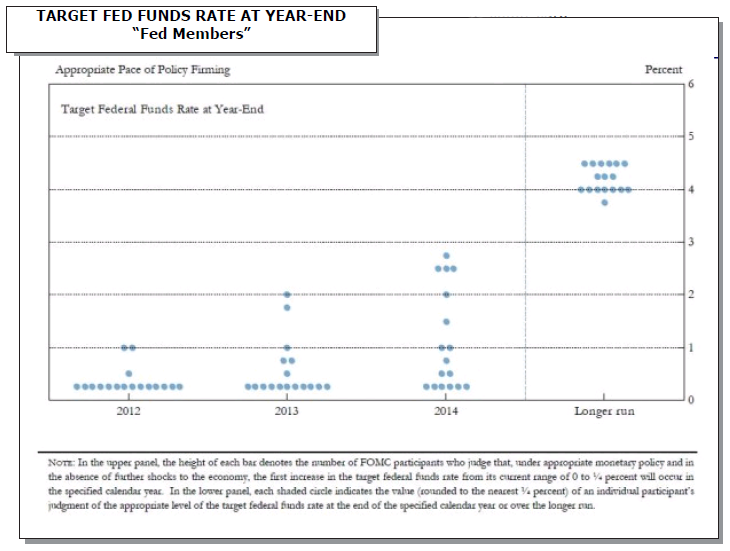

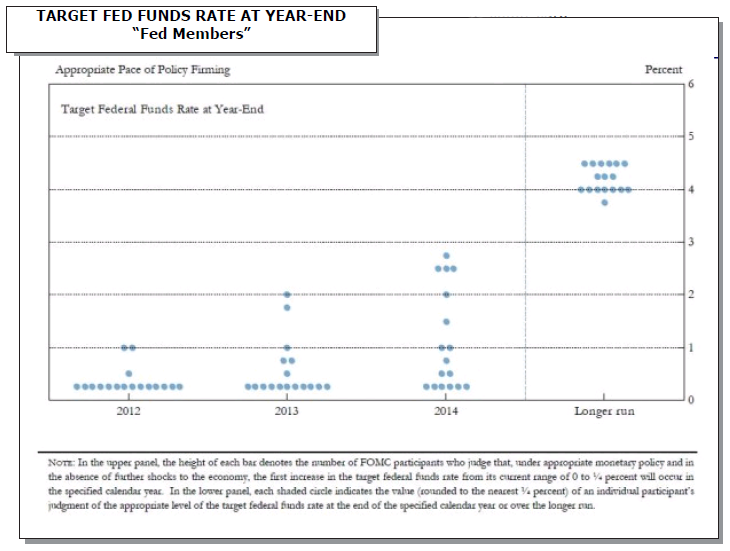

First, FOMC members’ Fed funds projections were very hawkish, with three calling for tightening in 2012, three more calling for tightening to begin in 2013, and another two whose 1% year-end 2014 forecast suggests tightening to start before “late-2014” (we assume the Fed will move 25bps every other meeting in the early stages of the tightening cycle, as the market will be extremely fragile as it comes off of 0% rates).

That is eight forecasts that are inconsistent with the late 2014 language—even the median forecast of 75bps is barely in line with “at least through late 2014”.

There are two conclusions. First, everyone must be cautious about overanalyzing the Fed funds projections, as not every participant’s projection carries the same weight in forming policy. And second, for the same reason, investors should use caution in trading based on comments from any Fed member other than Bernanke, Yellen, or Dudley.

outperform – then in a better risk environment we’ll be buyers. But for now…”risk-off” is slowly creeping back into an extended market psyche; and yesterday we noted that the S&P futures were at over +6% above its 2000-hour moving average – a place where larger corrections occur. Even with today’s and yesterday’s losses – it remains +5% above that level, and generally bottoms at -5% below this level as it cycles around.

AN EXIT PLAN TO CONSIDER…NOT TODAY’S BUSINESS, BUT SOMETHING TO THINK ABOUT: On Thursday, we were passed a very interesting commentary out of RBS regarding the FOMC statement and what has been perceived as being “dovish” in nature. Certainly we though the statement was dovish given the 18-month extension of ZIRP out to late-2014. However, when one looks at the actual FOMC committee member projections – both voting and non-voting members mind you – then one has

In other words, some FOMC members are more equal than others.

But the RBC gentlemen go on to make another very interesting point. Projections like these can now be used to anticipate repo-market moves. And from that point, they are are a little concerned about what the prescribed exit path could do to repo markets. They note: Keeping rates pinned for at least an extra 15 months is clearly positive for intermediate rates. Yet, if we assume there is 100 bps of tightening in 2015 (25 bps every other meeting) and 200bps of tightening in 2016 (25 bps at every meeting), this would leave Fed funds at a still-low 325 bps at the end of 2016.

