It has been about a month since the last earnings report for Gamestop Corporation (NYSE:GME) . Shares have lost about 12.6% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

GameStop Tops Q1 Earnings & Revenue Estimates

GameStop continued with positive earnings surprise streak for the sixth straight quarter, as it reported first-quarter fiscal 2017 results. Moreover, sales of this multichannel video game and consumer electronics retailer also surpassed the estimate after missing the same in the preceding three quarters.

The company recorded adjusted earnings of $0.63 per share that comfortably beat the Zacks Consensus Estimate of $0.49 but declined $0.03 from the year-ago quarter. Net sales were up 3.8% year over year to $2,045.9 million and surpassed the Zacks Consensus Estimate of $1,890 million.

The company’s better-than-expected results in the reported quarter came on the back of robust international sales along with steep increase in net hardware sales on account of strong sales of Nintendo Switch as well as Collectibles. Sharp increase in Technology Brands sales also drove the results higher.

Despite reporting better-than-expected results, this Grapevine, TX-based company kept its guidance unchanged. This can be attributed to delay in launch of "Red Dead Redemption: 2" and less visibility for the demand of Nintendo Switch for the entire year. GameStop doesn’t expect “Red Dead Redemption: 2” to be launched this fiscal year.

Let’s Delve Deep

Consolidated comparable store sales (comps) increased 2.3%, reflecting a gain of 17.1% at international locations but declined 2.4% at domestic locations. By sales mix, new video game hardware sales jumped 24.6% to $389.9 million, while new video game software sales declined 8.2% to $520.5 million. Moreover, pre-owned and value video game products sales came in at $526.2 million, down 6.2% year over year.

Video game accessories sales were up 8.2% to $176.1 million. Non-GAAP digital receipts decreased 9% to $235.6 million, while GAAP digital sales increased 3% to $44.1 million. However, decline in new consoles adversely impacted digital sales.

Technology Brands sales jumped 21.5% to $201.4 million driven by year-over-year growth in AT&T (NYSE:T) authorized retail stores. Collectibles sales surged 39.1% to $114.5 million buoyed by robust sales of Pokémon-related products.

Management expects sturdy performance of Technology Brands and Collectibles to continue in fiscal 2017, and added that new hardware innovation in the video game category also looks promising. Technology Brands’ adjusted operating earnings came in at $18.4 million, down 2.1% from the prior-year quarter.

Management also anticipates Technology Brands’ operating earnings to rise over 30% to $120 million during fiscal 2017 and to be $200 million in fiscal 2019. During fourth-quarter fiscal 2016 conference call, the company stated that it expects Technology Brands sales to increase 10–16% in fiscal 2017.

GameStop expects to enhance collectibles business approximately $650–$700 million during fiscal 2017 and anticipates becoming a $1 billion business by the end of fiscal 2019. In the second quarter, Collectibles sales are forecasted to increase by 35–40%. The company remains optimistic about non-physical gaming businesses and expects this category to reach approximately 50% of operating earnings by the end of fiscal 2019.

During the reported quarter, gross profit increased 4% to $702.5 million, while gross margin of 34.3% was flat year on year. Adjusted operating income declined 8.2% to $108.4 million, while adjusted operating margin decreased 70 basis points to 5.3%.

Store Update

In the reported quarter, GameStop shuttered a net of 27 video game stores globally, ending the year with 3,902 video game stores in the U.S and 1,998 internationally. The company acquired 22 technology brand stores, opened 11 and closed 47 stores, and consequently bringing the store count to 1,508. The company opened nine collectible stores during the quarter and now has 95 stores.

Other Financial Aspects

GameStop ended the quarter with cash and cash equivalents of $311.9 million, net receivables of $172.5 million, long-term debt of $815.7 million and shareholders’ equity of $2,268.9 million.

Management projects capital expenditures in the range of $110–$120 million and free cash flow to be approximately $300 million in fiscal 2017.

Guidance

GameStop continues to expect fiscal 2017 comps to be in the range of flat to down 5%. For the fiscal year, management also reiterated earnings outlook and continues to project in the range of $3.10–$3.40 per share.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last one month period as none of them issued any earnings estimate revisions.

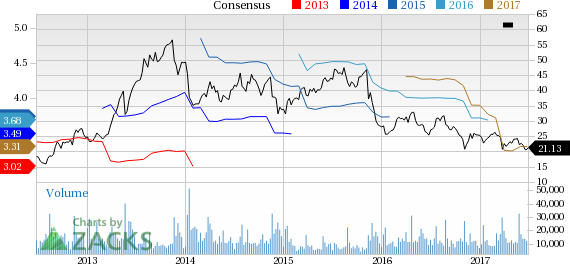

Gamestop Corporation Price and Consensus

VGM Scores

At this time, the stock has a subpar Growth Score of 'D', while its Momentum is lagging a lot with a 'F'. Charting a somewhat similar path, the stock was allocated a grade of 'A' on the value side, putting it in the top 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of 'B'. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is solely suitable for value investors.

Outlook

The stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Gamestop Corporation (GME): Free Stock Analysis Report

Original post