Economists are projecting growth for the monthly comparisons in tomorrow’s April updates on residential housing construction and industrial output in the US. But while the consensus forecasts are calling for an encouraging start for the second-quarter data, the implied one-year changes are still on track to stay negative.

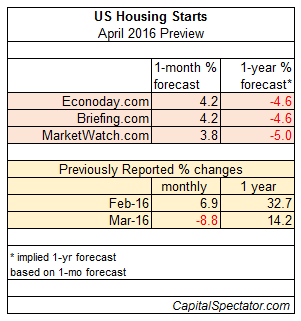

Let’s start with housing starts (seasonally adjusted annualized rate), which are expected to pop roughly 4% in April, according to three consensus forecasts. That’s an improvement vs. the 8.8% slump in March.

But the upbeat monthly prediction due on Tuesday (May 17) still leaves the implied 1-year percentage change for new residential construction in the red by as much as 5%, according to dismal scientists.

If so, starts are headed for the first year-over-year drop since last October.

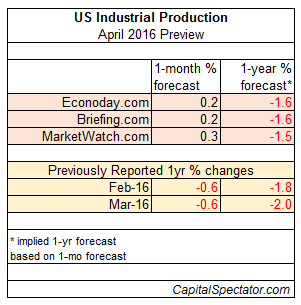

Industrial output is also expected to rebound in April vs. the previous month. Econoday.com’s consensus forecast, for instance, is looking for a 0.2% increase over March.

An expansion in production will certainly be welcome after two consecutive monthly declines. But the expected gain isn’t strong enough to generate an annual increase in production.

The implied one-year change for April is a slightly softer shade of red, but the crowd’s consensus view still translates into a 1.6% year-over-year slide.

Note that industrial production has been tumbling in annual terms since last September, the longest stretch of year-over-year contraction since the 2008-2009 recession, and the downturn looks set to roll on by this yardstick.

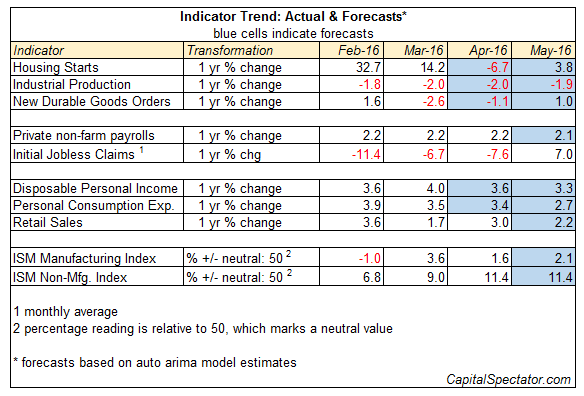

Finally, here’s how projected annual changes for housing starts and industrial output compare with other indicators, based on forecasts via an ARIMA model.

Note that while both indicators are expected to contract in year-over-year terms through April—in line with the consensus forecasts above—the ARIMA model sees an annual rebound for housing starts in May.

Industrial activity, by contrast, is expected to remain underwater for the annual comparison through this month.