PPG Industries (NYSE:PPG) celebrated the completion of its $10 million coatings center at its facility in Tianjin, China. The center is aimed at serving automotive plastics and decorative accessories’ customers in the region. It is the company’s first Chinese facility catering to consumers in this part of the automotive supply chain. The facility currently provides OEM coatings as well as industrial coatings to customers in the Asia Pacific region.

PPG INDS INC (PPG): Free Stock Analysis Report

BASF SE (BASFY): Free Stock Analysis Report

AKZO NOBEL NV (AKZOY): Free Stock Analysis Report

INNOSPEC INC (IOSP): Free Stock Analysis Report

Original post

Zacks Investment Research

The center brings PPG Industries’ technological expertise and innovation for the producers of automotive decorative parts, providing enhanced color consistency and reduced lead times. The company will be able to help customers gain competitive advantage by improving yield rates on painting lines as well as lowering the cost of painting plastic parts. The target customer base includes Tier 1 and Tier 2 suppliers, along with auto manufacturers.

PPG Industries is optimistic about the Chinese auto market. The sector is expected to continue growing at a fast pace, proving beneficial for the company. The construction of the new center in China is aimed at further strengthening PPG Industries’ presence in the country. The company first established a coatings plant in the nation at the Tianjin site in 1994 which has now become its largest coatings production base in the world.

Earlier in the year, PPG Industries announced the completion of its $20 million on-site electrocoat coatings blending center at its resin manufacturing facility in Zhangjiagang, China. This enabled the company to cater to the growing demand from automotive manufacturing and industrial customers seeking environmentally friendly coatings like waterborne e-coat products which abide by the Chinese environmental norms.

PPG Industries saw higher profits in the first quarter of 2016, aided by its cost-management initiatives and contributions from acquisitions. Adjusted earnings for the quarter beat the Zacks Consensus Estimate while revenues missed the same. The company raised its quarterly dividend by 11% and also reaffirmed its plans to deploy $2–$2.5 billion cash over 2015–2016 toward acquisitions and share repurchases.

Revenues from the Industrial Coatings segment of PPG Industries rose 2% year on year to $1.37 billion in the first quarter. The upside was driven by an improvement in sales volume as well as acquisition-related sales, partly offset by currency headwinds. Segment income rose almost 9% from the prior-year quarter to $265 million, backed by manufacturing cost efficiencies and benefits from restructuring and acquisitions. The company is taking steps toward its goal of developing and commercializing customer-driven technologies and consumer branding strategies.

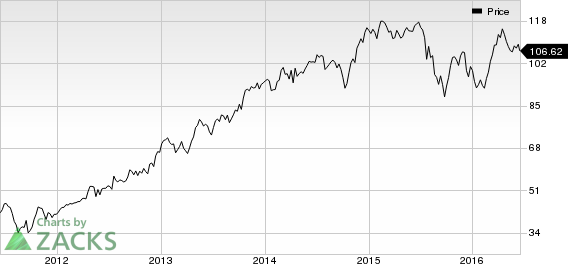

PPG Industries currently holds a Zacks Rank #2 (Buy).

Some other favorably ranked companies in the chemical space include Akzo Nobel N.V. (OTC:AKZOY) , BASF SE (OTC:BASFY) and Innospec Inc. (NASDAQ:IOSP) , all sporting a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

PPG INDS INC (PPG): Free Stock Analysis Report

BASF SE (BASFY): Free Stock Analysis Report

AKZO NOBEL NV (AKZOY): Free Stock Analysis Report

INNOSPEC INC (IOSP): Free Stock Analysis Report

Original post

Zacks Investment Research