Also, we should expect repo rates to rise faster than Fed funds over this horizon. The Fed will do a massive amount of reverse RPs as part of its exit process.

In addition, Treasury supply is likely to rise by another $5+ trillion while the money market fund industry shrinks (regulatory reform remains a major headwind), so at some point the money fund industry will stop being the marginal price-setter in the Treasury repo market with the next buyer coming in at significantly higher rates.

Together, these effects make us think that financing rates should average a bit more than 70 bps over the next five years. Even with an extremely thin term premium, to get 5s to trade below the mid-70s we will need news that reduces tightening expectations four and five years from now. Nonetheless, low and stable 5yr rates suggest that investors will grab for yield in highly rated assets— covered bonds, SSAs, etc. should perform well in the coming months.

In other words, while repo-rates have had a tendency to run below Fed Funds rates (quite significantly in fact leading into the crisis), the amount of reverse-repos that will have to be done in order to lift rates in line with the projected path – in the face of growing Treasury supply and a diminished money market industry – will very likely see repo- rates overshoot Fed funds rates from that point on.

This is the backside of the easing process; and a circumstance no one is now considering. Now, if the Fed was to include QE asset sales as part of its exit process as well, then the effect on the capital markets could be even more extreme. In fact, according to RBS, it could have a greater impact than the QE purchases had in the first place. Anticipation of this prospect, meanwhile, could now come to compromise the Fed’s current curve-flattening agenda.

Indeed, as RBS notes: In the Q&A, the Chairman mentioned that the Fed could start asset sales in 2015. This suggests increasing recognition at the Fed that there is no way to quickly drain all the reserves that QE has created without selling (reverse QE). And this creates limitations on how flat the curve can become due to QE.

We think that, in an environment where the Treasury is issuing more than $1 Trillion of net supply every year, asset sales will have a much larger price effect than asset purchases.

So if we know that rates will be driven higher in 2015-2017 due to asset sales, we should find sellers if forward rates fall too far. In order for asset purchases to drive forward rates sharply lower, the Fed needs to buy so much that arbitrageurs do not have the capacity to offset the flow. In essence, the Fed needs to overwhelm the liquidity of the Treasury market in order to drive forward rates significantly lower, which is a very dangerous game.

That’s to say, a more pronounced understanding of the Fed’s exit plans could run the risk of skewing everything. What’s more, if repo rates were to run significantly above effective Fed funds from now on… that could have unexpected and potentially inflationary consequences.

To read the entire report please click on the pdf file below.

STOCKS: As 2012 begins, very little has changed from the end of 2011: the European debt contagion remains in place and is growing, China remains on a growth deceleration curve — while the US is showing stable growth, with an increasing probability of a recession. What is clear to us, is that at this point — the US is better positioned than the rest of the world, which simply means that it shall outperform yet again this year.

STRATEGY: Technically speaking, the S&P 500 remains above longterm support at the 45-mema at 1190; which is critical given it delineates bull & bear markets. But thus far, the 2012 rally is technically weak, and therefore suspect. Rallies are to be sold; and we’ve done so. We look to add to our short positions as the S&P 500 breaksdown below the 1265 level...still far below the current 1326.

ALL WORLD MARKETS ARE TRADING LOWER as market participants appear to be using the FOMC post meeting communiqué to “sell the news” as it were, and we see European bourses lower as well as the S&P futures lower by -6 points at the time we are finishing up. Too, we find all the commodity markets lower, with the USD modestly

lower. In a word, volatility reigns supreme, and one gets the sense it shall become more so in the weeks ahead.

TRADING STRATEGY: As for the trading portfolio, yesterday we added a long position in Arch Coal (ACI) today; we’ll look to exit Chesapeake Energy (CHK) – even though we put it on the day prior. The reason is very simple: JPMorgan issued a rather damning report on the company, with a cash flow shortfall that is greater than the market anticipated. Yesterday’s losses were greater than the market, just as the prior day’s gains were less than the market. This isn’t the type of price action we like, and we simply want to exit – understanding quick, small losses are better than larger ones.

Also, we remain interested in adding gold shares, with both Eldorado Gold (EGO) and Pan American Silver (PAAS) on our radar screen. However, we want to see how they trade given the current market downdraft, which if the S&P breaks 1304 an closes below it – would signal a larger decline is underway. Moreover, this would turn our 40-day models lower as the 14-day models are now declining. Hence, there is “risk” in the markets; and we want to see how our current long positions and any potential long positions perform. If they

to listen care- fully to what RBS says as we believe their analysis has merit.

