- The US Small Business Optimism for December should rise again for December

- Job openings in the US should ease for a second month in a row in November

- The UK PM’s Brexit remarks make a hard Brexit look likely, prompting a pound selloff

Two US numbers will be influential in today’s trading: NFIB’s Small Business Optimism Index for December, followed by the November update on job openings. Meantime, keep your eye on GBPUSD, which briefly traded below October’s low yesterday following comments by Prime Minister May that were widely interpreted as favouring a hard Brexit.

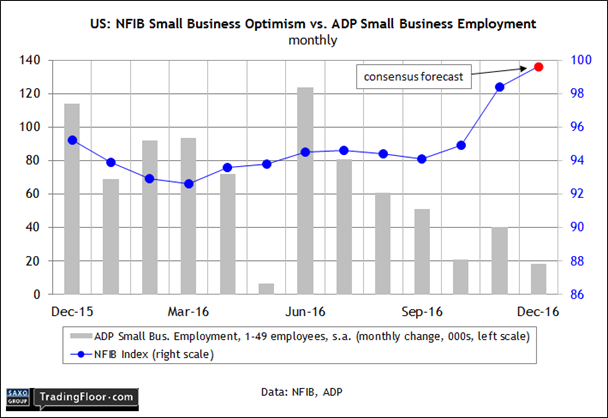

US: NFIB Small Business Optimism Index (1100 GMT): The mood in the small-business community is brightening, but the decelerating trend in job growth in this corner of the economy implies that the improving mood may be due for a reversal.

ADP data last week estimated that employment growth for companies with fewer than 50 workers dipped in December to the smallest gain in seven months – a slight increase of just over 18,000. As recently as last June, small firms added more than 120,000 employees.

But perhaps small-business owners are upbeat because they plan on ramping up hiring in the months ahead. Maybe, although yesterday’s December update of the Fed’s Labour Market Conditions Index (LMCI) suggests otherwise.

LMCI dipped into negative territory for the first time since May. The slide isn’t all that surprising after last week’s weaker-than-expected gain in payrolls for December, although the LMCI does corroborate the fact that hiring is slowing. The year-over-year growth rate for private payrolls in the US overall eased to a five-year low last month.

The positive interpretation is that employment gains are on a slower but sustainable path. One could say that small business owners agree. Today’s update on sentiment is expected to reaffirm the upbeat outlook. Econoday.com’s consensus forecast sees the Small Business Optimism Index rising to 99.6 for December after November’s surge – the biggest gain since 2009 – in the wake of Donald Trump’s election victory.

“We bifurcated the [November] data to measure the results before and after the election,” said the chief economist at the National Federation of Independent Business last month. “The November index was basically unchanged from October's reading up to the point of the election and then rose dramatically after the results of the election were known.”

Today’s release is set to build on November’s surge. The question is whether the hard data on small-company job growth will follow suit in 2017.

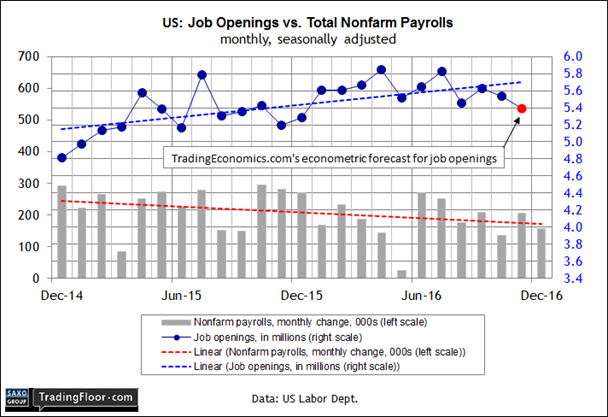

US: Job Openings and Labour Turnover Survey (1500 GMT): The slowdown in the labour market is expected to receive another clue for projecting softer growth in the months ahead.

Job openings are on track to ease for a second month in November, falling to 5.4 million, the lowest level of last year, based on TradingEconomics.com’s econometric estimate.

Surprising? Perhaps not. Until recently, job openings have been trending higher, reaching the 5.8 million-plus level twice in 2016. But the bullish trend has been accompanied by a downward bias in job growth for more than a year, as reported in private payrolls (see chart below). As I’ve been observing for months, one trend or the other had to give way and it appears that the culprit is job openings.

A slow decline in new openings still leaves room for optimism because softer levels remain close to the record highs reached last year. Nonetheless, evidence is mounting that the labour market has passed its peak, as today’s numbers are expected to reaffirm.

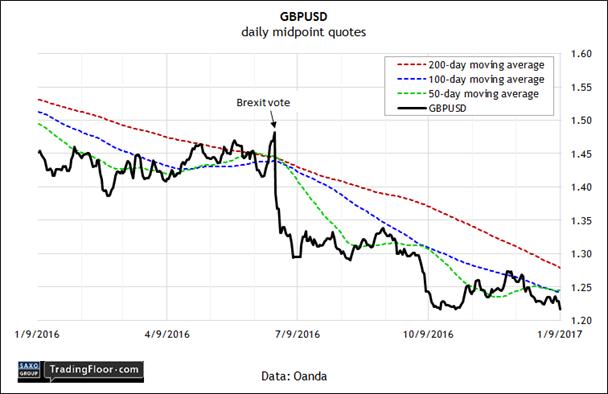

GBP/USD: A renewed bout of selling weighed on the pound in the wake of Prime Minister Theresa May’s comments over the weekend that suggested that a hard Brexit – a complete and comprehensive break with the European Union – is now Britain's fate.

Speaking to SkyNews on Sunday, May said her government won't try to keep pieces of membership after it leaves the EU. “We are leaving. We are coming out. We are not going to be a member of the EU any longer,” she insisted.

But on Monday, the Prime Minister moved into damage-control mode and tried to downplay her earlier comments and explaining that the goal is simply to pursue “the best possible deal for the United Kingdom” as it relates to leaving the EU.

Nonetheless, May’s remarks that seemed to reject the concept of a soft Brexit – retaining key aspects of the current relationship with the EU – provided the bears with a new reason to sell the pound. “It looks almost certainly now like a hard Brexit, and the market doesn’t like it,” noted the global chief economist at UniCredit SpA. “It’s a political crisis in the brewing here, for sure.”

Traders will be keenly watching sterling this week for signs that the currency's stumble will continue. As of mid-day trading on Monday, GBPUSD fell slightly below its previous low of 1.2159 from last October before rebounding slightly. But with the technical profile looking quite bearish, the question that everyone’s asking: How low can the pound go vs. the US dollar?

Disclosure: Originally published at Saxo Bank TradingFloor.com