Leading oilfield services company Weatherford International Ltd. (NYSE:WFT) is expected to report first-quarter 2016 earnings on May 5, 2016.

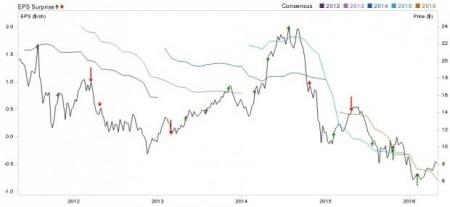

In the last quarter, the company reported adjusted loss of $0.13 per share, narrower than the Zacks Consensus Estimate of a loss of $0.19. However, Weatherford’s performance deteriorated from fourth-quarter 2014 adjusted earnings of $0.32 per share amid the continued weakness in oil prices.

Let’s see how things are shaping up for this announcement.

Factors at Play

The measures undertaken by Weatherford to reduce expenses both through direct cost reduction in view of the major downturn as well as by restructuring its overall cost structure should result in a more efficient and better run company going forward. With revenue trends projected to surpass its peers, this could lead to improved earnings performance in first-quarter 2016.

Weatherford is aligning its organizational structure to keep up with the changing market conditions which, in turn, should greatly aid financials. The company is planning to shut down and consolidate several of its operating facilities across North America.

Though we believe that expenditure on exploration and production activity levels are gaining traction, this might be partially offset by competitive pricing and continued margin pressure from excess capacity. In addition, Weatherford could face a more adverse impact compared with its peers, if the North American market underperforms. The reason is that a significant portion of its revenues comes from this region. Weatherford believes that the depressed natural gas and oil price environment will further put downward pressure on its earnings.

Moreover, Weatherford's debt-heavy balance sheet, its incapability to generate strong free cash flow as well as competition from larger peers are causes for concern.

Earnings Whispers

Our proven model shows that Weatherford is likely to beat earnings because it has the right combination of two key ingredients.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, stands at 0.00%.

Zacks Rank: Weatherford carries a Zacks Rank #3 (Hold), which when combined with a 0.00% ESP, makes earnings prediction difficult.

Note that stocks with Zacks Ranks #1, 2 or 3 have a significantly higher chance of beating earnings. Conversely, the Sell-rated stocks (Zacks Ranks #4 and 5) should never be considered going into an earnings announcement.

Stocks to Consider

Here are some companies from the same space which, according to our model, have the right combination of elements to post an earnings beat this quarter:

Chesapeake Energy (NYSE:CHK) has an Earnings ESP of +9.09% and a Zacks Rank #3.

Rowan Companies plc (NYSE:RDC) has an Earnings ESP of +2.70% and a Zacks Rank #3.

Dril-Quip Inc (NYSE:DRQ) has an Earnings ESP of +1.47% and a Zacks Rank #3.

WEATHERFORD INT (WFT): Free Stock Analysis Report

DRIL-QUIP INC (DRQ): Free Stock Analysis Report

ROWAN COS PLC (RDC): Free Stock Analysis Report

CHESAPEAKE ENGY (CHK): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research