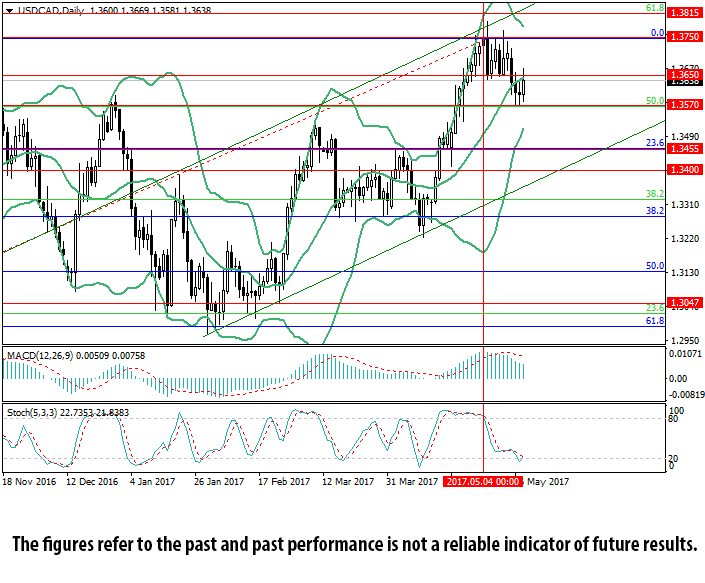

During the current week the pair has been falling and reached the level of 1.3570 (Fibo correction 50.0%). The strengthening of CAD is explained by the increase of oil prices: Brent grew above $52, and WTI above $49 per barrel. On the other hand, political scandals in the USA lead to the weakening of USD.

Currently the price has slightly corrected and is trading around the middle line of Bolliner Bands near 1.3650. If it is broken through, the price may continue to grow to 1.3750 and 1.3815 (upper border of the upward channel). The key mark for the “bears” will be 1.3570: if it is broken through, one may expect the price to continue falling to the lower border of the upward channel 1.3455 and 1.3400.

Currently investors are waiting for the news on the extension of the agreement on the cutting of oil production that may push oil to grow and drag CAD along. Tomorrow releases from Canada include April data on consumer price index and March retail sales. Both indicators are expected to be strong and to support CAD.

Technically the price moved from the upper border of the upward channel and is aiming at the lower one (1.3400). On the other hand, Stochastic is reversing upwards near the oversold zone which is a sign of a possible upward movement to the area of May maximums (1.3750).

Support levels: 1.3570, 1.3455, 1.3400.

Resistance levels: 1.3650, 1.3750, 1.3815.