RBC’s head of US rates strategy Michael Cloherty and its Chief US economist Tom Porcelli explain it as follows:

First, FOMC members’ Fed funds projections were very hawkish, with three calling for tightening in 2012, three more calling for tightening to begin in 2013, and another two whose 1% year-end 2014 forecast suggests tightening to start before “late-2014” (we assume the Fed will move 25bps every other meeting in the early stages of the tightening cycle, as the market will be extremely fragile as it comes off of 0% rates).

That is eight forecasts that are inconsistent with the late 2014 language—even the median forecast of 75bps is barely in line with “at least through late 2014”.

There are two conclusions. First, everyone must be cautious about overanalyzing the Fed funds projections, as not every participant’s projection carries the same weight in forming policy. And second, for the same reason, investors should use caution in trading based on comments from any Fed member other than Bernanke, Yellen, or Dudley.

outperform – then in a better risk environment we’ll be buyers. But for now…”risk-off” is slowly creeping back into an extended market psyche; and yesterday we noted that the S&P futures were at over +6% above its 2000-hour moving average – a place where larger corrections occur. Even with today’s and yesterday’s losses – it remains +5% above that level, and generally bottoms at -5% below this level as it cycles around.

AN EXIT PLAN TO CONSIDER…NOT TODAY’S BUSINESS, BUT SOMETHING TO THINK ABOUT: On Thursday, we were passed a very interesting commentary out of RBS regarding the FOMC statement and what has been perceived as being “dovish” in nature. Certainly we though the statement was dovish given the 18-month extension of ZIRP out to late-2014. However, when one looks at the actual FOMC committee member projections – both voting and non-voting members mind you – then one has

In other words, some FOMC members are more equal than others.

But the RBC gentlemen go on to make another very interesting point. Projections like these can now be used to anticipate repo-market moves. And from that point, they are are a little concerned about what the prescribed exit path could do to repo markets. They note: Keeping rates pinned for at least an extra 15 months is clearly positive for intermediate rates. Yet, if we assume there is 100 bps of tightening in 2015 (25 bps every other meeting) and 200bps of tightening in 2016 (25 bps at every meeting), this would leave Fed funds at a still-low 325 bps at the end of 2016.

Also, we should expect repo rates to rise faster than Fed funds over this horizon. The Fed will do a massive amount of reverse RPs as part of its exit process.

In addition, Treasury supply is likely to rise by another $5+ trillion while the money market fund industry shrinks (regulatory reform remains a major headwind), so at some point the money fund industry will stop being the marginal price-setter in the Treasury repo market with the next buyer coming in at significantly higher rates.

Together, these effects make us think that financing rates should average a bit more than 70 bps over the next five years. Even with an extremely thin term premium, to get 5s to trade below the mid-70s we will need news that reduces tightening expectations four and five years from now. Nonetheless, low and stable 5yr rates suggest that investors will grab for yield in highly rated assets— covered bonds, SSAs, etc. should perform well in the coming months.

In other words, while repo-rates have had a tendency to run below Fed Funds rates (quite significantly in fact leading into the crisis), the amount of reverse-repos that will have to be done in order to lift rates in line with the projected path – in the face of growing Treasury supply and a diminished money market industry – will very likely see repo- rates overshoot Fed funds rates from that point on.

This is the backside of the easing process; and a circumstance no one is now considering. Now, if the Fed was to include QE asset sales as part of its exit process as well, then the effect on the capital markets could be even more extreme. In fact, according to RBS, it could have a greater impact than the QE purchases had in the first place. Anticipation of this prospect, meanwhile, could now come to compromise the Fed’s current curve-flattening agenda.

Indeed, as RBS notes: In the Q&A, the Chairman mentioned that the Fed could start asset sales in 2015. This suggests increasing recognition at the Fed that there is no way to quickly drain all the reserves that QE has created without selling (reverse QE). And this creates limitations on how flat the curve can become due to QE.

We think that, in an environment where the Treasury is issuing more than $1 Trillion of net supply every year, asset sales will have a much larger price effect than asset purchases.

So if we know that rates will be driven higher in 2015-2017 due to asset sales, we should find sellers if forward rates fall too far. In order for asset purchases to drive forward rates sharply lower, the Fed needs to buy so much that arbitrageurs do not have the capacity to offset the flow. In essence, the Fed needs to overwhelm the liquidity of the Treasury market in order to drive forward rates significantly lower, which is a very dangerous game.

That’s to say, a more pronounced understanding of the Fed’s exit plans could run the risk of skewing everything. What’s more, if repo rates were to run significantly above effective Fed funds from now on… that could have unexpected and potentially inflationary consequences.

To read the entire report please click on the pdf file below.